What to know:

- SOL surged 7% in 24 hours, reaching $166.65, as institutional engagement and ETF speculation heat up

- DeFi Dev Corp, BIT Mining, and Upexi are expanding their Solana exposure with hefty treasury allocations and investment commitments

- Trading turnover increased 19% to approximately $4.90 billion, with market analysts maintaining a 95% probability estimate for Solana ETF authorisation by October

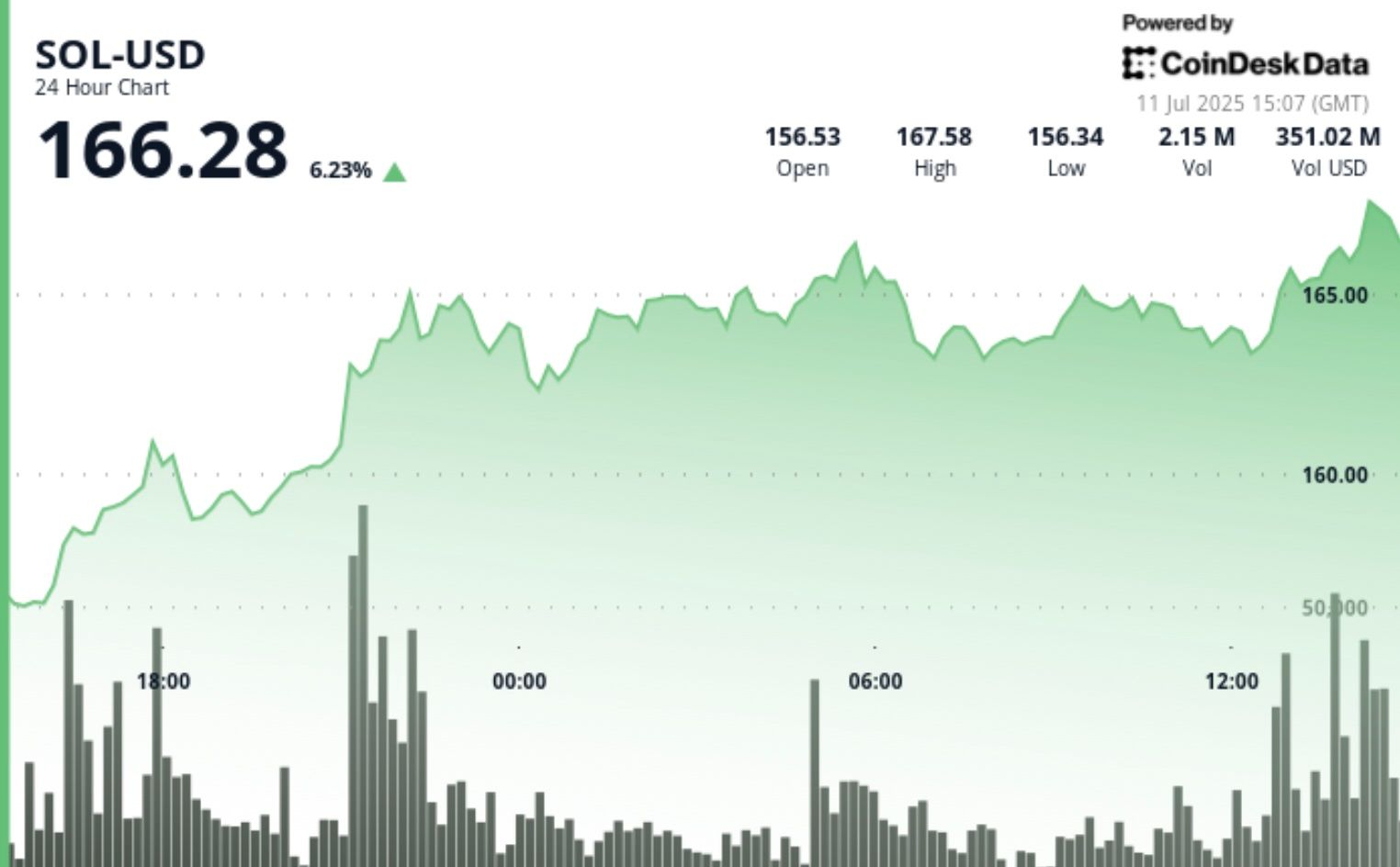

At the time of writing, solana is trading at around $166.28, up 6.23% in the past 24-hour period, according to CoinDesk Research’s technical analysis model. 📈

Upexi (UPXI), a Tampa-based consumer brands company listed on Nasdaq, announced Friday it has secured approximately $200 million in new financing through a combination of equity and convertible note offerings. A portion of the proceeds will support Upexi’s existing operations, while the rest will be used to grow its cryptocurrency treasury, with a specific focus on Solana. 💰

As part of the equity component, Upexi raised $50 million from accredited and institutional investors, including its CEO Allan Marshall. Shares were sold at $4.00 each, with management purchasing at a premium of $4.94. The company said the equity deal is expected to close around July 14. 🤝

Separately, Upexi entered into agreements to issue $150 million in convertible notes to institutional investors. The notes are backed by SOL as collateral and carry a 2% annual interest rate. They are convertible into Upexi stock at a fixed price of $4.25 per share and mature in 24 months. The notes are expected to close around July 16, at which point the associated SOL will be added to the company’s holdings. 📝

In a June 26 press release, Upexi disclosed that it held 735,692 SOL as of June 24, an 8% increase from the 679,677 SOL reported on May 28. Upon closing of the new financing, Upexi expects to more than double its current SOL position. 🚀

The offerings were conducted privately and are not registered with the SEC. 🕵️♂️

Technical Analysis

- SOL demonstrated exceptional resilience throughout the preceding 24-hour period from 10 July 15:00 to 11 July 14:00, progressing from $156.45 to $166.65, constituting a substantial 6.52% appreciation with an aggregate trading range of $10.99 extending from $155.78 to $166.76. 📈

- The price dynamics unveiled distinctive accumulation sequences with considerable volume-backed support materialising at $160.31 during the 21:00 hour advancement, where extraordinary volume of 3.23 million substantially surpassed the 24-hour mean of 1.34 million, corroborating institutional capital deployment. 🏦

- Pivotal resistance emerged proximate to $165.30, subjected to multiple examinations between 22:00 and 03:00, whilst the conclusive breakthrough above $166.00 transpired with amplified volume of 2.26 million, intimating persistent bullish conviction. 📈

- The technical architecture suggests SOL has consolidated a superior trading corridor with robust volume validation, establishing foundations for prospective advancement towards the $170.00 psychological threshold. 📈

- Throughout the concluding 60-minute interval from 11 July 13:05 to 14:04, SOL encountered considerable volatility whilst preserving its overarching bullish disposition, oscillating within a $2.90 bandwidth from $164.24 to $166.76 and settling at $165.87, representing a marginal 0.44% contraction from the hour’s commencement at $165.92. 📉

- The period manifested quintessential consolidation attributes encompassing two discrete phases: an initial retreat to $164.28 circa 13:33 accompanied by intensified distribution pressure of 45,017 volume, succeeded by a vigorous recovery commencing at 13:48 where volume escalated to 81,740 during the ascent towards $166.76, validating renewed accumulation interest. 📈

- Fundamental support crystallised near $164.30 with multiple successful examinations, whilst resistance materialised around $166.50-$166.75, establishing a well-delineated trading corridor that suggests constructive price discovery following the antecedent 24-hour advance, positioning SOL for potential continuation of its broader upward trajectory upon completion of this consolidation phase. 📈

Read More

- BTC PREDICTION. BTC cryptocurrency

- Bitcoin’s Cosmic Cringe: Why the Crypto World Is Now a Black Hole 🌌💸

- Ethereum Whale’s Bold $280M Short: Is the Market on a Cliff or Just a Cliffhanger? 🤔

- Bitcoin’s Wild Ride: Whales Strike Back, Shorts Cry 😭💰

- Upbit’s Wild Goose Chase: $1.77M Frozen, Hackers on the Run 🕵️♂️💰

- SEC v Cryptos: ‘Innovation Exemption’ Will Arrive in 30 Days… Maybe? 🧨💸

- EUR USD PREDICTION

- 🚀 NEAR Protocol Soars 8.2% While Others Stumble – CoinDesk 20 Chaos! 💸

- 🔥Vienna’s Crypto Carnage: Ukrainians Burn Wallets & Souls! 💰💀

- You Won’t Believe What Secretly Predicts Bitcoin’s Next Crash! 😱

2025-07-11 19:37