So, the crypto market just wrapped up its first red weekly candle after a five-week green parade. You know what that means? Profit-taking pressure is back, and it’s like a bad sitcom—everyone’s feeling the gloom. Just look at those liquidation maps for some altcoins; it’s like watching a slow-motion train wreck. 🚂💥

In this delightful mess, a few altcoins are strutting around with a high risk of triggering liquidations for those poor derivatives traders in early August. So, which ones are we talking about? Buckle up! 🎢

1. XRP

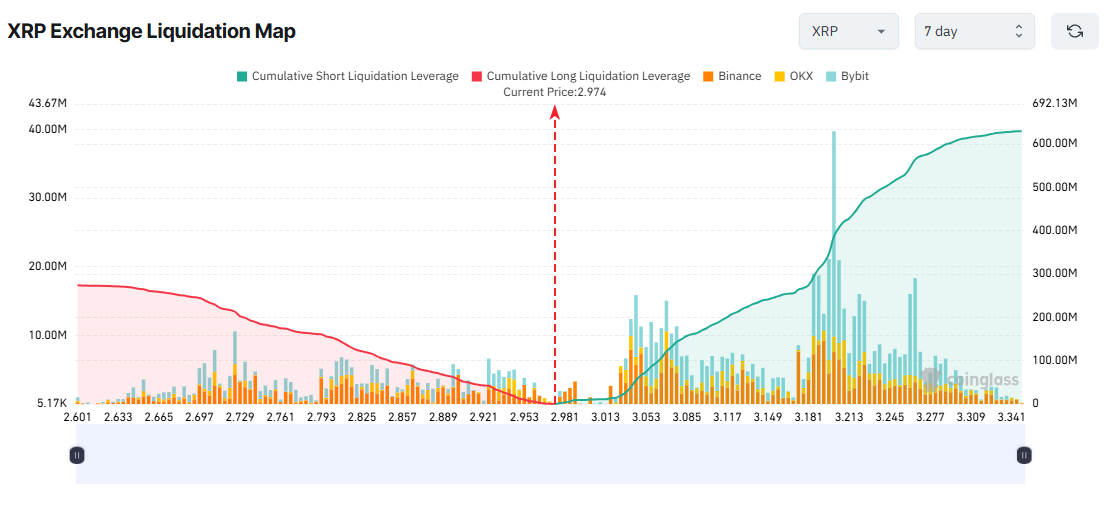

The 7-day liquidation map for XRP is like a bad relationship—major imbalance between Long and Short positions. The Short volume (green bars on the right) is practically throwing a party, while the Long volume (red bars on the left) is sitting in the corner, sulking. 😒

This reflects the prevailing sentiment that XRP’s price is on a downward spiral, and it’s not looking pretty. After two weeks of losses, it’s dropped over 18% from $3.65 to $2.97. Traders are convinced the downtrend is here to stay. Who wouldn’t be? It’s like watching a car crash in slow motion. 🚗💥

But hold your horses! Short traders might be in for a surprise if XRP decides to pull a fast one and recover this week. If it bounces back to $3.20, over $400 million in Short positions could be liquidated. Talk about a plot twist! 📈

From July’s peak to early August, XRP has dropped 25%. Historically, such steep declines are often followed by notable rebounds. So, some analysts are waving red flags about potential liquidations driven by this recovery. It’s like a horror movie where the monster just won’t die. 👻

“XRP is liquidating short positions following the liquidation of highly leveraged long positions. If XRP rises to $3.06, a large amount of short positions will be liquidated,” analyst CW stated. Sounds like a fun party, right? 🎉

2. TRUMP

Now, let’s talk about the TRUMP meme coin. The liquidation map here is also showing a big imbalance, with most potential liquidations hanging out on the Short side. It’s like a bad joke that just keeps getting worse. 😂

But wait! Analysts think TRUMP has found a cozy spot around the $8.50 range—a key support level for months. If it climbs to $9.80 this week, about $50 million worth of accumulated Short positions could be wiped out. Ouch! 😬

At the end of July, SunPump—a meme coin launch and trading platform on TRON—announced the listing of TRUMP, which gave the token a little boost. This followed Justin Sun’s public commitment to invest $100 million in the TRUMP token. I mean, who doesn’t love a good meme coin story? 🤷♂️

These developments give TRUMP some momentum for a potential recovery, which could leave traders betting on a price decline feeling a bit… deflated. 🎈

3. CFX

And finally, we have Conflux (CFX). This one surprised everyone last month by nearly quadrupling in price and pushing its market cap above $1 billion. It’s like the underdog story nobody saw coming! 🐶

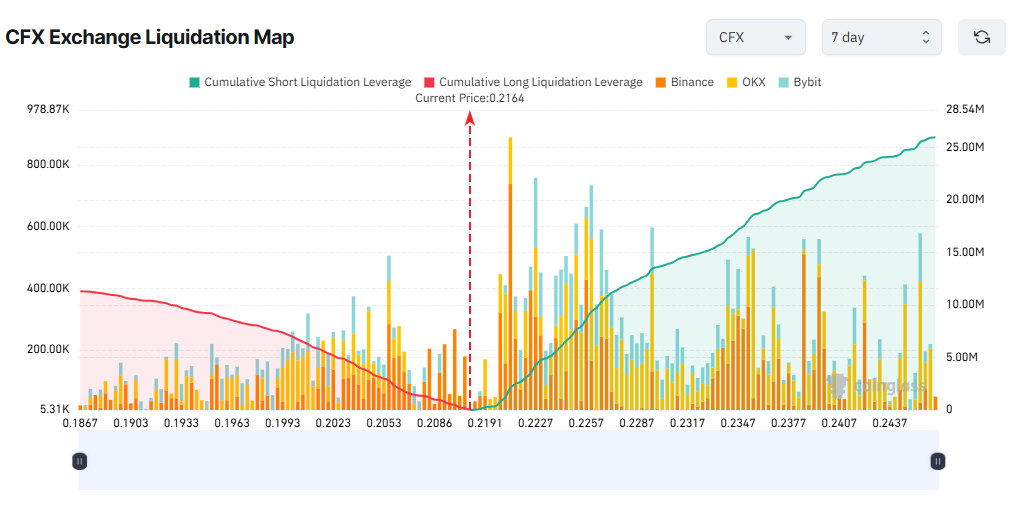

The liquidation map shows that most traders expect CFX to correct in early August. This is evident in the large volume of potential Short liquidations, which far exceed those on the Long side. It’s like a game of musical chairs, and guess what? There aren’t enough chairs! 🎶

If CFX keeps its rally going and hits $0.243, around $25 million in Short positions may be liquidated. Can you imagine the chaos? 😱

Recent project updates might help keep the positive vibes flowing. On August 1, Conflux announced the Conflux v3.0.0 Upgrade, which got a thumbs up from the community. It’s like a makeover that actually works! 💄

“This major upgrade introduces 8 NEW CIPs focused on enhancing EVM compatibility, fixing bugs, and optimizing network specs!” the Conflux Network declared. Sounds fancy, right? 🥳

Plus, Google Trends data shows that searches for “Conflux Network” have surged in the past month. This renewed interest could leave leveraged traders betting on a price decline feeling a bit… well, let’s just say, not so great. 😅

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- BTC PREDICTION. BTC cryptocurrency

- EUR USD PREDICTION

- GBP CNY PREDICTION

- USD VND PREDICTION

- Brent Oil Forecast

- POL PREDICTION. POL cryptocurrency

- PI PREDICTION. PI cryptocurrency

- EUR KRW PREDICTION

2025-08-04 18:27