A 50% gain from despair to delirium has analysts reaching for their crystal balls once more 🚀, as Ethereum’s latest escapade lures them into predicting a $15,000 climax by 2025. Institutional inflows, technical charts, and blockchain enthusiasts whispering sweet nothings have created a symphony of optimism—or perhaps mass hysteria. Either way, it’s *so* fetching.

ETH Stumbles into Resistance Like a Tipsy Aristocrat at a Garden Party 🥂

After flirting with $3,812 on July 22—a high since the days when your grandmother still called crypto “witchcraft”—Ethereum’s rally tripped over its own petticoats. Nine days of gains collapsed into a 1.9% decline, leaving traders clutching pearls over the $3,650 “critical support” zone. How dramatic. 🎭

Chartists claim ETH failed to conquer $3,800 due to “supply zone resistance” (a phrase that sounds suspiciously like a Bond villain’s henchman). The Bollinger Bands now yawn with boredom, signaling low volatility. Yet, like a phoenix in a spreadsheet, ETH still flutters above its 200-day EMA. Resilience? Or denial? 🦚

ETF Inflows: Where Institutions Pour Money Like It’s 1899 and the Champagne Never Stops 🍾

U.S. ETFs sucked in $2.18 billion last week—a new high for institutional FOMO. Coinbase’s ETH reserves are now as sparse as a minimalist’s closet. 🏦 Is this “long-term conviction”? Or just rich folks buying lottery tickets with Monopoly money? Either way, it’s *divine*.

Regulators, ever the reluctant chaperones, might finally wink at Ethereum ETFs. More inflows could “stabilize” prices and shrink supply. Because nothing says “stability” like a crypto market dictated by Wall Street’s mood swings. 🎠

Whales Buy the Dip; Retail Sips Chamomile Tea and Wonders What Year It Is 🐟

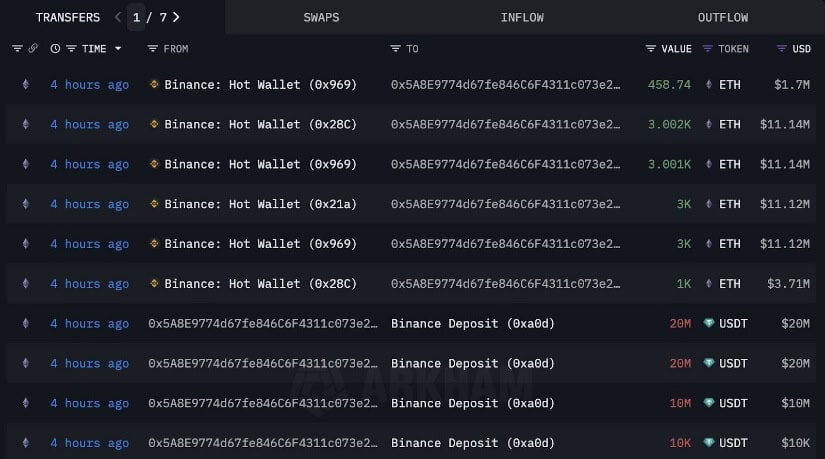

Whales added 500,000 ETH to their treasure chests last fortnight, including a $50M purchase at $3,715. Strategic positioning? Or just rich folks playing *SimCity* with real money? 🏦 Meanwhile, retail investors are too busy watching cat videos to notice the parade. 🐱

Institutional buying is “supporting” the uptrend. Because nothing says “organic growth” like a market propped up by billionaires. 🤭

Layer 2 Growth: Because Gas Fees Were Too Low and Someone Had to Raise Them Again 🚗

Arbitrum, Optimism, and zkSync are slashing gas fees—how *democratic*! Network activity booms, scalability soars, and investors swoon. Ethereum’s ecosystem now rivals a Silicon Valley startup’s mission statement: “We fix what wasn’t broken!” 💡

Bitmine and SharpLink Gaming added ETH to their balance sheets. Corporate adoption! Or as we call it, “Bitcoin’s 2020 moment, but with better PR.” 📈

The Great ETH Gamble: $15,000 by 2025 or a Very Embarrassing Obituary 📉

Ethereum’s forecast? “Positive!” (With a side-eye.) Staking, ETFs, and technicals all point to gains. $15,000? Maybe. $6k-$8k? Also possible. This is a market where “analysis” is just astrology for people who own Teslas. 🌌

Ethereum’s price? Driven by “structural changes” like institutional demand. Because nothing says “decentralized future” like Wall Street’s leftovers. 🧩

Ethereum today is a masquerade ball where everyone’s wearing “HODL” masks. ETFs, whales, and Layer 2s dance under the chandelier of speculation. Resistance levels? Merely a tango partner. And $15,000? Darling, it’s not a target—it’s a *mood*. 🎭

Read More

- EUR USD PREDICTION

- 🚀 NEAR Protocol Soars 8.2% While Others Stumble – CoinDesk 20 Chaos! 💸

- BTC PREDICTION. BTC cryptocurrency

- SEC’s Peirce Champions Crypto Privacy as Tornado Cash Trial Heats Up 🚒💼

- SEC v Cryptos: ‘Innovation Exemption’ Will Arrive in 30 Days… Maybe? 🧨💸

- Bitcoin’s Wild Ride: Whales Strike Back, Shorts Cry 😭💰

- Chinese Company Sheds Cars, Digs Digital Gold-You Won’t Believe Cango’s Bitcoin Binge! 🚗💰

- USD MYR PREDICTION

- ENA Price Jumps 18% as December Breakout Setup Strengthens: Can It Hit $0.65 Next?

- Cardano’s Melancholy Ballet: Death Cross Dances as Markets Pause for Dramatic Effect

2025-07-22 23:53