As the world’s leading cryptocurrency continues to make headlines, analysts are turning their attention to higher price targets for Bitcoin. 📈

Bitcoin Price Today: Buckle Up for a Thrilling Ride to New Heights!

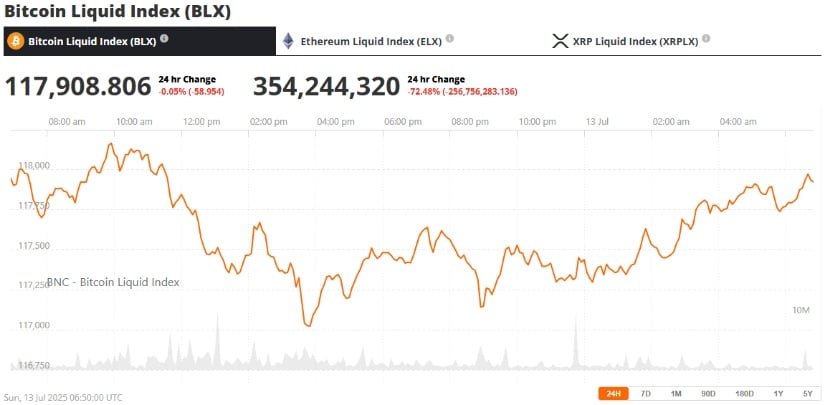

Bitcoin is once again in the spotlight as it hovers around $117,900, up nearly 8% this week. The rally has been fueled by a mix of bullish chart patterns, favorable macroeconomic conditions, and surging institutional interest. With RSI readings above 75 and continued inflows into spot Bitcoin ETFs, the momentum could push Bitcoin beyond $120K, with $127.6K now emerging as a realistic near-term target.

Bitcoin Technical Analysis Signals Breakout Potential

From a technical standpoint, Bitcoin has broken out of a symmetrical triangle, clearing the 0.382 and 0.5 Fibonacci retracement levels with strong follow-through. The digital asset is now consolidating above $117K, with critical support from the 50-period simple moving average (SMA) resting around $110,527.

The Relative Strength Index (RSI) currently stands at 75.5, signaling an overbought market, but with no immediate bearish divergence. This suggests the uptrend may continue unless a reversal candlestick or decline in volume emerges. The Fibonacci extension level at 1.618 points to $120K–$127.6K as the next area of interest.

Technical data from TradingView and CryptoQuant reinforce this bullish outlook. Notably, a 2021 study found that RSI readings above 70 often precede significant price movements in crypto. In addition, Fibonacci retracement zones have historically acted as accurate support markers in 61% of Bitcoin’s bull phases since 2017.

Bitcoin Halving 2025, ETF Hype & Whale Activity Fuel Bullish Outlook

Beyond charts, macro forces and emerging trends are aligning to support higher Bitcoin prices. The Federal Reserve remains divided on interest rate policy, keeping markets in a state of suspense. Some officials are pushing for more tightening, while others hint at possible rate cuts. This uncertainty is driving risk-on sentiment in crypto markets.

At the same time, Bitcoin ETF news continues to play a critical role. Despite delays surrounding Grayscale’s Digital Large Cap ETF, analysts expect more spot ETF approvals in the coming months, which could bring fresh institutional liquidity.

Adding to this momentum is a spike in whale activity and long-term holder conviction. On-chain metrics show major transactions over $100K increasing, while spot exchanges see declining BTC reserves—both signs of accumulation.

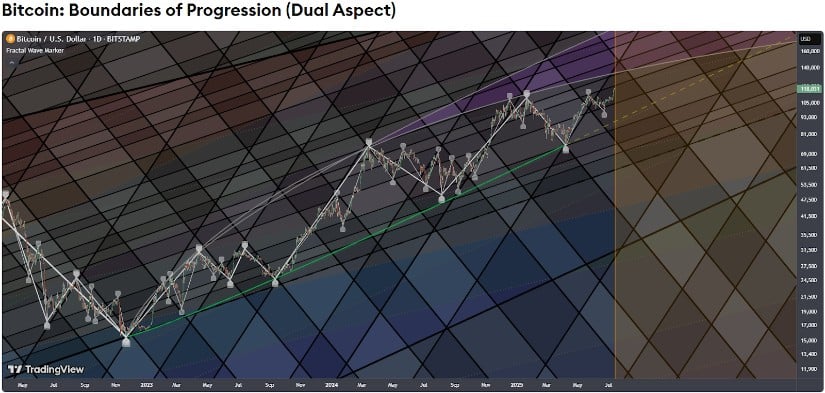

Looking further ahead, long-term projections see Bitcoin possibly reaching $300,000 by the end of the cycle, though conservative targets of $160K remain more plausible within 2025.

Bitcoin Long-Term Outlook: What’s the Next Move?

The Bitcoin price prediction landscape is becoming increasingly optimistic, with analysts seeing $120K–$127.6K as near-term targets. The ongoing rally has defied seasonal patterns, suggesting that Bitcoin may now be operating under a fundamentally different investment regime driven by ETF adoption and macro trends.

While a short-term correction is not off the table, the broader outlook favors continued upside. With Bitcoin entering price discovery mode, investors are eyeing $127.6K as the next psychological resistance—and possibly a stepping stone toward the next major peak in the bull cycle.

As the market evolves, all eyes remain on Bitcoin to guide the trajectory of the broader crypto ecosystem. Whether it’s ETF momentum, RSI strength, or institutional positioning, BTC appears well-positioned for its next big move.

Read More

- BTC PREDICTION. BTC cryptocurrency

- Bitcoin’s Cosmic Cringe: Why the Crypto World Is Now a Black Hole 🌌💸

- Bitcoin’s Wild Ride: Whales Strike Back, Shorts Cry 😭💰

- Upbit’s Wild Goose Chase: $1.77M Frozen, Hackers on the Run 🕵️♂️💰

- 🚀 NEAR Protocol Soars 8.2% While Others Stumble – CoinDesk 20 Chaos! 💸

- Ethereum Whale’s Bold $280M Short: Is the Market on a Cliff or Just a Cliffhanger? 🤔

- Ethena’s $106M Token Unlock: Will Aave’s Liquidity Bust or Just a Bad Hair Day? 🤔

- 🐳 XRP Whales Splash Cash: Is the Tide Turning? 🌊

- EUR USD PREDICTION

- SEC v Cryptos: ‘Innovation Exemption’ Will Arrive in 30 Days… Maybe? 🧨💸

2025-07-13 15:10