Oh, what a lark! This cup-and-handle pattern, that whimsical contraption of chartists, is strutting about like a pompous uncle at a family gathering, hinting at a bullish romp that aligns with the current price capers and volume fandango. One can almost hear the champagne corks popping already. 🍾

Traders, those eternal optimists, are glued to the $1.368 mark, treating it like the gatecrasher at a posh party that might just let in a horde of gains. Meanwhile, at this very moment, the daily chart’s technical tomfoolery—indicators and all—whispers of growing hoards of buyers flexing their muscles. 💪

Dogwifhat’s Price Shenanigans: A Cup-and-Handle Farce Unfolds

The 3-day WIF/USDT chart, as spotlighted by the ever-enthusiastic analyst Rafaela Rigo, unveils a cup-and-handle that’s more polished than a butler’s shoes. The rounded base kicked off in late 2024 and wrapped up its “cup” phase in May 2025, probably with a bow on top. 😄

Then came a pullback that sculpted the “handle” over June and July, a series of higher lows that one might liken to a staircase built by an overconfident architect. This handle, you see, is the market’s way of catching its breath before potentially vaulting upward, provided it smashes through that neckline with the grace of a bull in a china shop. Of course, nothing’s guaranteed—markets are trickier than a cat with cream. 🐱

The neckline’s perched at $1.368, with WIF lounging at $1.13 after reclaiming support at $1.11 like a knight retaking his castle. Rigo’s pegged $1.368 as Take Profit 1 (TP1), and a cheeky secondary target at $1.828 (TP2) nods to those dusty resistance zones from late 2024. The jump from current prices to TP1 could mean a sprightly 21% uptick, while stretching to TP2 might deliver a whopping 60%—all based on the cup’s depth and past market hissy fits. How delightful! 😂

Volume Hullabaloo and Price Antics: Buyers Seem to Be Having a Ball

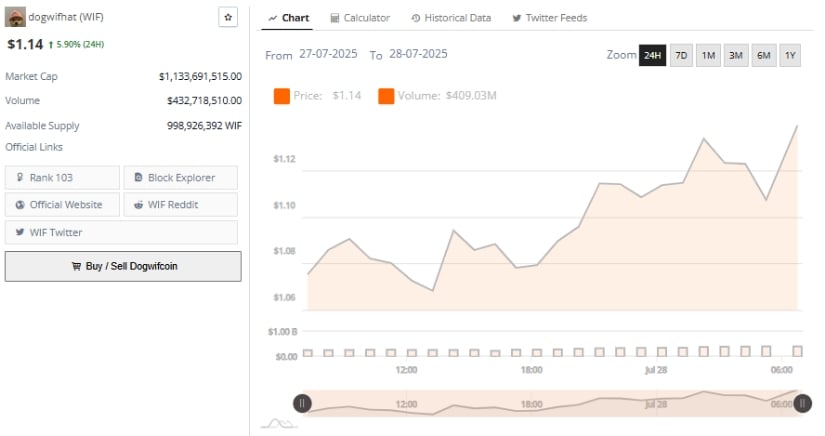

On the 24-hour chart, Dogwifhat’s been climbing like a social climber at a garden party, surging from about $1.06 to a peak of $1.14, chalking up a cheeky 5.90% gain. The price wiggled with higher highs and lows, building momentum like a runaway train in the final hours—suggesting buyers are itching for a crack at that $1.368 resistance, or perhaps just showing off. 🚂

Volume’s playing its part too, with a robust $432.7 million in daily trades, and $409 million in the last 24 hours alone. It’s all very civilized, this correlation between price pops and steady volume, implying accumulation that’s more enduring than a bad habit, not some fleeting fling. With a circulating supply of 998.9 million WIF and a market cap over $1.13 billion, Dogwifhat’s elbowed its way into the top 110 cryptos—quite the socialite, isn’t it? If the price holds above $1.11, we might see another upward jaunt; otherwise, a pullback could ensue, but let’s not spoil the fun just yet. 😉

WIF’s Indicator Capers: Bulls Still Holding the Umbrella

On the daily WIF/USDT chart, the token’s strutting at $1.138, having clawed up from a lowly $0.304 earlier this year, forging a pattern of higher lows that’s as reliable as a well-worn umbrella in a drizzle. Recent dips are being snapped up by buyers faster than canapés at a cocktail party, hinting that demand’s as sturdy as ever. A lunge toward the local high of $1.393 isn’t out of the question if this bullish binge continues. 🍸

The Chaikin Money Flow (CMF) is smirking at +0.08, indicating capital’s flowing in like guests to a free buffet, staying above zero to confirm that accumulation’s the order of the day. Historically, such CMF readings have tagged along with trends that refuse to quit, much like an uninvited relative at dinner. Similarly, the Bull and Bear Power (BBP) is hovering at 0.051, with bulls just edging out the bears—hardly a landslide, but enough to keep things ticking. If these numbers stay cheerful, Dogwifhat might just charge at that $1.368 resistance like a knight errant. All in all, it’s a merry dance, but remember, markets can turn on a sixpence. ⚡

Read More

- GBP USD PREDICTION

- EUR USD PREDICTION

- BTC PREDICTION. BTC cryptocurrency

- INJ PREDICTION. INJ cryptocurrency

- USD KZT PREDICTION

- USD MYR PREDICTION

- ETH PREDICTION. ETH cryptocurrency

- GBP CNY PREDICTION

- SHIB PREDICTION. SHIB cryptocurrency

- USD COP PREDICTION

2025-07-28 21:20