It seems our esteemed friends on Wall Street have found a new objet d’art, and it’s a decidedly digital one. Ethereum, you see, is causing quite a stir – a trembling, perhaps, in the perfectly polished shoes of the financial elite. A strategist, one Mr. Lee, pontificates that this nascent affection might propel ETH to the dizzying heights of $60,000. One almost feels sorry for the poor currency, subjected to such vulgar displays of speculative fervor. 😉

Mr. Lee, a Managing Partner at FSInsight – a name that sounds suspiciously like a clandestine organization – has expounded, at length on X (a platform best left to pronouncements of questionable wisdom), why these institutions are positively flocking to Ethereum. It currently trades around $3,600, a pittance, naturally, given its ‘implied value.’ A matter of ratios, you understand. So dreadfully boring.

Why the Sudden Devotion?

Apparently, Ethereum possesses certain qualities that appeal to the pragmatic, if somewhat late, sensibilities of traditional finance:

- A certain… “legal clarity” in the American realm. One assumes this simply means it hasn’t been expressly forbidden yet.

- An absolutely unbroken record of uptime. Ten years without a hiccup! Such reliability is almost… unsettling.

- The network effect, of course. Even the likes of JPMorgan and Robinhood are dabbling. How delightfully fashionable.

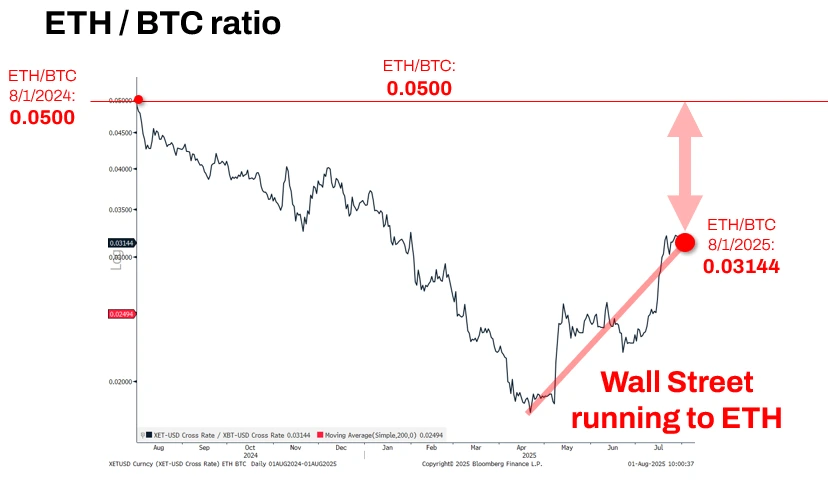

“Wall Street is running to ETH,” Mr. Lee declared, with the dramatic flair one expects from a purveyor of financial predictions. A narrative, he insists, is stronger than it was last year. One shudders to think what wretched state it was in previously. 🙄

Staking, Darling, Staking!

But it’s not merely a superficial attraction. Oh no. Wall Street intends to stake ETH. To participate, as they say, in the “value layer.” It sounds terribly earnest, doesn’t it?

This all stems from a grand scheme to tokenize “real-world assets” on Ethereum. Because apparently, everything must be digital now. Even things that are perfectly adequate in their analog form.

As Mr. Lee so eloquently put it, “As Wall Street financializes the world onto the blockchain, they will stake ETH to be involved in Ethereum’s growth.” How very… enterprising.

A Question of Valuation

The ETH/BTC ratio, it seems, is a crucial metric. Last year, it hovered around 0.0500. With Bitcoin currently lounging around $114,000, this implies an ETH valuation of a rather modest $5,707. A premium, of course, to its current state. Though one suspects “modest” is a relative term in these circles. 🧐

“This argues the ETH/BTC ratio should recover,” Mr. Lee solemnly intoned, lamenting the apparent disconnect between price and Ethereum’s “growing dominance.” One feels a headache coming on.

“The ETH story is stronger today than August 2024,” declared the sage. Such profound pronouncements.

ETH to $60,000?

And now for the truly audacious claim: $60,000! Should Ethereum become the foundation for financial markets. A “possibility,” Mr. Lee hastens to add. But as institutions align, it becomes… less far-fetched. One can only hope they have a good tailor, for all the celebratory suits they will undoubtedly require. 🥂

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more. Because one must always be aware, mustn’t one?

FAQs

Is Ethereum undervalued right now?

Undervalued? Darling, everything is undervalued to someone with enough money. The ratio suggests $5,707, a far cry from its current price. Analysts detect a disconnect. How predictable.

How will Wall Street use Ethereum?

Beyond mere transactions, they shall stake ETH and tokenize real-world assets. A grandiose undertaking, certainly.

What makes Ethereum attractive to traditional finance?

Perfect uptime (almost suspiciously so), regulatory ambiguities, and the presence of certain fashionable firms. A trifecta of irresistible allure. 😏

Read More

- GBP CHF PREDICTION

- USD VND PREDICTION

- Bitcoin’s Downfall: Two Scenarios That’ll Make You Scream 😱

- USD MYR PREDICTION

- BTC PREDICTION. BTC cryptocurrency

- EUR USD PREDICTION

- GBP CNY PREDICTION

- EUR AUD PREDICTION

- EUR BRL PREDICTION

- EUR RUB PREDICTION

2025-08-02 11:09