Markets

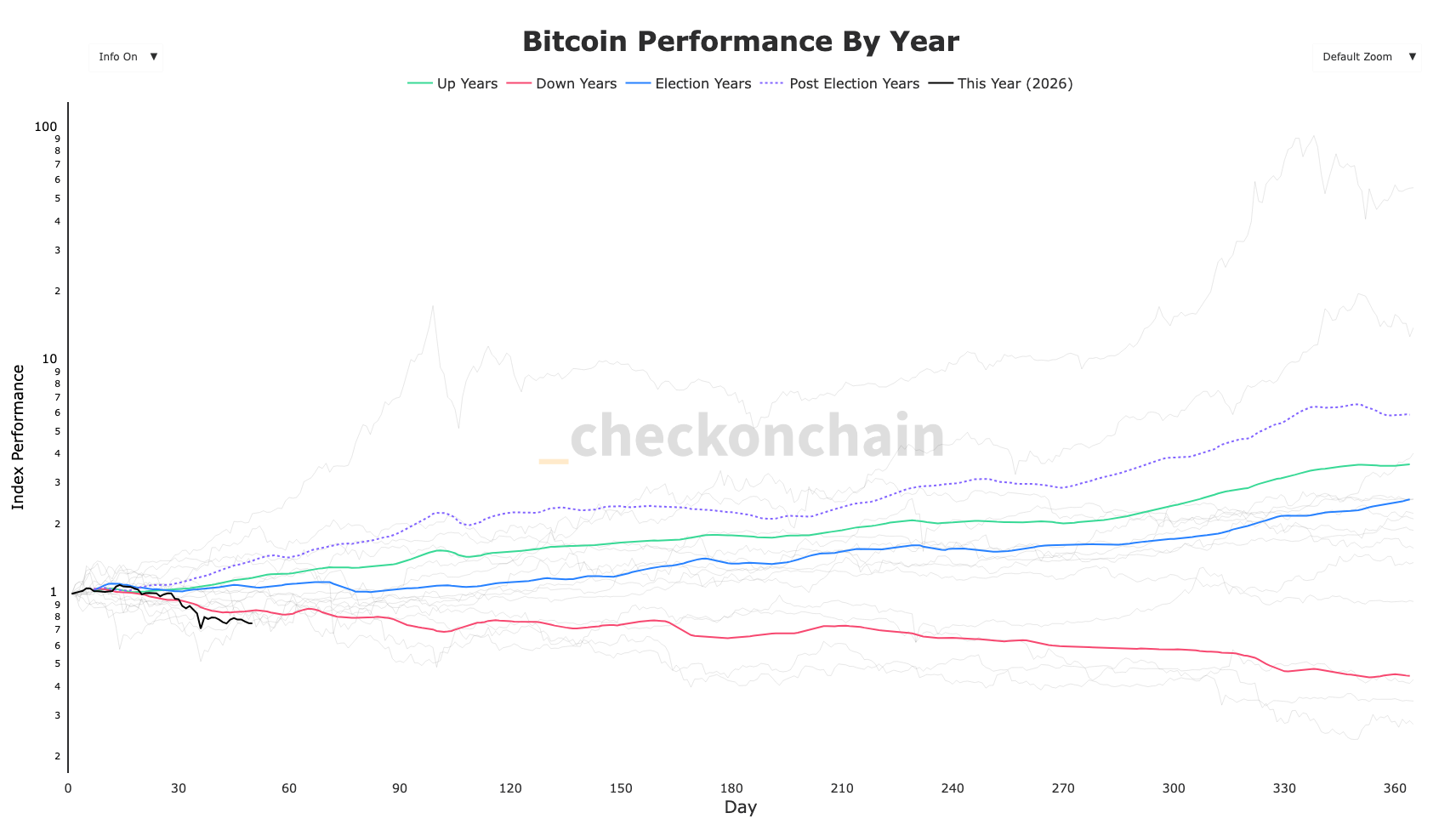

In the shadowed corridors of 2026, where dreams of crypto utopia crumble like stale bread, Bitcoin staggers into its worst first 50 days since the dawn of digital currency. A 23% plunge-year to date-echoes the hollow thud of a hammer striking the anvil of hubris. January, that foolhardy optimist, fell 10%, while February, with the grace of a drunkard, added another 15%. One might say the market’s winter began with a frostbitten handshake.

Never before has this “digital gold” endured such consecutive January-February declines, a feat that would make even the most cynical investor chuckle at fate’s dark humor. In years past, January’s stumbles were met with February’s redemption-2015, 2016, 2018-all followed by silver linings. Now? The linings are lead. If this trend holds, 2026 will etch its name beside 2022’s “worst monthly performance” in the annals of crypto despair, a museum of mistakes.

Checkonchain’s data, that cold arbiter of cycles, reveals Bitcoin’s 50-day index at 0.77-a number that whispers of ruin to those who once claimed it was the future. In a typical down year, the benchmark is 0.84; here, it’s a dirge. Traders, those modern-day alchemists, now scratch their heads as their charts resemble the scribbles of a deranged monk.

This collapse follows a 17% drop in 2025, that post-election year which, history cruelly notes, should have been a season of triumph. After all, election years are the graveyard of hope, and post-election years are meant to rise from the ashes. But not this time. Perhaps the real question is not why Bitcoin fell, but why anyone still clings to the delusion of digital gold in an age of such profound disillusionment.

Read More

- BTC PREDICTION. BTC cryptocurrency

- USD MYR PREDICTION

- Gold Rate Forecast

- Silver Rate Forecast

- EUR JPY PREDICTION

- XRP’s Wild Ride: Liquidity Vanishes Faster Than Brooks at a Drama Club Meeting!

- EUR RUB PREDICTION

- Tether’s Big Bet on Bitcoin Lightning Network: Will It Work? 🤔

- 🍿 Crypto Mom vs. Big Brother: Who Will Win the Privacy Battle? 🕵️♂️

- Why Coinbase’s Stablecoin Revival Is the Crypto Drama You Didn’t Know You Needed

2026-02-20 09:02