Ah, XRP, that cheeky little crypto that’s been flexing its muscles in July, leaving the rest of the market in the dust like a tortoise trying to keep up with a hare on espresso. Now, with rumors swirling that BlackRock—the Goliath of asset management—might be hatching an XRP Trust, the bulls are practically doing cartwheels. A favorable nod from the SEC on July 31 could sweep away the regulatory cobwebs, unleashing a torrent of institutional cash. And let’s not ignore those technical charts, screaming bullish signals louder than a foghorn at a rock concert, while Wall Street sharpens its pencils. Could XRP elbow its way into the ETF elite alongside Bitcoin and Ethereum? Oh, the drama! 😏🚀

BlackRock’s XRP Move? Market Anticipates ETF Expansion

Picture this: BlackRock, the behemoth that turned Bitcoin and Ethereum ETFs into cash cows, now eyeing XRP like a cat spotting a laser pointer. After raking in over $86 billion for its Bitcoin Trust and $10.6 billion for Ethereum, you’d think they’d be content, but no—greed or genius, take your pick. Analysts are whispering that XRP is the obvious next conquest, especially with Teucrium and ProShares’ ETFs already hoovering up nearly $470 million in mere months. JPMorgan’s crystal ball even predicts $8 billion flooding in if XRP gets the ETF green light. Because nothing says ‘sensible investment’ like betting on crypto rumors, right? 😂💰

BlackRock’s iShares Bitcoin Trust has been a goldmine, out-earning traditional ETFs faster than a teenager spends allowance money. So, why not throw XRP into the mix? It’s like adding hot sauce to a bland meal—sure, it might burn, but oh, the flavor! With XRP’s price holding steady and Wall Street’s gossip mills in overdrive, this could be the setup for a spectacular show or a spectacular faceplant. Either way, popcorn’s ready. 🍿

SEC Appeal Outcome Could Be the Trigger for XRP ETF Approval

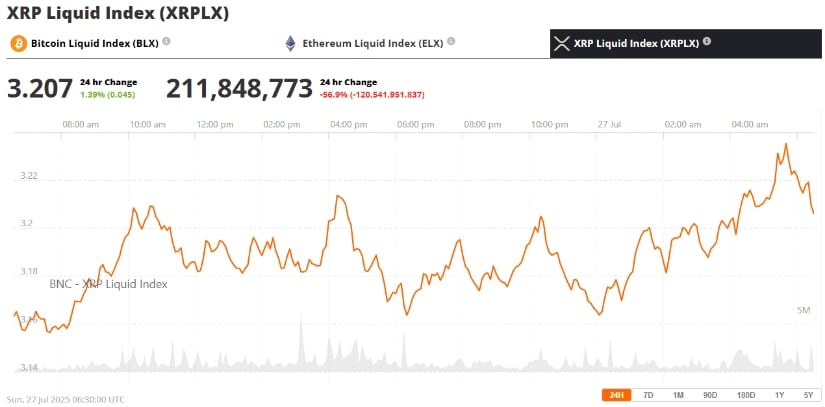

Now, enter the SEC vs. Ripple saga, a legal thriller that’s dragged on longer than a bad blind date. With a closed-door meeting looming on July 31, traders are glued to their screens, hoping for a miracle where the SEC drops its appeal and lets XRP waltz into ETF legitimacy. If that happens, poof—gone are the legal shackles, and BlackRock’s iShares XRP Trust could strut onto the stage. XRP’s price? Oh, it’s clinging to $3 like a cat to a curtain, up 0.76% on July 26, smirking at the broader market’s measly 0.31% gain. But remember, in crypto land, hope is as volatile as a caffeinated squirrel. 🐿️🤦♂️

XRP Price Prediction: Can Bulls Push Past $3.66?

Technically speaking, XRP’s chart looks as bullish as a tourist in a souvenir shop—sitting pretty above its 50-day and 200-day EMAs, practically begging for a breakout. Crack $3.30, and it’s off to the races toward $3.50 or even that lofty $3.66 high from July 18. Analysts are eyeing a cup-and-handle pattern, which, if it pans out, could catapult XRP to $5.20. I mean, who wouldn’t want to ride that wave? Just don’t forget your surfboard, because crypto seas are choppy. If a spot ETF gets approved, well, hold onto your hats—$5 might be child’s play. But hey, predictions are like weather forecasts: often wrong, but always entertaining. 🌊😂

Ripple’s Broader Ecosystem Adds Fuel to the Rally

Beyond the ETF hoopla, Ripple Labs is busy playing the long game, rolling out its RLUSD stablecoin that’s already amassed $530 million in assets. It’s like Ripple’s saying, ‘Hey, we’re not just here for the party; we’re bringing the snacks.’ With remittance solutions and XRP Ledger tech gaining fans in finance, XRP might actually have some real-world use—shocking, I know, in a sea of speculative bubbles. Institutional interest is growing, which could prop up the price even if the ETF dreams fizzle. Because nothing says stability like a crypto that’s useful… or so they claim. 😎💼

Macroeconomic Factors and Regulatory News Still Matter

Of course, it’s not all sunshine and rainbows. Lurking in the shadows are macroeconomic gremlins like trade wars and a Fed that’s about as predictable as a cat in a box. A hawkish stance could deflate risk assets faster than a pin in a balloon, dragging XRP down with it. On the flip side, some monetary easing or a trade truce might send everything soaring. And don’t overlook the regulatory roulette: the SEC appeal, the CLARITY Act, and other laws could make or break XRP’s future. It’s a reminder that in crypto, the only constant is uncertainty—and perhaps my growing collection of gray hairs from following this madness. 🤷♂️📉

Final Thoughts

So, here we are at the crossroads: ETF rumors, SEC suspense, and technical tea leaves all converging like a plot from a bad spy novel. XRP could be on the cusp of glory or another crypto crash landing. With BlackRock potentially in the wings and a key decision days away, the next few weeks might just redefine XRP’s fate. Will it soar or splutter? Your guess is as good as mine—after all, I’m just here for the laughs and the occasional emoji. Stay buckled in; this ride’s not over yet. 🚀😂

Read More

- EUR USD PREDICTION

- GBP USD PREDICTION

- USD INR PREDICTION

- SOL PREDICTION. SOL cryptocurrency

- INJ PREDICTION. INJ cryptocurrency

- STX PREDICTION. STX cryptocurrency

- TIA PREDICTION. TIA cryptocurrency

- USD TRY PREDICTION

- ETH PREDICTION. ETH cryptocurrency

- BTC PREDICTION. BTC cryptocurrency

2025-07-27 16:08