In the last week of July, the price of ADA climbed up to $0.92, fueled by high trading volumes and active on-chain transactions.

However, due to some investors taking profits, there’s been a slight adjustment towards a period of stability rather than growth, causing the price to dip to around $0.85.

Despite the retracement, whale accumulation signals a strong possibility of an extended rally.

ADA Price Rally Slows as Traders Book Profits

After showing impressive momentum through July, the ADA price experienced a temporary cooldown.

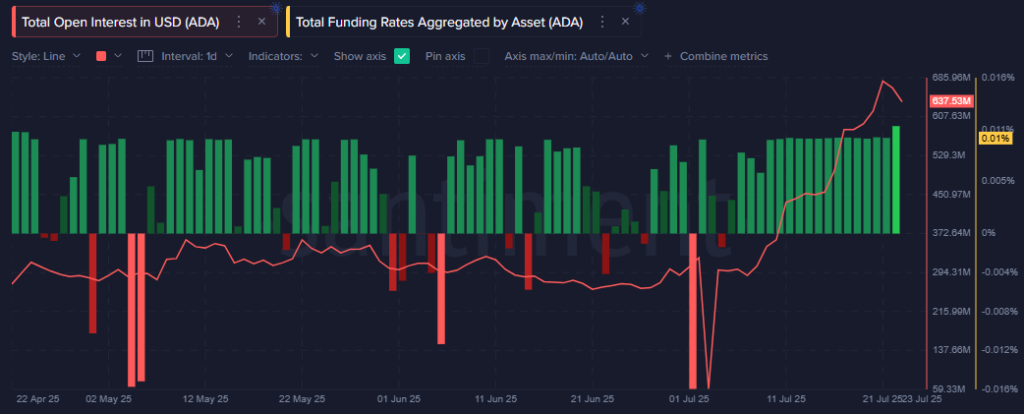

Alternatively, despite a slight decrease, the Open Interest remains around $637.53 million, suggesting a moderated selling pressure.

Recently, the price of ADA crypto reached $0.92, sparking significant attention in both the spot and futures markets. This surge caused Open Interest (OI) to peak at approximately $675 million. Additionally, funding rates remained favorable at around 0.01%, indicating that bulls continue to pay a premium to keep their long positions leveraged, a sign of ongoing optimism.

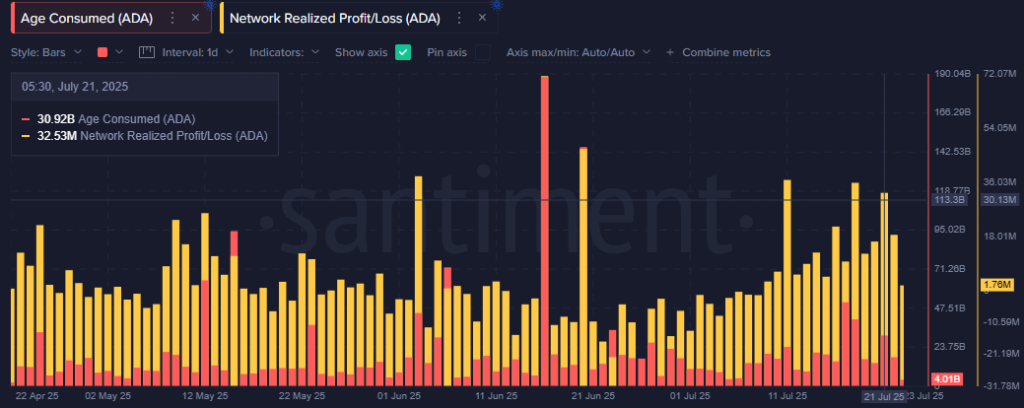

Furthermore, the downward trend observed was reflected in Santiment’s “Network Realized Profit/Loss” indicator, which showed a significant increase. This implies that numerous short-term investors chose to cash out at the recent peaks, causing a dip towards $0.85.

On-Chain Signals Show Whales Absorbing Retail Sell-Off

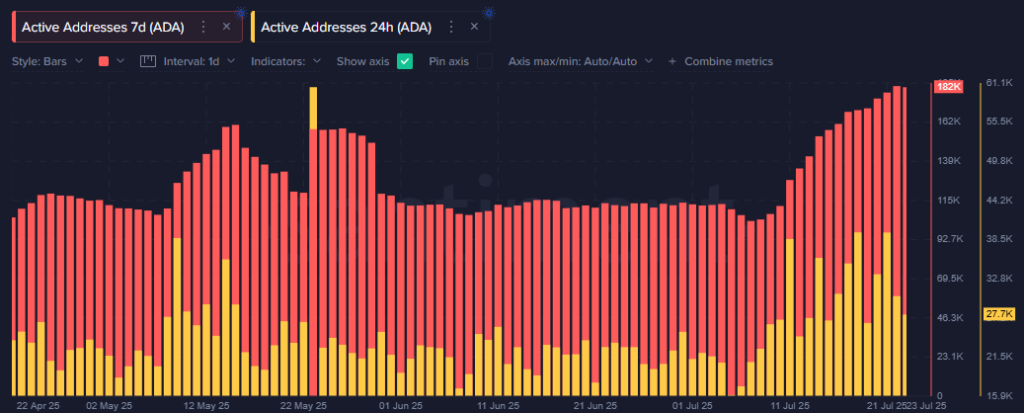

As a researcher examining the network, I can report that although there was a slight adjustment, the fundamental network health indicators continue to thrive. Notably, Santiment’s data on active addresses over both the 7-day and 24-hour periods have maintained a high level throughout July.

These are strongly signaling a sustained user engagement on the Cardano blockchain.

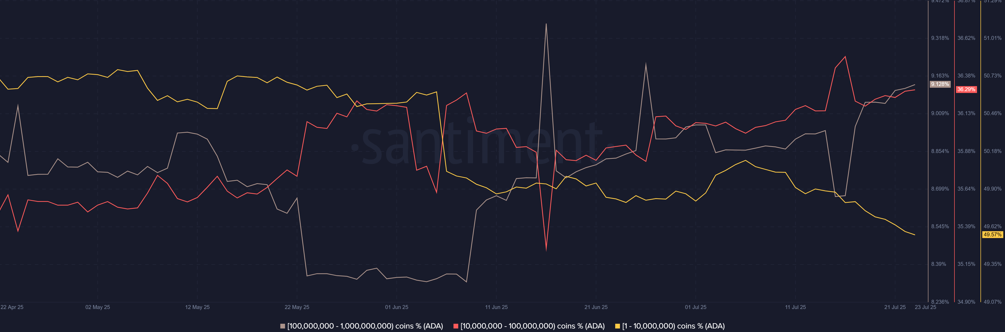

To put it simply, the distribution of ADA within wallets tells an intriguing story of redistribution. Specifically, the data indicates that the number of wallets containing between 1 and 10 million ADA has been decreasing consistently.

Simultaneously, significant holders of “10 million to 100 million,” as well as those with “100 million to 1 billion” ADA coins, have been accumulating them steadily.

As a crypto investor, I’ve noticed that the traditional buying pattern we see is usually a sign of confidence from big players like whales and institutions. Historically, this has often served as a precursor to more positive price movements for ADA.

ADA Price Prediction Points to $2, If $1 Barrier Breaks

Moving ahead, there’s a surge of analyst opinions on platforms such as X, and they are quite confident that this temporary downturn might set the stage for further growth in the long term.

Should whales keep amassing and if the overall market opinion remains positive, surpassing the $1 barrier might serve as a catalyst for a significant price increase.

It seems that Cardano could use some time to regroup, but this could be the opportune time for ADA to burst through the barriers of its bull market and head toward $2 and potentially even higher values.

— Dan Gambardello (@cryptorecruitr) July 22, 2025

As its technological foundation strengthens and it maintains backing from the blockchain, there’s increasing talk that the price of ADA might return to $2 before the year is over. However, if it drops below $0.85, it may revisit levels lower than that.

Read More

- BTC PREDICTION. BTC cryptocurrency

- Cardano’s Melancholy Ballet: Death Cross Dances as Markets Pause for Dramatic Effect

- ENA Price Jumps 18% as December Breakout Setup Strengthens: Can It Hit $0.65 Next?

- SEC v Cryptos: ‘Innovation Exemption’ Will Arrive in 30 Days… Maybe? 🧨💸

- 🔥Vienna’s Crypto Carnage: Ukrainians Burn Wallets & Souls! 💰💀

- Bitcoin’s Wild Ride: Whales Strike Back, Shorts Cry 😭💰

- EUR USD PREDICTION

- SEC’s Peirce Champions Crypto Privacy as Tornado Cash Trial Heats Up 🚒💼

- Shocking Rally Ahead for NIGHT Token: Analyst Predicts 4x Surge to $0.20!

- Meet Vector: The Blockchain That Tosses Finality Speeds Out the Window! 🚀

2025-07-23 17:45