It is a truth universally acknowledged, that a cryptocurrency in possession of a strong rally, must be in want of a correction. Yet, dear reader, the tale of Dogecoin (DOGE) is far from simple. Over the past week, the price of this beloved digital coin has slipped more than 13%, a stark contrast to its triumphant 31% ascent in the preceding three months. While the current range-bound appearance might deceive the untrained eye, deeper inspection reveals a tapestry of hidden strength, particularly through a divergence that eludes the casual observer.

Short-Term Holders Capitulate, But Cost Basis Support Kicks In

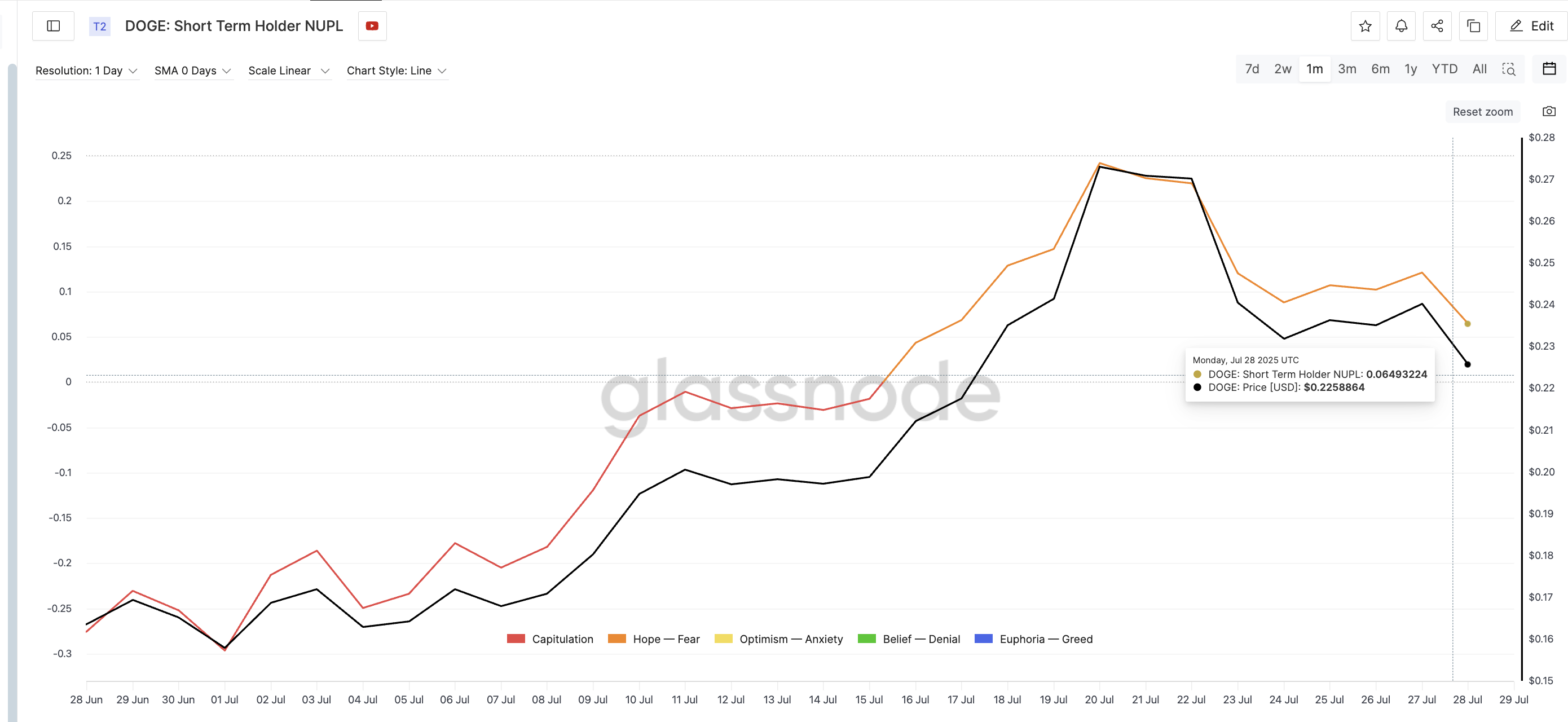

The first whisper of changing tides emerges from the short-term holder Net Unrealized Profit/Loss (NUPL), a metric that charts the unrealized gains and losses of those who have acquired DOGE within the last 155 days—these are the souls most prone to the whims of the market.

As the price dipped from its late-July zenith, the short-term holder NUPL plummeted from a respectable 0.24 (on July 20) to a mere 0.06 by July 28. This decline signifies that many recent investors, having tasted the bittersweet nectar of modest gains or the sting of minor losses, have chosen to part ways with their holdings—a common spectacle during the tempests of market correction.

Yet, this wave of despair may have encountered an immovable object, a bastion of support.

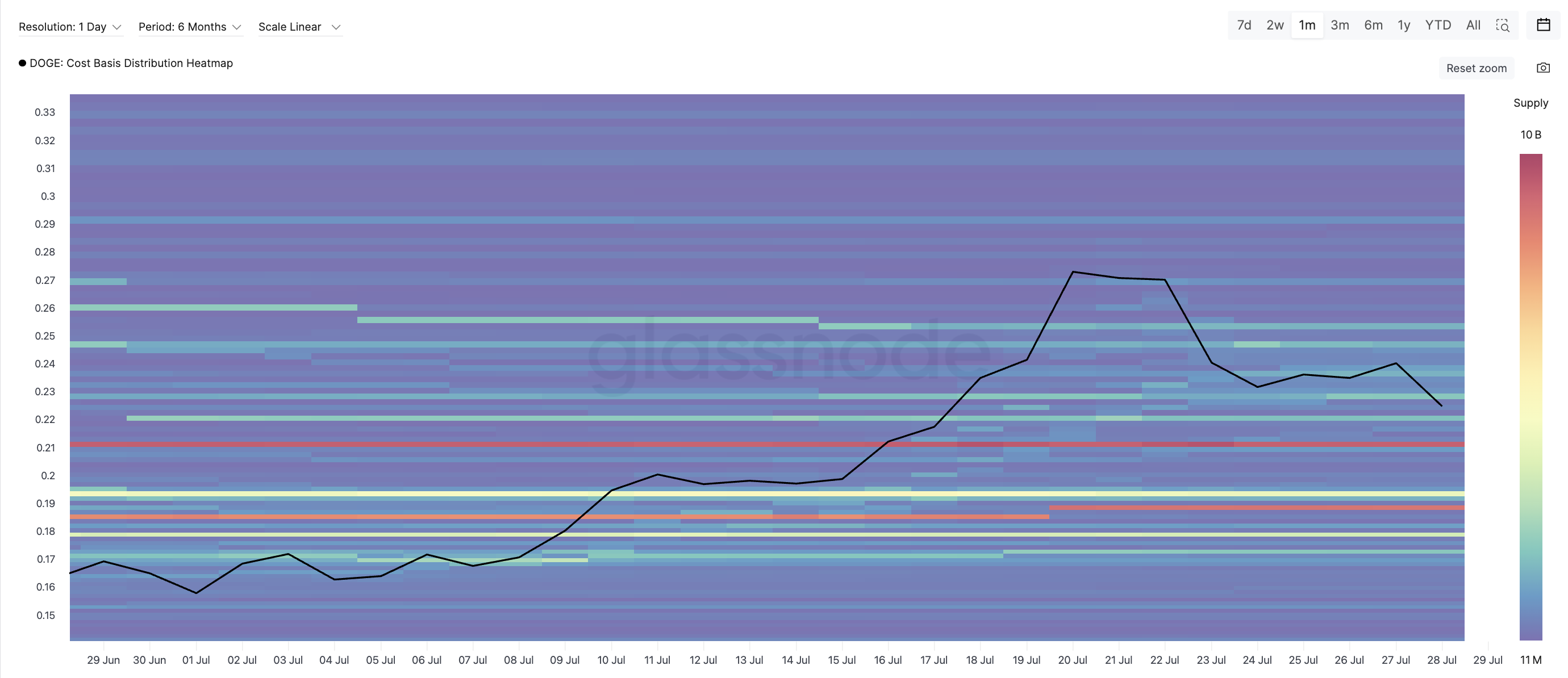

The DOGE cost basis heatmap, a visual representation of wallet clusters by average acquisition price, reveals a formidable band of supply around $0.21. A staggering 9.77 billion DOGE reside in this region, indicating that numerous holders have staked their claim at this level and are unlikely to relinquish it without a fight. History, dear reader, has shown these zones to act as formidable bulwarks against the forces of correction.

This convergence of emotional surrender (NUPL drop) and structural fortitude (cost basis support) crafts a scene ripe for a reversal: the storm of panic subsides, and the steadfast guardians of value stand firm.

Hidden Bullish Divergence Forms as Sellers Lose Steam

And now, the pièce de résistance: a hidden bullish divergence on the Relative Strength Index (RSI), a momentum indicator that could very well tip the scales.

The RSI, a measure of the vigor with which price moves, typically aligns with price in bullish trends, both ascending in tandem. However, hidden divergence disrupts this harmony.

In recent days, Dogecoin’s price has formed higher lows, a sign that buyers are reentering the fray at earlier stages of dips. Meanwhile, the RSI has etched out lower lows, a subtle indication that while momentum may have waned, the underlying price structure remains robust. This dissonance is crucial; it suggests that the sellers’ resolve is weakening, not strengthening.

Such hidden bullish divergence often manifests during consolidations or retracements within larger uptrends—precisely the scenario we find ourselves in, with DOGE still boasting a 30% gain over the past three months. This form of divergence underscores that the broader DOGE price uptrend persists, and the recent consolidation is but a brief interlude rather than a harbinger of a bearish shift.

When coupled with the capitulation of short-term holders and the unyielding support at $0.21, the RSI setup does more than hint at latent strength; it constructs a compelling argument for a bullish resurgence simmering beneath the surface.

For token TA and market updates: If you yearn for more insights into the cryptic world of tokens, do consider signing up for Editor Harsh Notariya’s Daily Crypto Newsletter here. 📩📊

Dogecoin Price Needs a Breakout to Confirm the Setup

At present, Dogecoin trades just shy of $0.23, navigating the treacherous waters between key Fibonacci levels: $0.23 (0.382 retracement) and $0.21 (0.5 retracement). For the bullish divergence narrative to unfold in its entirety, the price must remain above $0.21 and reclaim the $0.25 mark.

A successful breach above $0.25 would open the gates to $0.28, the next significant resistance level.

However, should the $0.21 threshold falter, momentum would wane, and the price might seek solace at $0.19 or even $0.17, thereby invalidating the bullish prognosis. Nevertheless, the cost basis heatmap stands as a testament to the resilience of the $0.21 level, a fortress not easily breached. 🏰💰

Read More

- EUR USD PREDICTION

- GBP USD PREDICTION

- EUR RUB PREDICTION

- INJ PREDICTION. INJ cryptocurrency

- EUR AUD PREDICTION

- SHIB PREDICTION. SHIB cryptocurrency

- BTC PREDICTION. BTC cryptocurrency

- WLD PREDICTION. WLD cryptocurrency

- CNY JPY PREDICTION

- GBP CHF PREDICTION

2025-07-29 17:14