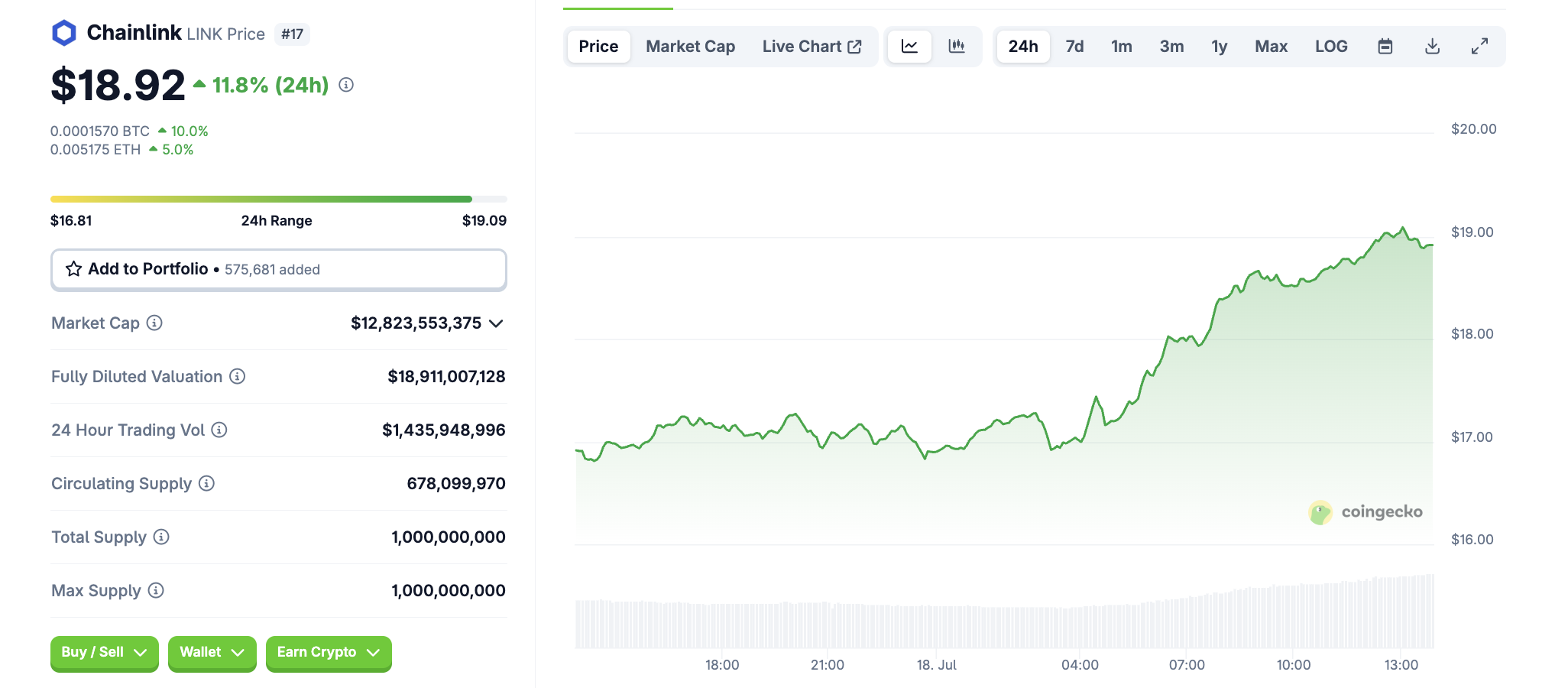

In what can only be described as a delightful little jaunt through the rollercoaster that is cryptocurrency, LINK, the illustrious native token of Chainlink, has bobbed up—wait for it—12% in just 24 hours. Talk about turbocharge! Not surprisingly, this has caused quite the teeny sensation in the land of the crypto enthusiasts.

As the fog of confusion slowly lifts—thanks to some legal wizardry—we’re seeing LINK preparing to be the charming liaison between our cozy, traditional finance and the adventurous, chaotic realm of blockchain.

The Genius Act: Chainlink’s New Best Friend

Now, before you roll your eyes at yet another fleeting “pump,” fear not; this chain of events appears to be more of a solid foundation than a mere blip on the crypto radar.

A standout cause behind this thrilling little rally? The passing of the Genius Bill Act, which, in a move reminiscent of a magician pulling a rabbit out of a hat, bestows legal clarity upon stablecoins and digital assets. Yes, you heard that correctly! US banks can now legally hug their crypto assets and stablecoins close.

“Stablecoin regulation in the US will kick off a wave of new stablecoins in the US and all over the world. They will all need proof of reserves and cross-chain connectivity to be used as a source of payment for the growing digital asset economy and tokenized funds. Chainlink is the only platform that provides proof of reserves and cross-chain connectivity in one system,” shared Chainlink CEO and Co-founder Sergey Nazarov, who probably deserves a cheering crowd right about now.

In this thrilling saga, Chainlink is like the sophisticated but relatable nerd in a superhero movie, serving as the vital infrastructure that binds real-world data and glittering assets to the mystical realm of blockchains. The Genius Act’s effects mean traditional finance may just need a guiding hand (or a compliance engine) for navigating this new digital asset domain. Enter Chainlink’s ACE (Automated Compliance Engine)—not to be confused with a superhero sidekick, though it’s pretty heroic in its own right.

ACE is like your overly cautious friend on a road trip, always ensuring you follow all the traffic laws—all while making sure those cross-chain transactions and crypto custodianship don’t step on any legal toes. With banks now grinning happily at the prospect of entering the digital asset market, Chainlink’s ACE could become a must-have “compliance gateway”—which, let’s be honest, is pretty snazzy for squeezing up demand for that LINK token.

“Genius Bill Act passed, stable coin clarity is in effect. Banks are allowed to hold in custody crypto and stablecoins. These banks can also issue their own stablecoins. Many will need a path to market. Most won’t have internal R&D to build it entirely in-house themselves. This is where Chainlink’s ACE (Automated Compliance Engine) comes in,” an astute yet slightly dramatic X user declared.

The Ripple Effect

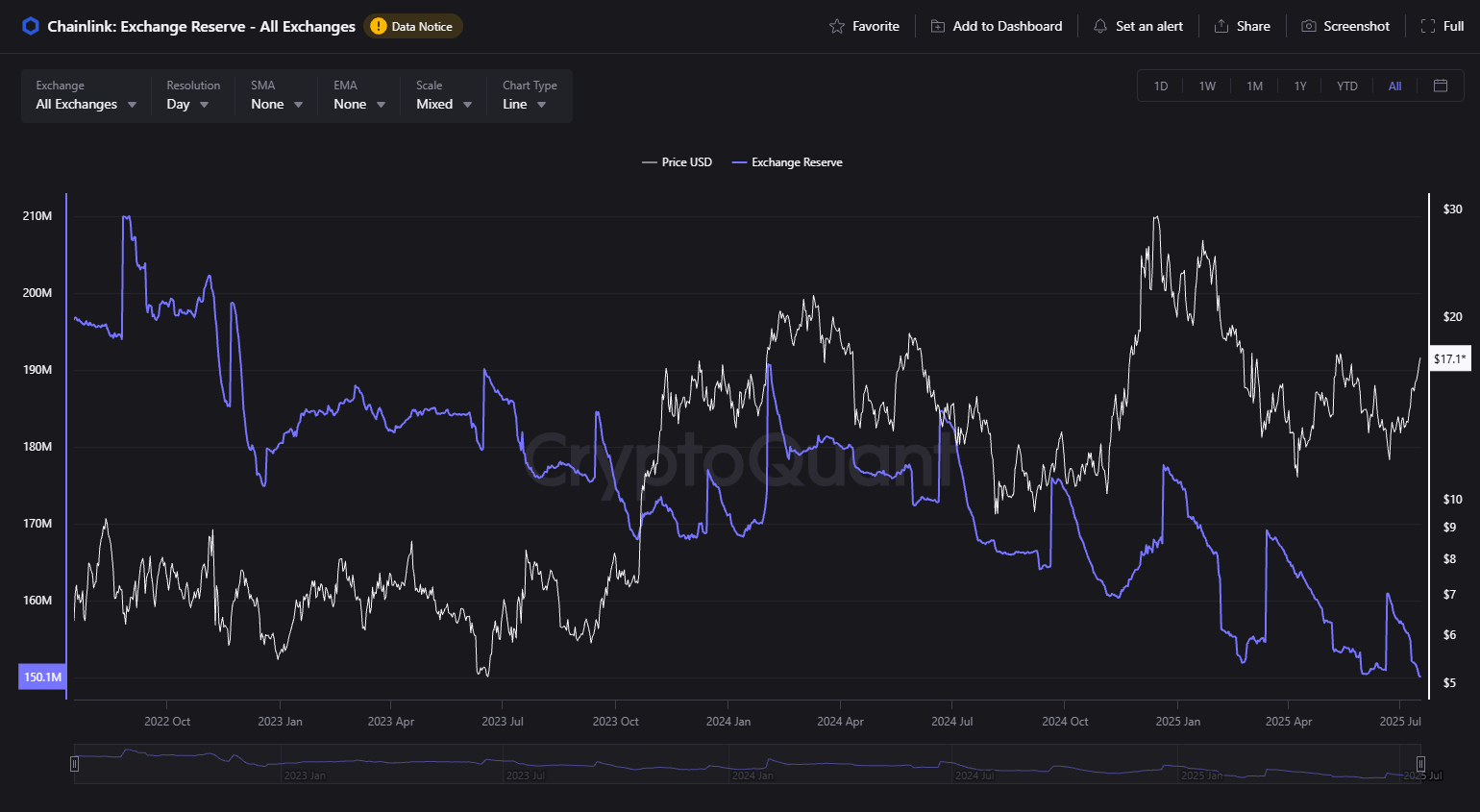

And just when you thought we’d reached the last surprise, a new factor is giving the old price of LINK a boost: it seems to be shrinking on exchanges, dipping to an all-time low. This can only mean one thing—confidence is building, folks!

As the pressure to sell fizzles out and the appetite for LINK grows with delightful use cases like staking and oracle data services, we might just witness a classic buying frenzy—a glorious spectacle driving LINK prices skyward.

Furthermore, the Chainlink Standard—a catchy little framework—has been increasingly embraced across financial ecosystems, striving to solidify the groundwork for an innovative blend of blockchain and traditional finance.

According to the ever-enthusiastic Sergey Nazarov, Chainlink has crafted a vision that stretches beyond mere “data oracle” duties; it’s almost like they’ve donned a superhero cape to become the compliance-focused data infrastructure for the world’s sprawling financial landscape.

“The future of the global financial system is on-chain and the on-chain world has to have a globally adopted set of standards [Chainlink Standard] for how on-chain transactions reliably work, both inside a country’s financial ecosystem and across countries, to create the new global financial system,” opined Sergey, probably while gazing dreamily at a digital horizon.

With regulatory policies sprouting like eager plants in spring, cutting-edge technology blossoming, strategic alliances forming, and investor confidence rising, Chainlink appears poised to embark on an exhilarating journey of growth. Who knows? That recent 12% price surge may just be the prelude to a grand symphony of recovery!

Read More

- BTC PREDICTION. BTC cryptocurrency

- Bitcoin’s Wild Ride: Whales Strike Back, Shorts Cry 😭💰

- SEC v Cryptos: ‘Innovation Exemption’ Will Arrive in 30 Days… Maybe? 🧨💸

- 🔥Vienna’s Crypto Carnage: Ukrainians Burn Wallets & Souls! 💰💀

- SEC’s Peirce Champions Crypto Privacy as Tornado Cash Trial Heats Up 🚒💼

- Cardano’s Melancholy Ballet: Death Cross Dances as Markets Pause for Dramatic Effect

- 🚀 NEAR Protocol Soars 8.2% While Others Stumble – CoinDesk 20 Chaos! 💸

- EUR USD PREDICTION

- Ethereum Whale’s Bold $280M Short: Is the Market on a Cliff or Just a Cliffhanger? 🤔

- Crypto Mayhem: Banks at Risk of Losing Their ‘AAA’… And Their Minds! 😬

2025-07-18 11:52