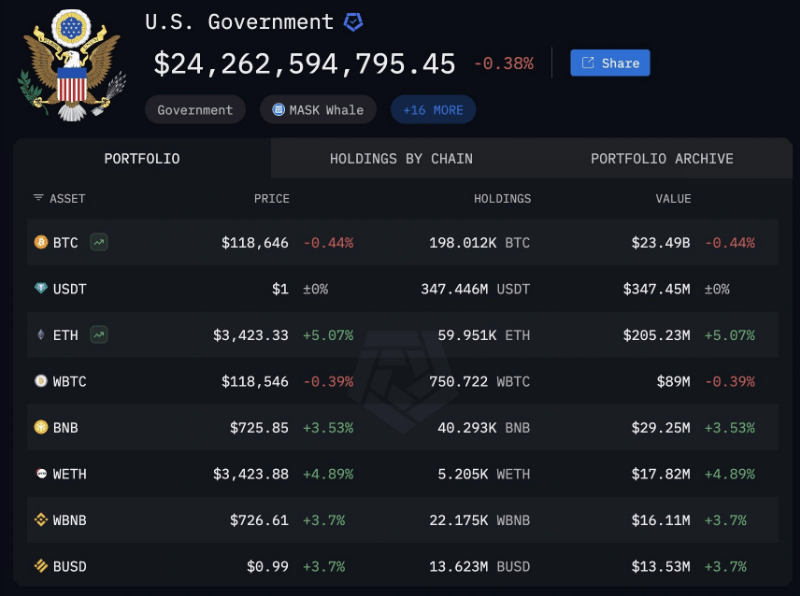

The United States, that most enigmatic of beasts, has hoarded over 198,000 Bitcoins—equivalent to a modest fortune in digital gold, if one can call it “gold” when it’s merely a number on a screen. 🧠💸

A recent spreadsheet, more tantalizing than a Russian novel’s cliffhanger, revealed a mere 28,988 BTC under the Marshals Service. But the true treasure lies in the shadows of the FBI, IRS, and DEA, where the numbers swell like a midnight feast. 🍽️

Government Stash Spread Across Agencies

The Marshals Service, that paragon of bureaucratic efficiency, clutches 28,988.356 BTC—worth roughly $3.45 billion—since July 15, 2025. But other agencies, those masters of secrecy, hoard coins from crime probes and prize auctions, leaving us to guess their totals. 🕵️♂️

Arkham, that modern-day oracle of blockchain, pieced together the puzzle, linking addresses to agencies with the precision of a surgeon. The result? At least 198,012 BTC, a sum so vast it could buy a small island—or a few dozen luxury yachts. 🏝️

DID THE US GOVERNMENT JUST SELL 170,000 BTC ($20 BILLION)?

No, dear reader, it’s merely a game of hide-and-seek with digital assets, where the rules are written in invisible ink. — Arkham (@arkham)

In everyday terms, the US is a Bitcoin whale, swimming through the digital seas with a hoard so vast it could make a pirate weep. Yet, the rest remains hidden, like a secret kept from a curious child. 🐟

Traders, those fickle creatures of the market, panicked upon seeing only the Marshals figure, as if the entire economy hinged on a single spreadsheet. But the real story is far more complex, involving agencies that treat Bitcoin like a forbidden fruit. 🍎

Senate darling Cynthia Lummis warned of a “total strategic blunder” if reserves dipped below 30,000 BTC. One wonders if she’s more concerned about the economy or her own crypto portfolio. 📈

Arkham: The US Government currently holds at least 198,000 BTC ($23.5B) across multiple addresses held by different government arms. None of this has moved for 4 months. — Wu Blockchain (@WuBlockchain)

Big Cases Make Up Most Holdings

The 2016 Bitfinex hack, a tale of betrayal and digital theft, contributed 114,599 BTC—enough to fund a small country’s internet for a decade. Silk Road’s legacy adds another 94,643 BTC, a testament to the eternal struggle between law and the shadowy corners of the web. 💻🕵️♀️

Alameda Research’s collapse added $81.25 million in BTC, while HashFlare scammers contributed $79.50 million. Even the Ryan Farace case, a minor footnote in the grand scheme, adds 58.7 BTC to the ledger. 📋

Sales Haven’t Touched Core Supply

The US sold 9,861 BTC in 2023, 10,000 in 2024, and another 10,000 in 2024. Yet the core reserves from Bitfinex and Silk Road remain untouched, like a treasure chest guarded by a dragon of bureaucracy. 🐉

Without a single public ledger, each FOIA release sparks fresh rumors. Traders, ever the drama queens, drive prices up or down on the flimsiest of whispers. But with the real number in hand, perhaps the chaos will subside. 🧠

Read More

- GBP USD PREDICTION

- EUR USD PREDICTION

- USD INR PREDICTION

- STX PREDICTION. STX cryptocurrency

- EUR RUB PREDICTION

- Tajikistan’s Bitcoin Blunder: $3.5M Gone! 🚨

- USD TRY PREDICTION

- ETH PREDICTION. ETH cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

- INJ PREDICTION. INJ cryptocurrency

2025-07-24 15:12