In the grand theater of cryptocurrency, Bitcoin has taken to the stage with a flourish, ascendant above the splendid realm of $118,500. With exuberance, it soared to dizzying heights above the illustrious $120,000, only to indulge in a rather dramatic entanglement of correction.

- Our dear Bitcoin, in its relentless pursuit of glory, commenced a gallant ascent beyond the $120,000 threshold.

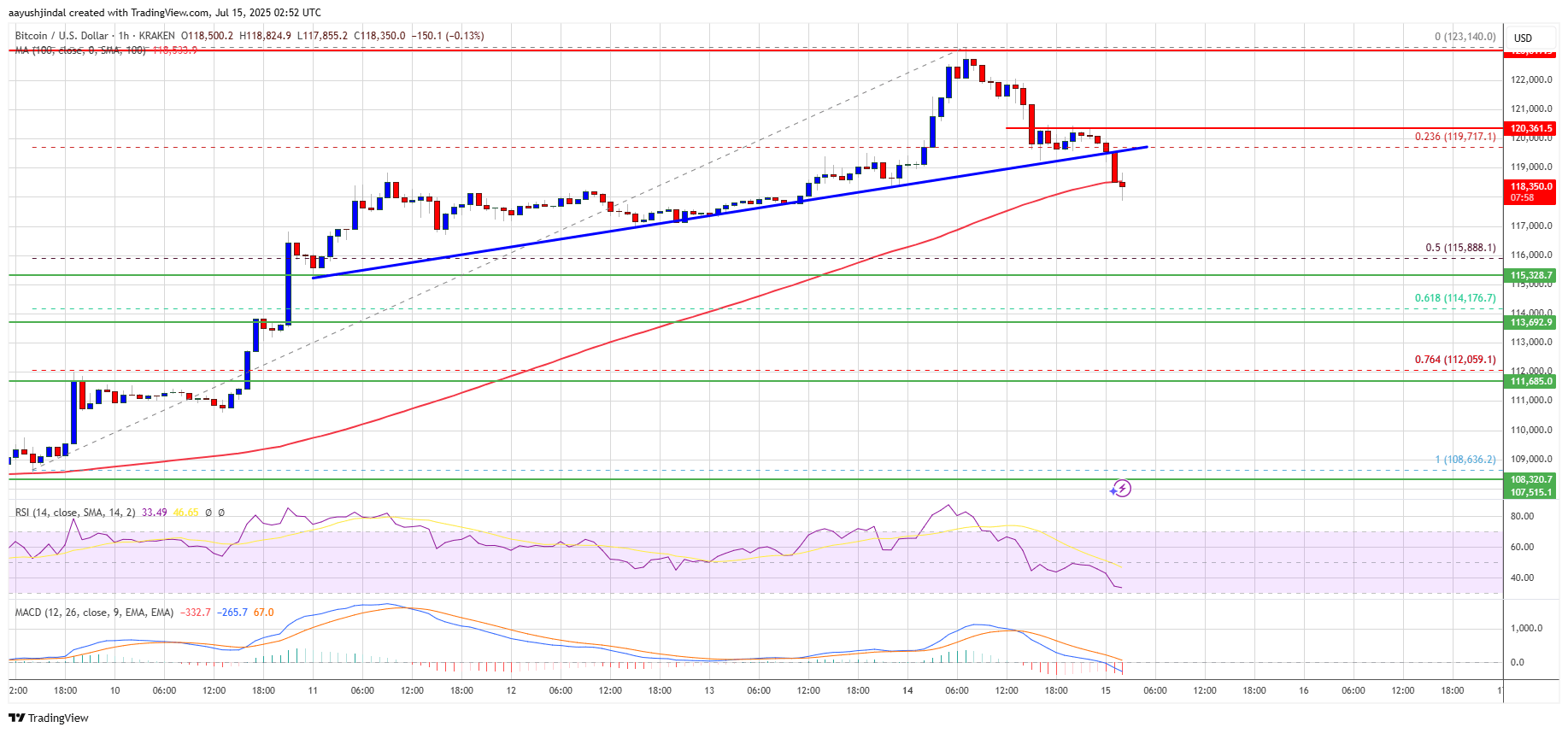

- As it finds itself waltzing around the elegant $118,500—so close to the entrenched 100 hourly moving average—one must wonder if it’s taken a moment to pause and catch its breath.

- Alas! A debonair break beneath a bullish trend line, sporting support at an oh-so-lofty $119,800, has graced the hourly chart of this audacious BTC/USD pair (thanks to the ever-reliable Kraken).

- Yet, fret not! This spirited pair may yet conjure another delightful ascent, should it cut the ribbon at the imposing $120,500 resistance zone.

The Dandy Bitcoin Inaugurates a New Pinnacle

Bitcoin, in a splendid display of determination, sought to break free from the shackles of $116,500, donning its finest attire as it danced above the prestigious realms of $118,000 and beyond, soon topping the scales at the impressive $120,000.

Those fervent bulls! They gallantly propelled our protagonist above the $122,000 barrier. The storyline of this narrative reached its climax at the staggering $123,140, with current affairs seeing it graciously consolidating its newfound fiefdom. Yet, a worrisome dip just below the 23.6% Fib retracement—a confession of vulnerability—revealed a longing for the world of $108,636 to $123,140.

But, what treachery lurks among the chart lines? A slip beneath the bullish trend line—support trembling at $119,800—now places Bitcoin in a delicate pas de deux with $118,500 and its 100 hourly moving average.

For those intrigued by the echoes of resistance, immediate obstacles frolic at approximately $119,550. The foremost challenge lies at the grand $120,500, while dreams of a triumphant leap past $122,000 linger. Should fortune favor our bold Bitcoin, we may witness it testing the ever-elusive $123,200—perhaps even tantalizingly tiptoeing toward the breathtaking $125,000, with the ethereal $130,000 whispering sweet nothings.

The Perilous Plunge of Bitcoin?

But dear reader, should our Bitcoin hero falter before the stalwart $120,500 tier, a descent is conceivable, a grand misstep. Immediate sanctuary, if desired, lies at $117,500. The first substantial fortress of support looms at $115,800, toasting to the 50% Fib retracement level, gingerly recovered from the bearish clutches of $108,636 swinging low to thrilling $123,140.

And now, our intrepid Bitcoin meanders toward the $114,000 haven. Yet, a further miscalculation could plummet it to the troubled depths of $112,500, with the ominous abyss of $110,500 lurking menacingly beneath, where it might continue its somber descent.

Technical musings, if one might indulge:

Hourly MACD – Ah! The MACD, once a resolute ally, now dawdles in the bullish zone, like a nobleman caught in a daydream.

Hourly RSI (Relative Strength Index) – Our dear RSI has descended below the lofty 50 mark on the BTC/USD chart, possibly seeking the wisdom of its peers.

Principal Support Levels – A somber $117,500, followed by the comforting embrace of $115,800.

Principal Resistance Levels – Standing proud at $120,500 and $122,000, daring bitcoin to reach its full potential.

Read More

- Bitcoin’s Wild Ride: Whales Strike Back, Shorts Cry 😭💰

- BTC PREDICTION. BTC cryptocurrency

- SEC v Cryptos: ‘Innovation Exemption’ Will Arrive in 30 Days… Maybe? 🧨💸

- 🔥Vienna’s Crypto Carnage: Ukrainians Burn Wallets & Souls! 💰💀

- 🚀 NEAR Protocol Soars 8.2% While Others Stumble – CoinDesk 20 Chaos! 💸

- EUR USD PREDICTION

- Cardano’s Melancholy Ballet: Death Cross Dances as Markets Pause for Dramatic Effect

- Bitcoin’s Cosmic Cringe: Why the Crypto World Is Now a Black Hole 🌌💸

- Ethena’s $106M Token Unlock: Will Aave’s Liquidity Bust or Just a Bad Hair Day? 🤔

- Ethereum Whale’s Bold $280M Short: Is the Market on a Cliff or Just a Cliffhanger? 🤔

2025-07-15 06:24