Oh, dear friends, how marvelously the tides of fortune have turned for Ethereum! A true spectacle of the modern age, with Ethereum soaring like a majestic bird in the winds of investor greed. One can only stand in awe as the price of this digital wonder now flirts with $3,378.77, a 40.4% rise since the beginning of the month. The crypto market, it seems, has found a new darling.

On July 14th, the great Bitcoin, though momentarily reaching $123,000, soon found itself cooling off like a weary traveler in the scorching sun. Yet, in the midst of its modest 0.7% gain, Ethereum emerged victorious, surging ahead by 7.3%. The true underdog story, wouldn’t you agree? XRP, BNB, Solana, Dogecoin, and Cardano followed suit, each managing to wrangle a fair share of the limelight. Oh, what a time to be an altcoin enthusiast!

Why, You Ask, Is Ethereum Soaring to Unprecedented Heights?

Ah, the answer, my dear interlocutors, lies in the history books of the financial world, written with the ink of institutional greed. Ethereum’s meteoric rise is fueled by a most wondrous occurrence: spot Ether ETFs. The inflows, mind you, are absolutely staggering. $726.6 million worth of Ethereum was greedily gobbled up by these ETFs on July 14th, a daily intake so monstrous it has set a record—one for the annals of history.

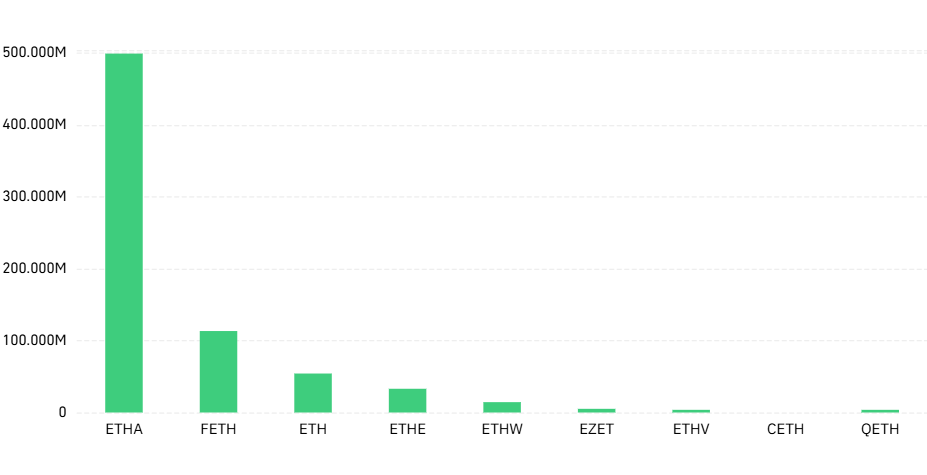

The Most Illustrious ETFs of Them All:

- BlackRock’s ETHA: $499.2 million – A truly regal sum, don’t you think?

- Fidelity’s FETH: $113.3 million – As dependable as the morning sun, one must admit.

- Grayscale ETHE: $33 million – A noble, albeit smaller, contributor.

- Grayscale ETH: $54.2 million – A rather respectable figure in the world of riches.

- Bitwise ETHW: $14.4 million – It seems that even the little ones have their day.

- Franklin’s EZET: $5.1 million – Oh, how charmingly modest.

- VanEck’s ETHV: $3.7 million – One mustn’t forget the humble few.

- Invesco’s QETH: $3.7 million – A gentle reminder that not all giants are born at birth.

Altogether, these fine institutions now hold a staggering 5 million ETH, a sum approaching 4% of Ethereum’s total circulating supply. The tables, it seems, have turned in favor of the financiers.

The Dreaded Ethereum Supply Crisis? More ETF Demand Than ETH Issuance?

As the crypto gods look down with a mixture of amusement and disdain, Ethereum’s net issuance simply cannot keep pace with institutional demand. In the past 24 hours, a paltry $6.74 million worth of ETH was issued by the network, but ETFs? Oh, they scooped up a sum more than 107 times that amount. The imbalance is grotesque, a true travesty of supply and demand.

Will this madness drive the price even higher? One can only speculate. But, dear reader, let us not be caught off guard. The winds of change are most favorable for those who can weather the storm.

ETH Price Performance: A 40% Monthly Rally – Is This the Stuff of Legends?

At this very moment, Ethereum dances at $3,378.77, a figure previously unimaginable. This marks a 40.4% increase from the 1st of July when it lingered around $2,403.27. The 14-day gain of 30.5% is evidence enough that institutional interest is growing by leaps and bounds. One can almost hear the rustle of the investor’s pockets jingling with excitement.

And as Bitcoin dominance retreats, capital has begun to flow like wine into Ethereum and its charming band of altcoins. Could it be that we are at the dawn of a new “Altcoin Season”? Time will tell, but I daresay the signs are quite clear.

Never Miss a Beat in the Crypto World!

Stay ahead of the game, dear reader. Keep your eyes wide open for the latest news, expert analysis, and real-time updates on Bitcoin, altcoins, DeFi, NFTs, and all the deliciously unpredictable wonders of the digital age.

FAQs

Why is Ethereum price going up today? Ah, the answer is simple—record inflows into U.S. spot Ether ETFs, of course. $726 million, led by BlackRock and Fidelity, has flooded into Ethereum’s coffers, and this institutional demand is driving the price up like a rocket ship.

What caused Ethereum to cross $3,300? A delightful combination of massive ETF purchases, far outpacing the issuance of new ETH. ETFs bought over 107 times more ETH than was created in the last 24 hours. The price surge was as inevitable as the sunrise.

How much ETH do spot ETFs hold now? A rather remarkable 5 million ETH, or roughly 4% of Ethereum’s circulating supply. This is no small feat, my friends.

Is this the beginning of altcoin season? Oh, indeed. Ethereum’s triumph and the rise of XRP, Solana, Dogecoin, and others signal the beginnings of a glorious altcoin renaissance. Rejoice!

Read More

- BTC PREDICTION. BTC cryptocurrency

- 🔥Vienna’s Crypto Carnage: Ukrainians Burn Wallets & Souls! 💰💀

- Bitcoin’s Wild Ride: Whales Strike Back, Shorts Cry 😭💰

- Cardano’s Melancholy Ballet: Death Cross Dances as Markets Pause for Dramatic Effect

- SEC v Cryptos: ‘Innovation Exemption’ Will Arrive in 30 Days… Maybe? 🧨💸

- EUR USD PREDICTION

- ENA Price Jumps 18% as December Breakout Setup Strengthens: Can It Hit $0.65 Next?

- SEC’s Peirce Champions Crypto Privacy as Tornado Cash Trial Heats Up 🚒💼

- Bitcoin’s Cosmic Cringe: Why the Crypto World Is Now a Black Hole 🌌💸

- 🚀 NEAR Protocol Soars 8.2% While Others Stumble – CoinDesk 20 Chaos! 💸

2025-07-17 10:30