The market’s rollercoaster ride has left investors dizzy as a drunk seagull, but analysts whisper that Ethereum might still have a few tricks up its sleeve. 🧠💰

Ethereum’s Struggle: A Dance with the $3,450 Ghost 🕯️

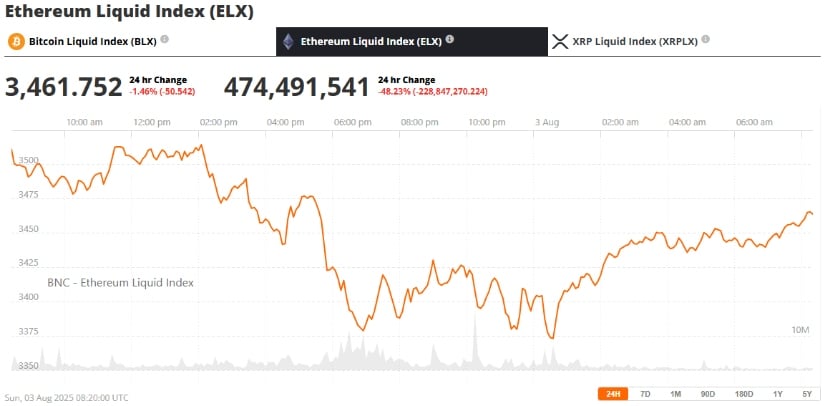

Ethereum briefly dipped below $3,450 on August 3, 2025, marking a 5.04% daily decline. The pullback mirrors a wider market correction affecting top digital assets, including Bitcoin. As of the latest data from the Ethereum Liquid Index (ELX) by Brave New Coin, ETH is trading just above $3,400, holding on to a pivotal support level that previously triggered a 10% drop in July. 🚪📉

Despite the decline, Ethereum’s broader market structure remains intact. The asset continues to trade above the SuperTrend support at $3,368, indicating the underlying bullish trend is still in play. 🦄📈

Analysts Highlight Bullish Structure Despite Liquidations 🧠

Market sentiment remains cautiously optimistic. Technical analyst IncomeSharks explained that Ethereum is “back to the line that saw a 10% drop last time,” noting that a move down to $3,400 still fits within a bullish framework. This suggests that the recent pullback might be a healthy retest rather than a trend reversal. 😏📊

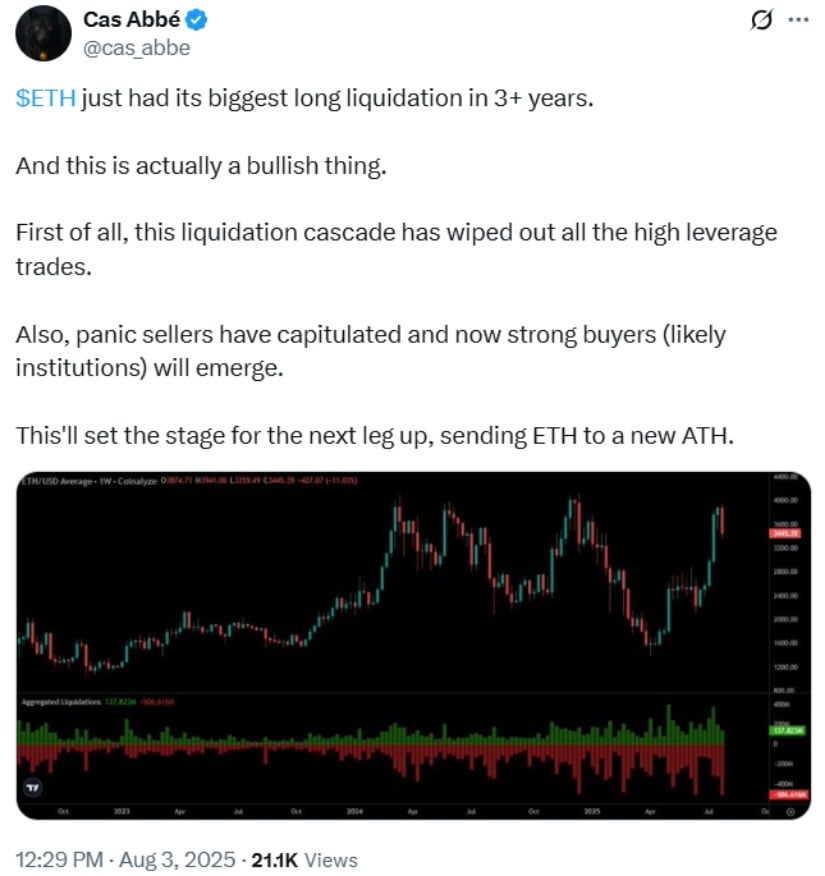

Meanwhile, market observer Cas Abbé pointed out that Ethereum just experienced its biggest long liquidation event in over three years. He considers this a constructive development, arguing that it has eliminated excessive leverage and flushed out panic sellers. According to him, such a reset often attracts institutional buyers and paves the way for a more sustainable rally. 🧨🚀

Market Overview: Ethereum Technicals and On-Chain Strength 🧱

Ethereum’s price action has formed a higher high and higher low pattern since early 2025, reaffirming its medium-term uptrend. As long as ETH can hold the $3,400–$3,368 level, the next target to the upside remains the psychological $4,000 level. 🎯💰

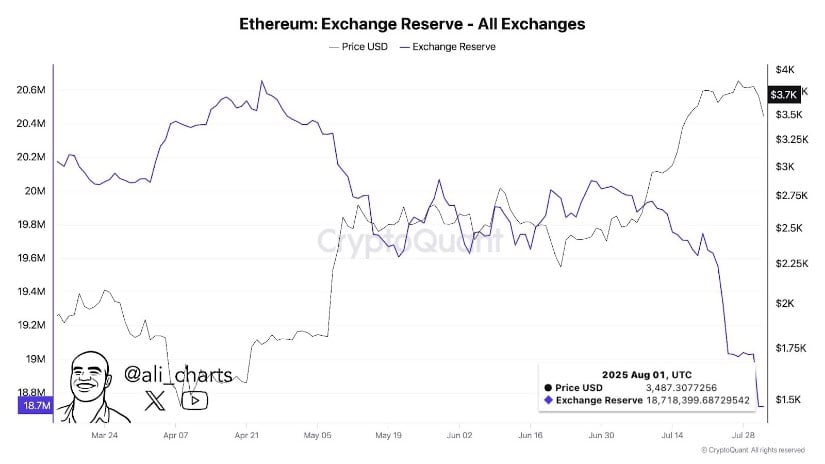

To corroborate the bull case, over a million ETH have been withdrawn from exchanges in the past two weeks, according to on-chain analyst Ali. A reduction in exchange balances is typically a sign that investors are moving assets to long-term storage, a vote of confidence in Ethereum’s long-term value. 🧠💸

In addition, Ethereum has also reclaimed its decentralized finance supremacy. Ethereum is presently the leading blockchain by decentralized exchange (DEX) volume in the 24-hour and 30-day time frames, according to analyst AkaBull. He noted that some months back, alternate networks had briefly displaced Ethereum in volume and revenue, but Ethereum has now reclaimed its supremacy. He also remarked that “Ethereum is really back” as the network achieves new highs in daily transaction volume and other key metrics. 🧑🚀📈

Broader Market Context: Sell-Off Driven by Risk-Off Sentiment 🧨

The recent drop in Ethereum is only a part of the broader risk-off movement in the crypto market. Rising macroeconomic uncertainty has led investors to reduce exposure to risky assets. Market capitalization of ETH is now at around $415 billion, and 24-hour trade volume stands above $18 billion. 📉📉

While there’s been no confirmation of the sell-off by Ethereum leadership, fundamentals in the ecosystem remain upbeat. Core metrics like validator rewards, staking activity, and Layer 2 volume all continue to buck challenges. 🧠⚡

Outlook: Can Ethereum Bounce Back Towards $4,000? 🎯

With the $3,400 support still in place thus far and fundamental technicals displaying stability, Ethereum could now attempt to bounce back. Market observers caution, though, that a confirmed close below the $3,368 SuperTrend support would transfer bear momentum. 🐻📉

Historically, these Ethereum pullbacks have been accompanied by strong recovery rallies. If accumulation continues and sentiment turns positive, Ethereum can retest the $3,800–$4,000 zone in the coming weeks. 🚀📈

Key Takeaways 🧠

- Ethereum price today hovers near $3,400, down over 5% from August 2. 📉

- ETH’s bullish structure remains intact despite large liquidations. 🦄

- 1M ETH withdrawn from exchanges points to long-term holding sentiment. 🧠💸

- DEX activity and Layer 2 adoption highlight Ethereum’s continued relevance. 🧑🚀

- A rebound toward $4,000 is likely if support holds and sentiment improves. 🎯

Final Thoughts 🌊

Ethereum’s recent price correction may appear sharp, but its market foundation remains firm. Technical patterns, on-chain data, and ecosystem activity suggest Ethereum is preparing for its next major move. As traders await confirmation of direction, the $3,400 zone stands as a critical level in determining whether the bulls can retake control. 🦄⚡

Read More

- Gold Rate Forecast

- EUR USD PREDICTION

- Silver Rate Forecast

- CNY JPY PREDICTION

- Brent Oil Forecast

- GBP CNY PREDICTION

- BTC PREDICTION. BTC cryptocurrency

- USD KZT PREDICTION

- EUR RUB PREDICTION

- Bitcoin’s Downfall: Two Scenarios That’ll Make You Scream 😱

2025-08-03 20:39