Ah, XRP, the darling of the crypto world, has ascended 3% in the past 24 hours, a mere trifle for those of us who measure success in champagne toasts. One might say the market’s bullish sentiment is as fleeting as a lover’s vow, yet here we are, dancing to the tune of a whale’s whims.

On July 19, the blockchain’s most observant gossip, Whale Alert, whispered of a transaction so grand it could make a king weep. A sumptuous 20.5 million XRP, valued at a cool $70 million, was spirited away from an enigmatic wallet to Coinbase, the digital equivalent of a grand ballroom for crypto’s elite. One might speculate the whale is simply hosting a lavish soiree—or perhaps plotting a coup.

XRP Futures Hit Record $11 Billion as Institutions Play the Long Game 🎭

This transaction has sparked speculation that the whale, having danced through the market’s recent rally, is now plotting a grand exit to sip profits in a distant isle. Or perhaps it’s simply indulging in a game of crypto chess, with the rest of us as pawns on the board. Either way, the price remains as stubbornly upward as a poet’s ego.

Historically, such transfers to centralized exchanges are as reliable as a politician’s promise. They often herald selling pressure, a tempest on the horizon. Yet XRP, ever the drama queen, continues its upward waltz, brushing off the storm with the grace of a Victorian heroine.

According to BeInCrypto’s data, the token briefly flirted with $3.54, a price so tantalizing it could make even a stoic investor blush. This weeklong rally, a 25% ascent, brings it perilously close to its 2018 zenith of $3.84. One might say history is repeating itself—or merely gossiping.

The rally reflects a wider recovery in the crypto sector, where the market’s $4 trillion valuation now glitters like a mirage. Investor sentiment, once as fragile as a soufflé, has improved, buoyed by the US regulatory climate’s sudden thaw. A thaw, of course, is merely a polite term for a bureaucratic ice cream social.

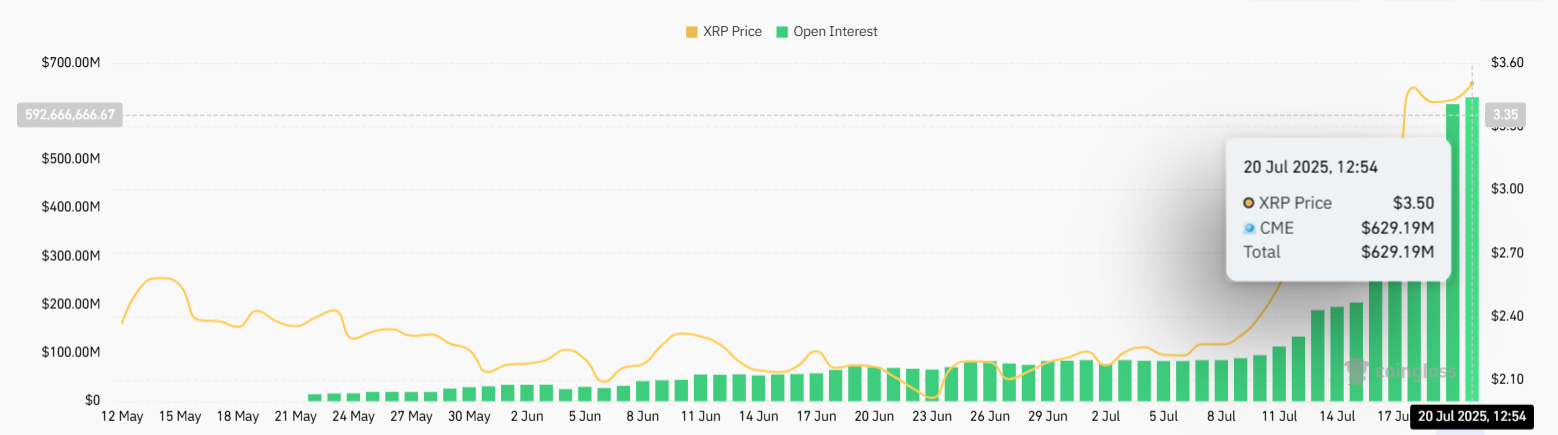

Meanwhile, XRP is gaining momentum not just in the spot market but on derivatives platforms, where the stakes are higher and the bets are as bold as a dandy’s cravat. According to CoinGlass, open interest in XRP perpetual futures has surged past $11 billion, a figure so staggering it could make the Queen of Hearts blush. This is no mere ripple in the pond; it is the grand ballroom of derivatives, where every bet is a waltz and every position a flourish.

This new high eclipses the previous $8 billion peak, a number that once seemed as unreachable as a Wildean ideal. The timing? Delightfully coincidental, as if the market itself is winking at us from behind a lace fan.

A rising open interest alongside price growth is the kind of signal that makes institutions sit up and take notice, their interest as insatiable as a Victorian’s appetite for scandal. Bitget leads the charge, holding over 20% of open positions valued at $2.2 billion—a sum that would make even Scrooge McDuck reconsider his financial strategy.

CME’s futures, too, have reached a record high of $630 million, a number so round it could pass for a Shakespearean tragedy. One might say the market is in a state of euphoric excess, a phrase that, in this context, means nothing at all.

Meanwhile, XRP’s resurgence aligns it with the likes of Bitcoin and Ethereum, the A-listers of the crypto world. These assets, with their institutional allure, have turned derivatives into a high-stakes ballet. XRP, ever the chameleon, now dances among them, its moves as calculated as a courtier’s bow.

XRP’s renewed vigor arrives on the heels of Ripple’s legal truce with the SEC and a series of upgrades to the XRP Ledger. One might call this a phoenix rising from the ashes—or simply a well-timed plot twist in a financial soap opera.

Read More

- EUR USD PREDICTION

- GBP CNY PREDICTION

- NEXO PREDICTION. NEXO cryptocurrency

- 🚀 NEAR Protocol Soars 8.2% While Others Stumble – CoinDesk 20 Chaos! 💸

- CNY JPY PREDICTION

- STX PREDICTION. STX cryptocurrency

- SEC’s Peirce Champions Crypto Privacy as Tornado Cash Trial Heats Up 🚒💼

- BTC PREDICTION. BTC cryptocurrency

- DOGE PREDICTION. DOGE cryptocurrency

- WLD PREDICTION. WLD cryptocurrency

2025-07-20 15:37