In an episode best described as “a very bad day at the digital casino,” Bitcoin (BTC) spent the morning perfecting the dramatic swan dive, briefly tumbling below $115,000—touching $114,116 for those who enjoy precision—or as it’s known in the industry, the price at which everyone remembers their mother’s maiden name.

You Thought Your Monday Was Bad? Bitcoin Just Lost $500 Million in Open Interest 🏊♂️

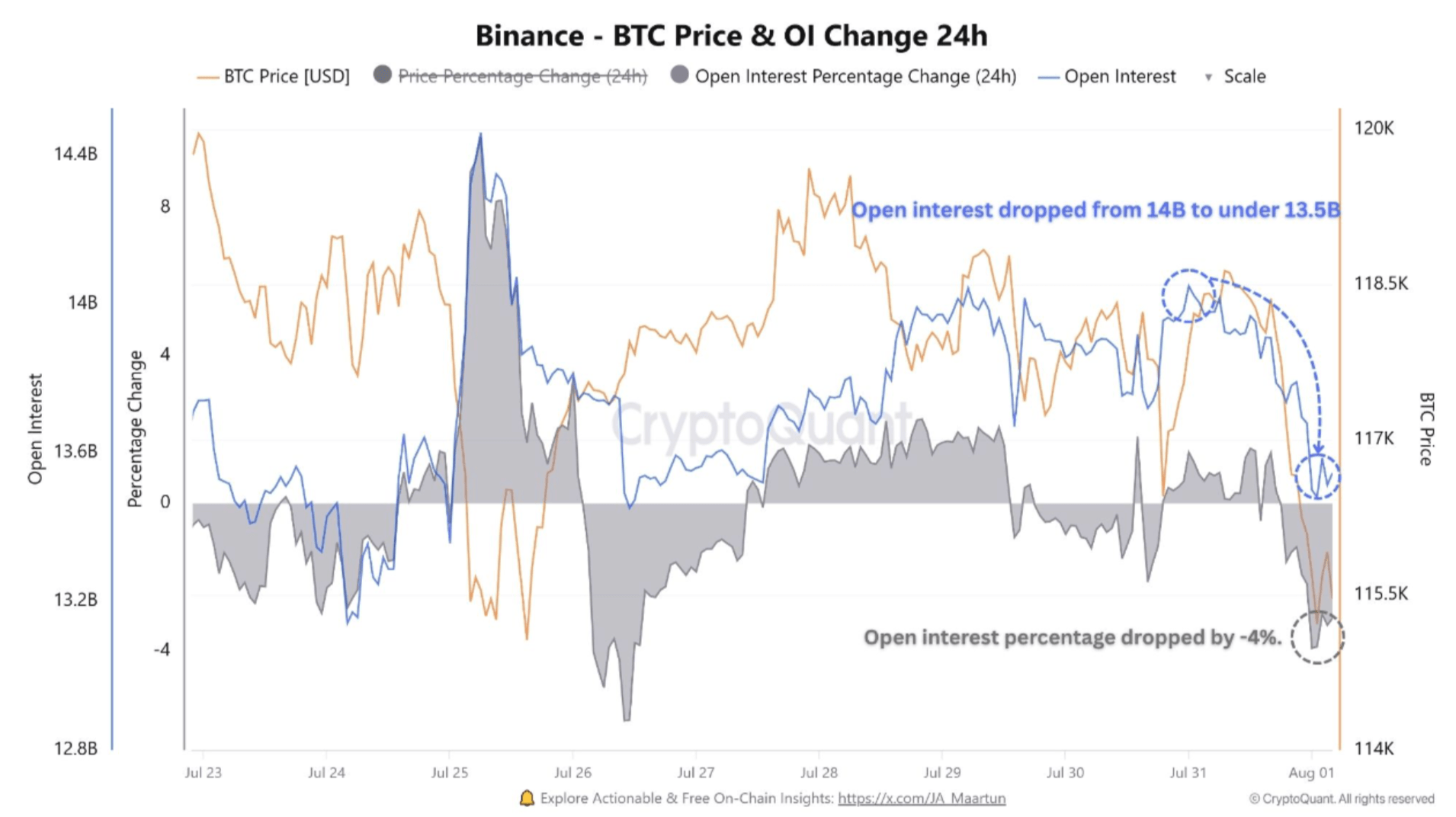

CryptoQuant’s Amr Taha informs us—probably with a numb look on his face—that this harrowing drop prompted open interest on Binance to plunge from a burly $14 billion to $13.5 billion. That’s right: half a billion dollars disappeared faster than your optimism in a crypto bear market.

For visual learners (or masochists), here’s a chart lovingly illustrating open interest doing its best impersonation of an elevator without brakes—a 4% drop in a single day. Cue chaos: CoinGlass tallied up $760 million in liquidations in just 24 hours. That’s a figure large enough to send even the most caffeine-immune trader searching for chamomile tea and perhaps a fainting couch.

Let’s translate: Liquidation events like this one happen when leveraged traders discover the dark side of margin calls and suddenly own only memories and regret. In just a day, 183,514 traders learned that (a) leverage is a double-edged sword and (b) why hardware wallets exist.

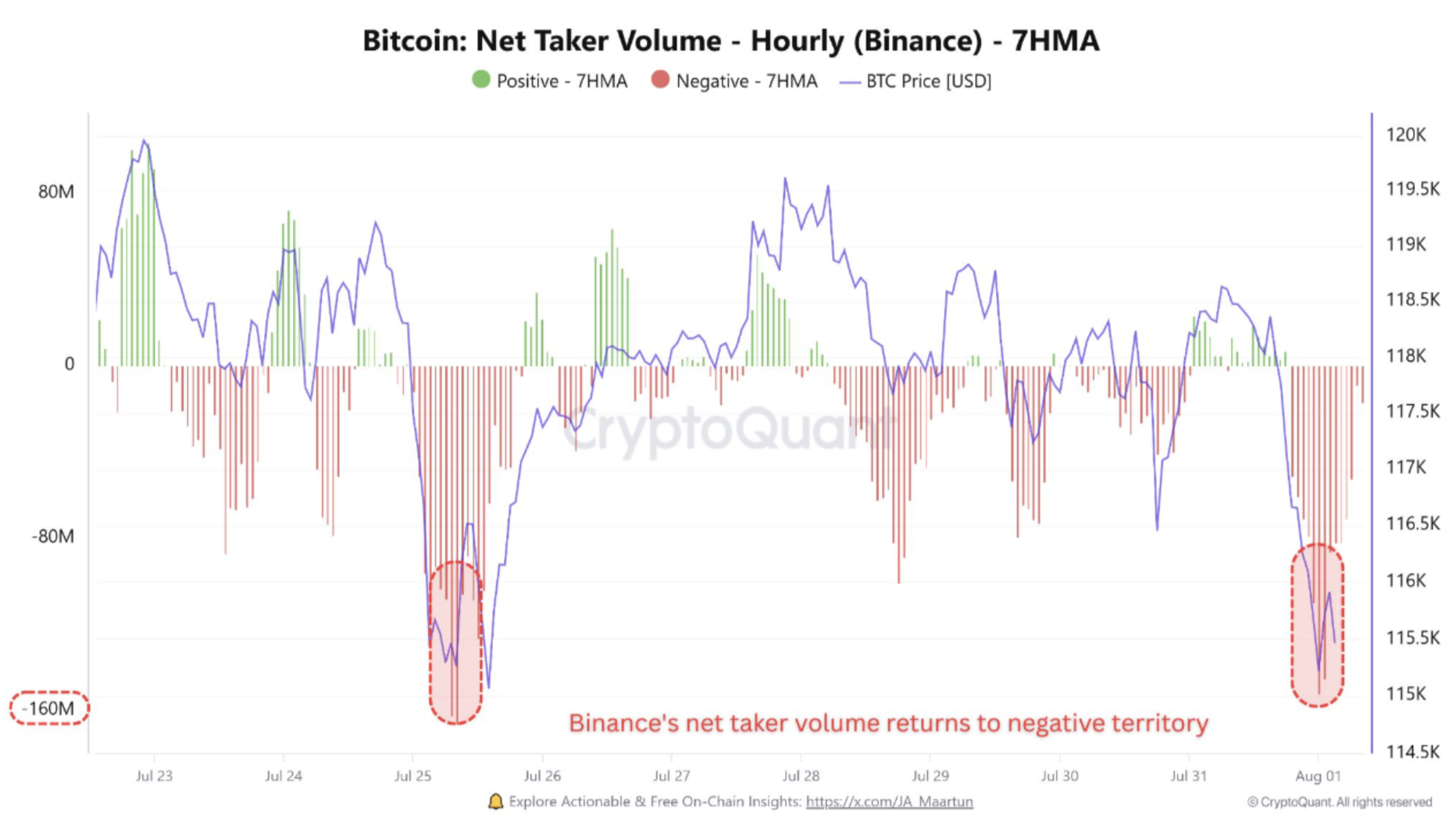

Meanwhile, net taker volume on Binance fell face-first to a brisk -$160 million, implying that the only thing being aggressively “taken” today was the hope out of bullish traders.🧟♂️

If you’re unfamiliar with net taker volume, imagine a slightly tipsy accountant tallying up whether more people are buying (bullish) or selling (bearish) at market. When that number goes negative, it is not a plot twist with a happy ending for the bulls.

Put together, negative net taker volume and declining open interest form the blockchain equivalent of “abandon ship.” Traders are bailing faster than you can say “hodl,” desperately closing out positions they probably bragged about last week at dinner parties.

So, What Happens After the Panic? (Hint: Even More Angst!) 🤡

Here comes the potential plot twist—a glimmer of hope amid digital carnage. Taha, possibly with a straight face, speculates that the market may be so oversold that its only option is to mount a rebound, if for no other reason than sheer exhaustion and a shortage of new people to panic-sell. Enter the possibility of a short squeeze: the only athletic event where everyone is both winner and loser simultaneously.🏃♀️

And yet, on-chain data remains about as cheery as a tax audit. A surging number of fresh BTC holders—picture an army of people who just heard about Bitcoin on a podcast—might cook up an overheated market in short order.

Exchange reserves are on the rise, paving the way for more selling. Meanwhile, long-term holders, those stoic creatures who usually clutch their coins with the tenacity of raccoons at a garbage buffet, are also selling enough to suggest the latest rally may be running on empty.

Of course, there’s always the tantalizing end-of-year target: $180,000, standing in the breezy optimism of financial projections everywhere. But first, Bitcoin needs to hang on to $110,000 like it’s his last lifeboat in the Atlantic. As of this writing, BTC trades at $115,310, down 2.1% in the past 24 hours—the emotional equivalent of finding out your favourite pub is out of beer.

Read More

- BTC PREDICTION. BTC cryptocurrency

- USD MYR PREDICTION

- GBP CHF PREDICTION

- ETH PREDICTION. ETH cryptocurrency

- USD VND PREDICTION

- GBP CNY PREDICTION

- SOL PREDICTION. SOL cryptocurrency

- Bitcoin’s Downfall: Two Scenarios That’ll Make You Scream 😱

- CNY JPY PREDICTION

- EUR USD PREDICTION

2025-08-02 07:18