Okay, folks, gather ’round! After a pretty meh July, OP token is finally showing some signs of life 🌟. It’s been stabilizing above the $0.645 zone, and momentum indicators are all like, “Hey, maybe we’re due for a recovery?” 🤔

Analysts are pointing to some key price structures that could support an advance toward $0.68. And if we get a sustained breakout from current levels, we might just see a new short-term trend emerge 📈.

Recovery Mode Activated

Check out this 15-minute chart from BullFrog Crypto 📊. It shows OPUSDT trying to make a comeback after falling below the $0.665 support. We’ve got a higher low forming, which is like a big ol’ hug from the buyers 🤗.

Volume is also stabilizing, which means the selling pressure is weakening 💪. There’s a critical supply zone between $0.665 and $0.6695 that’s the pivot point. If we can reclaim that, it could validate a continuation pattern 🔑.

The chart is pointing to a short-term target of $0.6695, which is like a big ol’ resistance level 🚧. If we can break through that, we might see some upside extension 🚀.

Traders are watching this zone like hawks, waiting for breakout and retest behavior 🕵️♀️. It’s all about short-term scalping or momentum-based intraday entries, especially if we can hold above $0.650 💸.

Bearish Pressure, Meet Recovery Effort

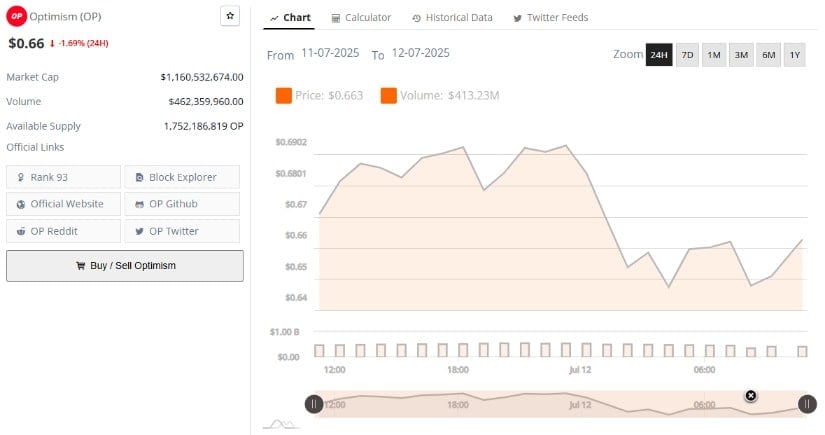

According to BraveNewCoin’s 24-hour chart data, OP had a wild ride 🎢. It rose from $0.663 to nearly $0.6902 before reversing sharply 🔄.

The reversal was like a big ol’ “nope” from the market 🙅♂️. But the closing stages hinted at a mild bounce from the $0.645 support floor 🌟.

Trading volume was a whopping $462.36 million, which means people were actively participating in the trading cycle 📊. Bears dominated the latter half of the day, but the closing stages were all like, “Hey, maybe we’re not done yet?” 🤔

If we can recover and maintain levels above $0.67, short-term sentiment might turn more constructive 📈. But we need confirmation for any breakout attempts above $0.68 🔑.

MACD and Bollinger Bands: The Dynamic Duo

The daily chart for OP/USDT on TradingView is like a big ol’ bullish party 🎉. Price action broke above the mid-Bollinger Band (20-day SMA), and we’re trading at $0.653 while approaching the upper band at $0.652 📈.

This positioning, paired with prior consolidation, is like a big ol’ “go” signal 🚀. We might be entering a short-term breakout phase if we can sustain above this volatility threshold 🔑.

The MACD indicator is like the icing on the cake 🎂. The MACD line (0.0187) crossed above the signal line (0.0162), and the positive histogram is confirming upward momentum 📈.

Historically, this has been a pretty reliable short-term signal 🔔. If buyers maintain momentum, we might see OP target resistance near $0.75 in the coming sessions, with the $0.568 mid-band serving as key support on any pullbacks 📊.

So, what’s next? Market participants are watching how OP behaves around the $0.67 to $0.68 range like hawks 🕵️♀️. A confirmed breakout above these levels could signal the start of a broader recovery trend after months of compression and downward drift 📈.

Read More

- BTC PREDICTION. BTC cryptocurrency

- Bitcoin’s Cosmic Cringe: Why the Crypto World Is Now a Black Hole 🌌💸

- Upbit’s Wild Goose Chase: $1.77M Frozen, Hackers on the Run 🕵️♂️💰

- Ethereum Whale’s Bold $280M Short: Is the Market on a Cliff or Just a Cliffhanger? 🤔

- Bitcoin’s Wild Ride: Whales Strike Back, Shorts Cry 😭💰

- SEC v Cryptos: ‘Innovation Exemption’ Will Arrive in 30 Days… Maybe? 🧨💸

- Crypto Mayhem: Banks at Risk of Losing Their ‘AAA’… And Their Minds! 😬

- Shocking Rally Ahead for NIGHT Token: Analyst Predicts 4x Surge to $0.20!

- 🚀 NEAR Protocol Soars 8.2% While Others Stumble – CoinDesk 20 Chaos! 💸

- 🔥Vienna’s Crypto Carnage: Ukrainians Burn Wallets & Souls! 💰💀

2025-07-12 23:01