Amidst the jubilation of economic figures, U.S. President Donald Trump once again urged the Federal Reserve to cut rates, as if the very heavens themselves could not resist his divine command.

Three Percent GDP Leap, Yet Bitcoin Clings Desperately to $118K

In the grand tapestry of American economic life, the U.S. gross domestic product (GDP) expanded by 3% in the second quarter, as reported by the Department of Commerce’s Bureau of Economic Analysis. The news, akin to a rare ray of sunshine piercing through the gloom, brought a smile to the face of President Trump, who declared it a victory of his own making. Stock markets, ever the faithful followers of economic whims, responded with cautious optimism. Bitcoin, that enigmatic and oft-misunderstood currency, showed a glimmer of hope, rising a modest 0.41%. 🌟

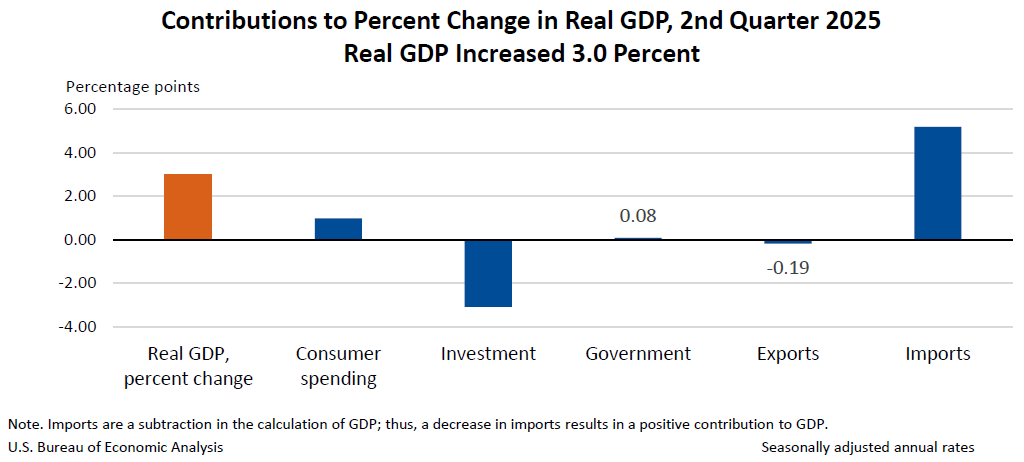

The robust GDP figures caught many Wall Street Journal and Dow Jones economists off guard, who had predicted a more modest 2.3% growth, largely due to the tariffs imposed by the Trump administration. These tariffs, like a double-edged sword, reduced imports by a staggering 30.1% and exports by a more modest 1.8%. The reduction in imports, a curious twist of economic fate, contributed significantly to the GDP surge. Americans, perhaps emboldened by the economic upturn, increased their spending, with personal consumption rising 1.4% in the second quarter, a marked improvement from the 0.5% growth in the first quarter. 💸

The official report, a document of considerable weight and import, stated, “The increase in real GDP in the second quarter primarily reflected a decrease in imports, which are a subtraction in the calculation of GDP, and an increase in consumer spending.”

The financial markets, ever the barometers of economic sentiment, saw the S&P 500 and Nasdaq rise by 0.06% and 0.27% respectively, while the Dow experienced a slight dip of 0.07%. Bitcoin, the digital phoenix, ascended by 0.41%, and the broader crypto market followed suit with a 0.48% increase in market capitalization. 📈

President Trump, never one to miss an opportunity to trumpet his achievements, took to Truth Social to declare, “2Q GDP JUST OUT: 3%, WAY BETTER THAN EXPECTED!” He then turned his gaze to the Federal Reserve, imploring, “‘Too Late’ MUST NOW LOWER THE RATE. No Inflation! Let people buy, and refinance, their homes!” His reference to Fed Chair Jerome Powell, who would soon announce the central bank’s interest rate decision, carried a hint of playful derision. 🎵

A Glimpse into the Cryptocurrency Abyss

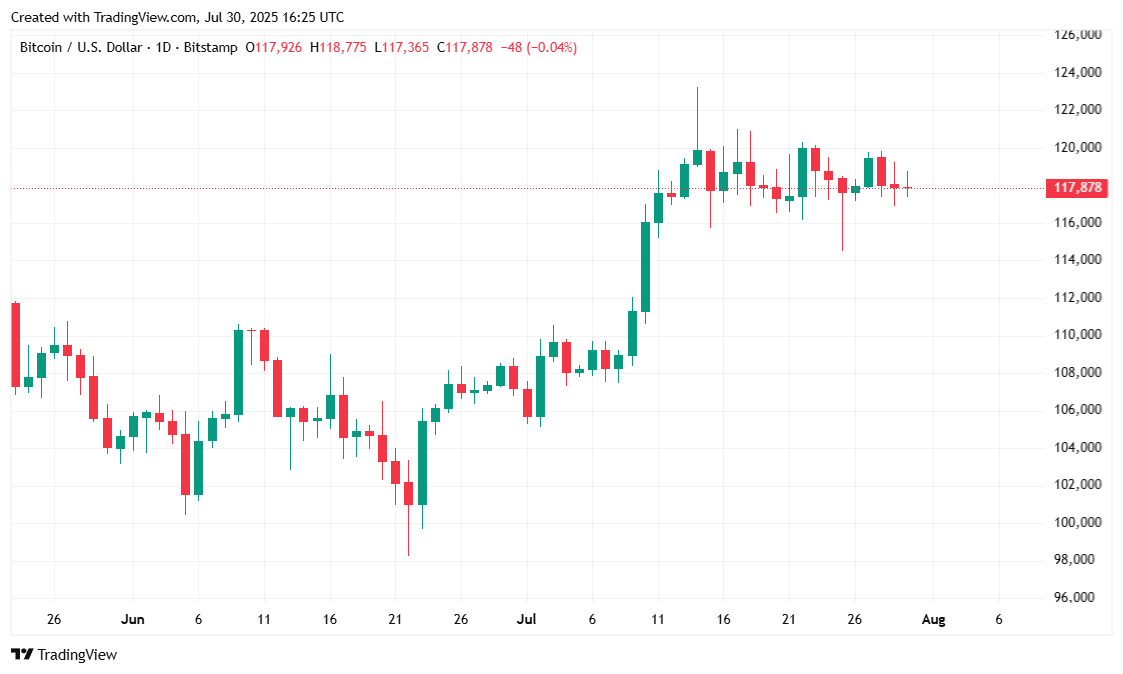

At the time of writing, Bitcoin was trading at $117,864.93, a slight 0.41% increase for the day, yet a 0.51% decline for the week. The cryptocurrency oscillated between $116,987.37 and $118,780.73 over the past 24 hours, as if caught in a perpetual dance of indecision. According to data from Coinmarketcap, trading volume since yesterday fell 8.58% to $62.88 billion, while market capitalization remained largely unchanged, increasing by only 0.28% to $2.34 trillion. Bitcoin’s dominance, a measure of its influence over the crypto market, inched up to 61.60%, a 0.18% increase over 24 hours. 🌍

The value of Bitcoin futures open interest declined 1.03% to $82.93 billion since yesterday, and Coinglass reported 24-hour bitcoin liquidations at $27.22 million. As is often the case, the majority of these liquidations, totaling $19.98 million, came from bullish long positions, while short positions accounted for $7.35 million in margin call liquidations. 🤑

Read More

- ETH PREDICTION. ETH cryptocurrency

- CNY JPY PREDICTION

- BTC PREDICTION. BTC cryptocurrency

- EUR RUB PREDICTION

- SOL PREDICTION. SOL cryptocurrency

- USD VND PREDICTION

- GBP CHF PREDICTION

- XMR PREDICTION. XMR cryptocurrency

- EUR USD PREDICTION

- SHIB PREDICTION. SHIB cryptocurrency

2025-07-30 19:58