So, here we are—Bitcoin (BTC) has decided it’s feeling bougie for the fourth month in a row. But wait, what’s this? It just wrapped up its first red weekly candle of July, and no, it wasn’t a cute picnic blanket!

Think analysts are still wearing party hats? Well, some might, but others are raising their eyebrows and sipping their green juices, whispering about signs of a potential price correction. Talk about drama! 🍿

Is Bitcoin About to Hit Pause and Take a Nap?

Now, these warning signs don’t guarantee Bitcoin will take a nosedive. They’re just those pesky alerts you see before things get a bit too spicy in the market kitchen. 🔥

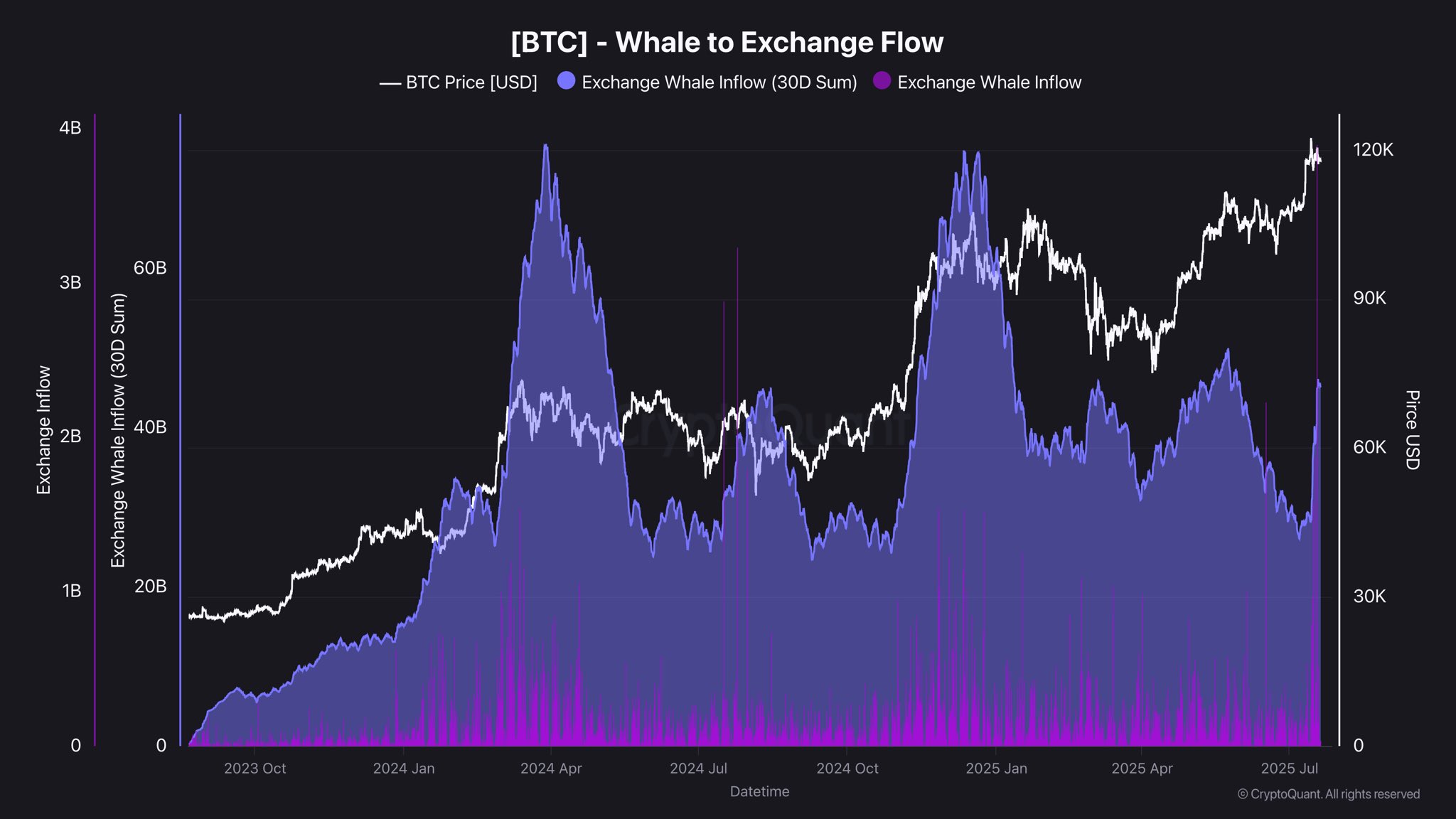

1. Whale Watching: They’re Swimming to the Exchanges! 🐋

First off, we’ve seen a surge in Bitcoin Whale-to-Exchange Flow. Yes, those big fish are sending loads of BTC to exchanges, hinting they might want to cash in. And you thought that yacht was just for show!

Our buddy Darkfost has some tea to spill; during the last two market peaks, whale influxes soared past $75 billion, which was basically the signal to say, “Um, correction incoming!” Between July 14 and July 18, they’ve already hit $45 billion, and yes, that’s a whale-sized problem!

“Be on alert with whale activity because they can sell faster than a hot cake on a Sunday morning,” Darkfost quipped.

And Darkfost isn’t done! He mentions that a clever whale just shipped 400 BTC (worth a jaw-dropping $47.1 million) to Binance because why keep a good profit to yourself?

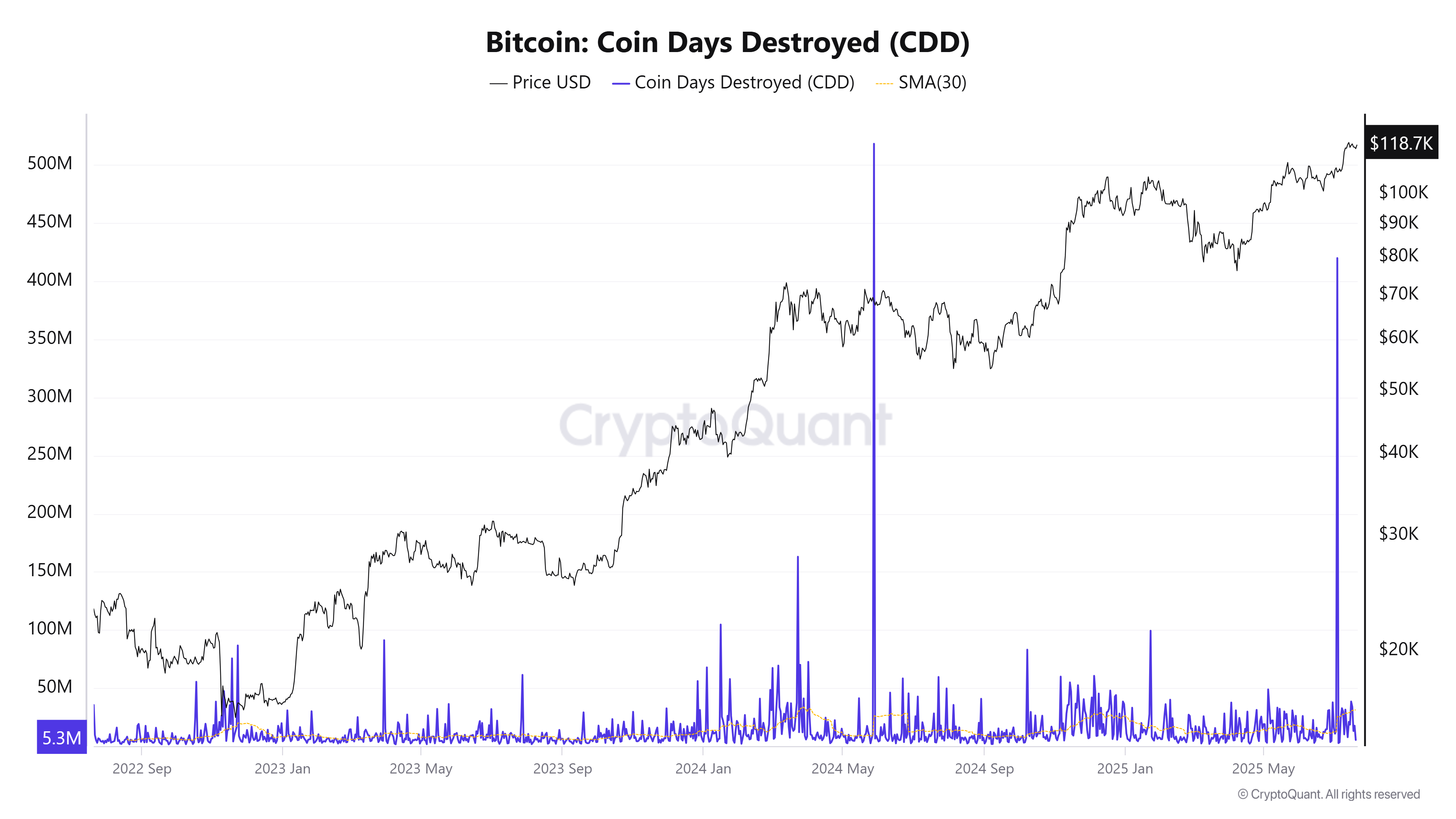

2. Coin Days Doing the Cabbage Patch 💃

On to the next red flag: Bitcoin’s Coin Days Destroyed (CDD) has hit a yearly high like it thinks it’s the star of a reality show.

CDD tracks how long coins have been dormant, and a spike? Well, it suggests our long-term holders might be shaking things up. Who knew coins had such social lives?

According to CryptoQuant, July’s average CDD has surpassed 31 million—highest since April 2024. Previous spikes have screamed “market correction!” But hey, maybe it’s just a friendly redistribution party for new investors? 🍾

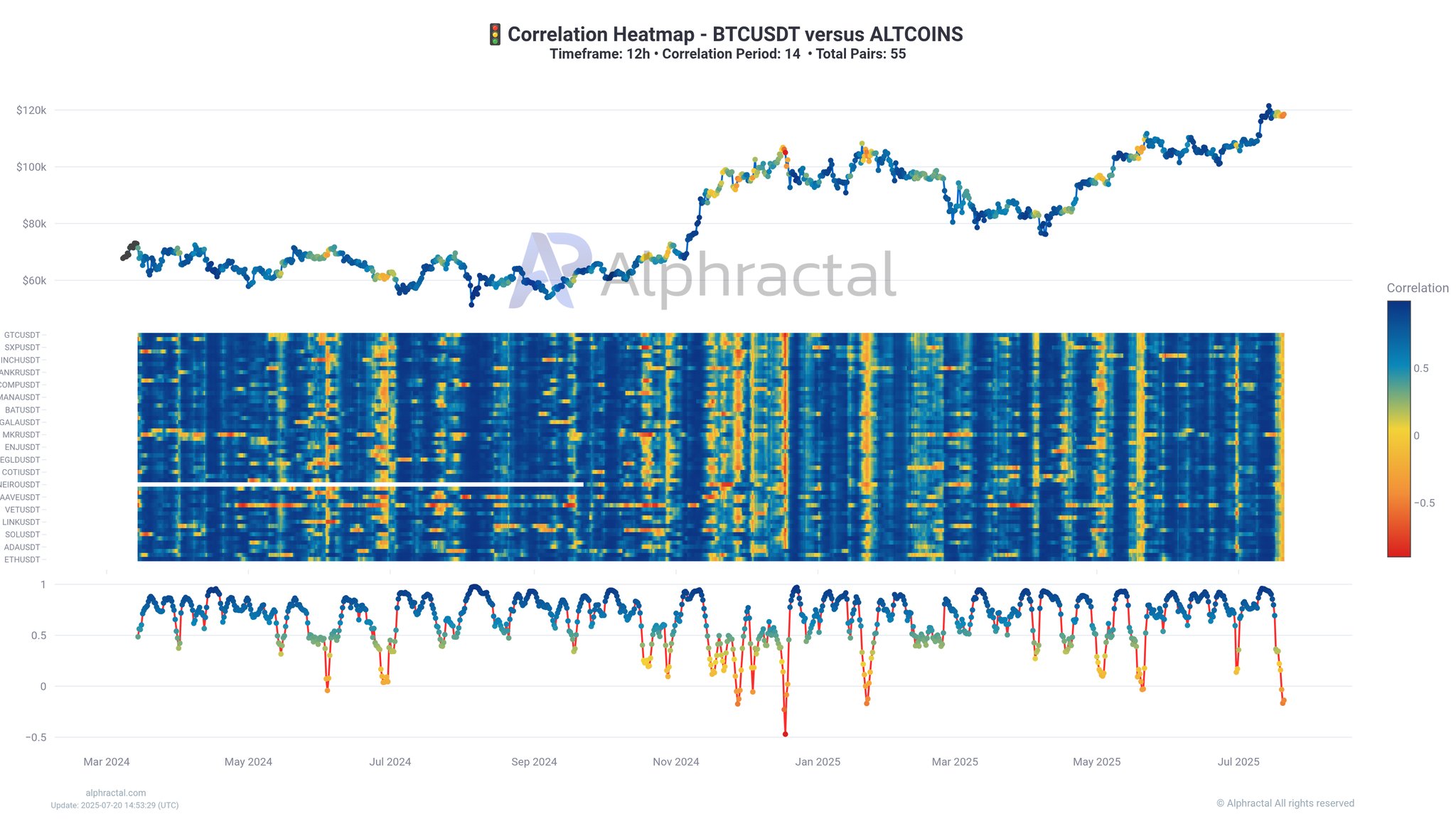

3. Altcoins Are Getting a Little Too Friendly 👀

And lastly, the correlation between altcoins and Bitcoin has taken a strange turn—like that friend who starts dating your ex. According to Alphractal, we’ve dipped below zero, which neatly implies altcoins are suddenly feeling extra confident.

But, oh boy, historically, this is like flashing red lights before a rollercoaster ride—strap in tight! 🎢

This drop in correlation has occurred three times since the start of 2025. Spoiler: In each case, Bitcoin’s price took a tumble. Coincidence or a bad pattern? You decide!

“Be wary of low correlation; it usually signals turbulence ahead. Fasten your seatbelts!” Alphractal cautioned.

Oh, and let’s not forget another juicy tidbit: the Coinbase Premium has decided to break up with the Kimchi Premium. This chaotic separation hints at an uneven bullrun, mainly due to fierce institutional demand in the US. Because why not add a little drama to this market romance? 💔

Read More

- EUR USD PREDICTION

- GBP CNY PREDICTION

- NEXO PREDICTION. NEXO cryptocurrency

- 🚀 NEAR Protocol Soars 8.2% While Others Stumble – CoinDesk 20 Chaos! 💸

- SEC’s Peirce Champions Crypto Privacy as Tornado Cash Trial Heats Up 🚒💼

- CNY JPY PREDICTION

- STX PREDICTION. STX cryptocurrency

- BTC PREDICTION. BTC cryptocurrency

- Is XRP About to Soar or Crash? The $3.27 Dilemma Explained!

- HBAR’s Price Tango: A Bumpy Ride with a Bearish Twist!

2025-07-21 13:16