Key Insights:

- Bitcoin whales dumped over 61,000 BTC into exchanges in one day—the biggest inflow in a year. Cue the drama. 🐳

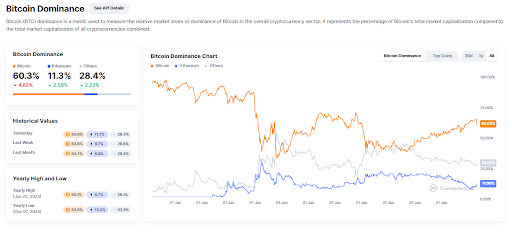

- Bitcoin dominance dropped from 64% to 60% faster than a rabbit running from a coyote. Capital is fleeing to altcoins like it’s Black Friday. 🛒

- Ethereum, Solana, and XRP are flexing their muscles, while meme coins are approaching a $90 billion market cap. Clown hats sold separately. 🤡💰

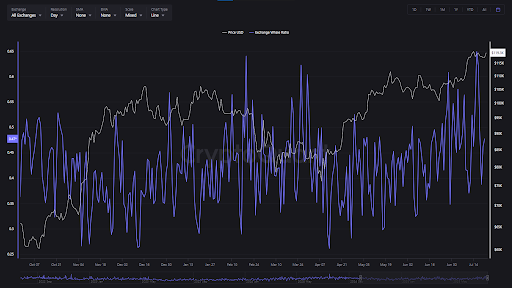

On July 17, Bitcoin whales decided it was time for a garage sale. They unloaded over 61,000 BTC onto exchanges in a single day, according to on-chain data from CryptoQuant. That’s the largest single-day Bitcoin inflow in a year. And guess what? It happened just days after Bitcoin hit a shiny new all-time high of $123,000. Classic timing, right? But before you grab your pitchforks and yell “bear market,” hold your horses—because the crypto market has other plans.

Bitcoin Dominance Takes a Dive (and Not the Fun Kind)

Something fishier than a sardine sandwich is going on here. While the sell-off grabs headlines, the real story is in Bitcoin’s market dominance. Between July 17 and July 21, Bitcoin dominance (BTC.D) plummeted from 64% to 60%. Sure, it sounds like a small shift, but in crypto land, that’s like watching a boulder roll downhill—it’s only a matter of time before chaos ensues.

A drop in BTC dominance usually means investors are swapping their Bitcoin for altcoins like they’re trading in old jeans for bell-bottoms. When this happens during Bitcoin’s post-rally chill session, it often signals the start of an altcoin season. History repeats itself, folks. In past cycles, similar drops in BTC.D were followed by Ethereum, Solana, and other mid-cap tokens throwing parties that even Gatsby would envy. And wouldn’t you know it, the pattern seems to be repeating. 🎉

Ethereum, Solana, and Meme Coins: The New Cool Kids on the Block

While Bitcoin sits in the corner, nursing its consolidation coffee ☕, altcoins are out there living their best lives. Ethereum, XRP, and Solana have all posted double-digit gains in the past week. Even meme coins, those mischievous troublemakers of the crypto world, are having their moment. Their total market cap surged 8% in a single day and is now knocking on the door of $90 billion. Who needs dignity when you’ve got Doge? 🐶

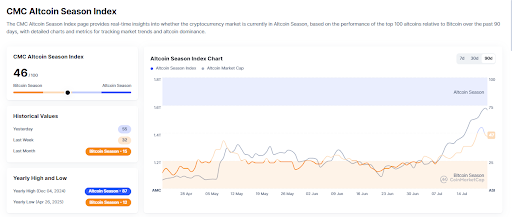

The Altcoin Season Index, which tracks whether altcoins are outperforming Bitcoin, jumped from 32 to 56 in just a few days. An index above 75 screams full-blown altcoin season, and we’re not far off. This isn’t just about performance—it’s psychological warfare. As Bitcoin stabilizes and fails to break new highs, investors start sniffing around for greener pastures. And where do they find them? Altcoins, of course. Always the bridesmaid, never the bride. 💍😂

BTC Cooling Off Fuels Altcoin Surge

Behind the scenes, the whales are playing chess while the rest of us are stuck playing checkers. According to CryptoQuant analyst JA Maartun, the 61,000 BTC inflow wasn’t random—it was orchestrated like a symphony. Or maybe more like a garage band. 🎸

Time to stay cautious

Open Interest in altcoins is starting to diverge from Bitcoin Open Interest. It’s all good while the music’s still playing—but there’s a risk hanging overhead.

— Maartunn (@JA_Maartun)

The whales moved 32,300 BTC in one hour, after two earlier batches of 15,800 BTC and 13,400 BTC. All of these transfers came from wallets holding over 100 BTC, which is whale-speak for “profit-taking.” But here’s the kicker: the market hasn’t collapsed. Bitcoin has held support above $115,000, suggesting new buyers are stepping in like brave knights saving the day. 🛡️

At the same time, whales seem to be rotating into altcoins themselves—or at least creating the perfect storm for altcoins to thrive. By reducing Bitcoin’s gravitational pull, they’re giving altcoins room to dance. 🕺

So, is Bitcoin weak? Not quite. After a massive rally, markets need time to catch their breath. Bitcoin’s support at $115,000 has held strong so far. If whales keep selling, that support might get tested again. But if institutional buyers and retail traders continue to step in, Bitcoin could stay in this consolidation phase without a deeper correction. Meanwhile, altcoins are busy stealing the spotlight like the overachieving younger sibling. 🌟

Read More

- BTC PREDICTION. BTC cryptocurrency

- ENA Price Jumps 18% as December Breakout Setup Strengthens: Can It Hit $0.65 Next?

- Cardano’s Melancholy Ballet: Death Cross Dances as Markets Pause for Dramatic Effect

- 🔥Vienna’s Crypto Carnage: Ukrainians Burn Wallets & Souls! 💰💀

- Bitcoin’s Wild Ride: Whales Strike Back, Shorts Cry 😭💰

- SEC v Cryptos: ‘Innovation Exemption’ Will Arrive in 30 Days… Maybe? 🧨💸

- SEC’s Peirce Champions Crypto Privacy as Tornado Cash Trial Heats Up 🚒💼

- EUR USD PREDICTION

- Bitcoin’s Cosmic Cringe: Why the Crypto World Is Now a Black Hole 🌌💸

- Meet Vector: The Blockchain That Tosses Finality Speeds Out the Window! 🚀

2025-07-22 20:20