Bitcoin’s Tug-of-War: A Tale of Support, Warnings, and Wages in the Wild Crypto Frontier

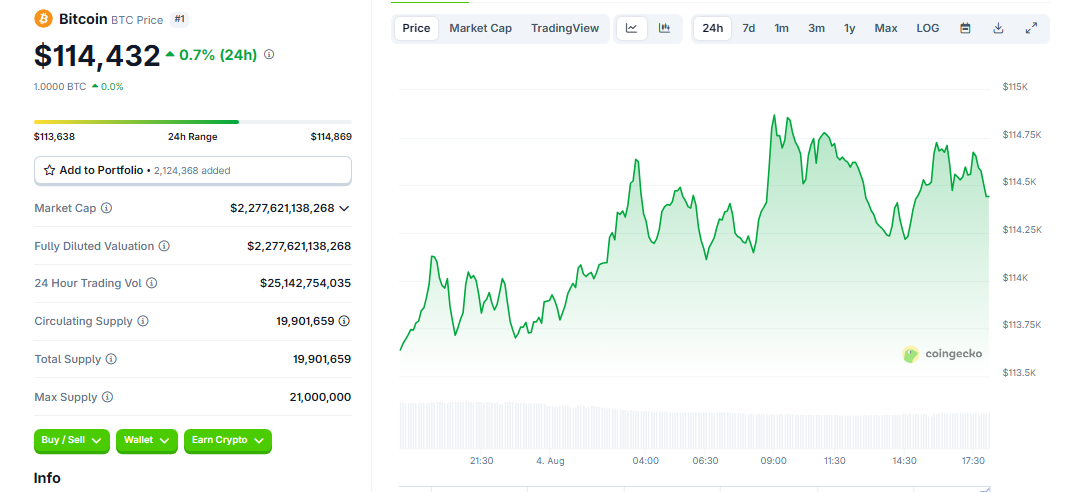

Bitcoin, that stubborn streak of digital gold, is once again teetering on the edge. After a six-day slip that felt like watching a cat trying to climb a wall of bubble wrap, it managed a little rebound—precisely around $114,432. Not enough to declare victory, mind you, but enough to make some folks squint and wonder if maybe, just maybe, the tide’s turning. Or if it’s just blowing hot air through a digital fan. 🚶♂️💸

Labor Data: The Fed’s Psychic Hotline

The latest U.S. numbers are about as inspiring as a Monday morning—jobs growth weaker than a soda shop during off-hours, and unemployment creeping up to 4.2%. Wages? A mere 0.3% bump, which is like giving a goldfish a tiny applause. All of this whispers softly that the Fed might hit pause, or even try to turn back the interest rate dial, as if some magic trick can fix the world’s complicated economic stew. 🍲

This potential shift is pure music to Bitcoin’s ears—cheaper borrowing, more liquidity, and a shot at the big leagues. But beware—the market’s mood is about as steady as a toddler on a sugar high. Some are sneaking in more coins, while others are sitting tight, eyes glued to the Fed’s next move.

ETFs: The Great Signal or Just Noise?

Bitcoin ETFs in the U.S. are apparently quite the social butterflies. June and July saw a rush, with over $50 billion flowing into spot Bitcoin ETFs—if you think about it, that’s a lot of zeroes. Institutions are finally giving Bitcoin a proper nod, a kind of digital handshake that says, “We’re serious, or at least pretending well enough.”

Meanwhile, around the globe, geopolitical chaos is pinning people’s hopes on Bitcoin as a kind of digital escape hatch. Rising Middle East tensions, the Russia-Ukraine mess, China’s tightening grip—these are the kind of wildcards that make Bitcoin look more like a safety deposit box than just another speculative asset. So, while it’s not quite as shiny as gold, it’s earnestly playing the backup plan card.

Support Still Solid at $100K (For Now)

Despite the poundings and the rollercoaster ride, Bitcoin’s backbone still looks sturdy. Data suggests more holders are holding tight—less leverage, fewer bets on the quick flip. It’s like watching a stubborn mule refuse to budge, even with a gentle prod. Analysts say as long as it stays above $100,000, the broader trend stays on track, even if this month threw a minor tantrum. 🐎

And if the Fed finally decides to be nice—less hawk, more dove—more capital might just sweep back into the scene by the end of the year. But for now? It’s hush-hush, cautious optimism wrapped in digital curiosity.

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- EUR USD PREDICTION

- BTC PREDICTION. BTC cryptocurrency

- GBP CNY PREDICTION

- USD VND PREDICTION

- Brent Oil Forecast

- POL PREDICTION. POL cryptocurrency

- PI PREDICTION. PI cryptocurrency

- EUR KRW PREDICTION

2025-08-04 18:42