Oh, Cardano, you old friend. Your price action is starting to look more compelling as you test those major resistance levels that we’ve all been watching for what feels like an eternity. Multiple bullish signals are lining up across technical charts, and ADA is quietly building momentum that could pave the way for a bigger move. But let’s not get ahead of ourselves, shall we? 🙃

Cardano Trendline Breakout Looks Imminent

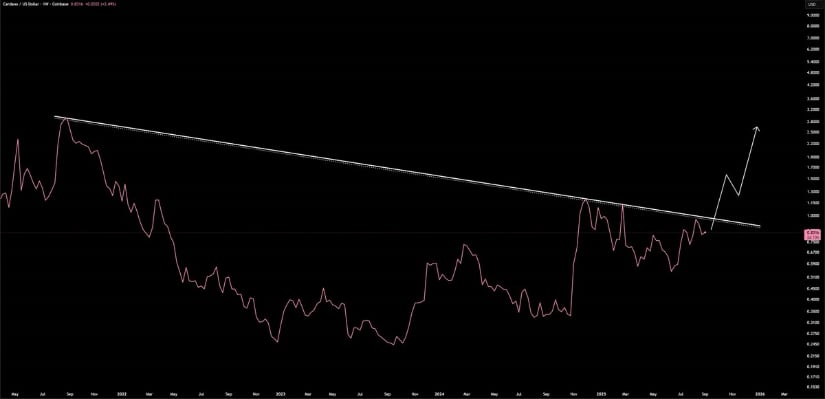

Cardano is once again pressing against a long-term descending trendline, and the price action is showing signs that a breakout could finally be in play. The bulls are holding strong, and Jesse Peralta believes that once ADA breaks, it could start looking parabolic. Momentum indicators suggest that buyers are gradually tightening their grip. It’s like they’re all whispering, “Just a little more…” 🙏

From a technical standpoint, the key zone to watch sits just above the $1.00 to $1.10 region. Clearing resistance here would likely confirm the breakout. If the bulls manage to push through with conviction, the immediate upside targets align in the $1.80 to $2.00 range. Imagine that! 🤩

Such a move would not only mark a significant technical shift but also reinforce the broader bullish narrative that ADA has been quietly building. It’s like a shy kid suddenly becoming the star of the school play. 🎭

Wyckoff Cycle Adds Narrative to Bullish Cardano Price Prediction

According to analyst Mr. Banana, Cardano’s structure fits neatly into the Wyckoff cycle, with ADA appearing to transition into the markup phase. This stage is often where accumulation turns into rapid expansion, marked by higher highs and strong follow-through in volume. The chart suggests ADA has successfully cleared its accumulation zone and is now showing signs of strength that align with a broader bullish cycle. It’s like ADA is saying, “I’ve been practicing, and I’m ready for my close-up.” 👀

If this pattern holds, ADA could build momentum towards testing higher resistance zones around $1.20 to $1.50 in the short term, with the larger structure supporting even higher targets beyond $2.00. The Wyckoff narrative ties well with the recent trendline pressure and parabolic outlook. It’s a perfect storm of bullishness. 🌪️

Cardano Fundamentals Add Strength to the Bullish Case

Alongside the growing technical momentum, Cardano is quietly getting stronger on the fundamental side. As analyst Sssebi points out, upcoming developments like the potential ADA ETF, the Leios upgrade, Hydra scaling integrations, and the Midnight privacy layer all contribute to a more complete ecosystem. These aren’t just minor updates but core improvements that could help ADA sustain long-term impact. It’s like ADA is getting a full makeover and a new wardrobe. 💄👗

The timing of these upgrades adds weight to the bullish narrative already forming on the charts. If technical structures confirm breakouts while fundamentals simultaneously strengthen, ADA could attract more institutional and retail interest. It’s like a pop star getting a feature in Vogue and a Grammy nomination all at once. 🎤✨

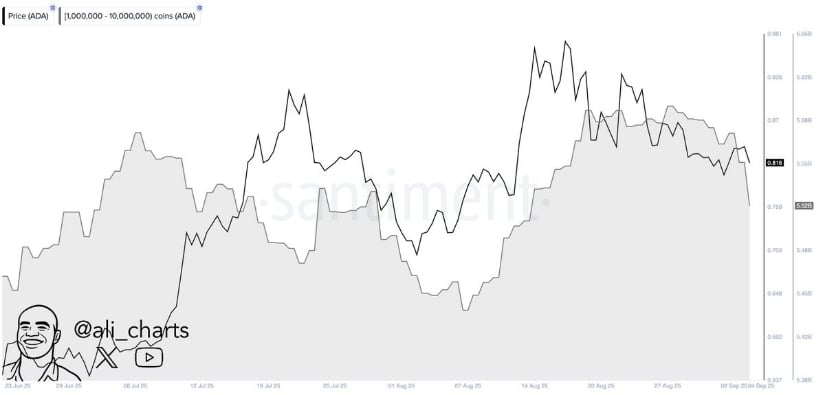

Whale Selling Sparks Short-Term Caution for ADA

Despite the wave of bullish reports surrounding Cardano, one sign of concern has surfaced. Whales have offloaded nearly 50 million ADA in just 48 hours, as highlighted by analyst Ali Martinez. Large-scale sell-offs like this can sometimes create short-term pressure on price, even when the broader structure remains supportive. It’s a reminder that while technicals and fundamentals lean bullish, heavy distribution from big holders can slow momentum. It’s like the band is playing, but the lead singer decides to take a break. 🎸…

That said, whale movements don’t always translate into a lasting trend. Often, these sell-offs get absorbed by new demand, especially if overall sentiment and upcoming catalysts stay positive. For ADA Cardano price, the bigger picture still points to growth. It’s like a temporary rainstorm during a sunny day-annoying, but not the end of the world. ☔🌞

Final Thoughts

Cardano’s setup is turning more convincing, with both trendline pressure and Wyckoff cycle signals pointing to a possible continuation higher. Short-term, ADA must prove it can hold above the $1.00 to $1.10 region to confirm strength, while whale activity and liquidity shifts remain the main variables to watch. If demand holds steady, a breakout could accelerate momentum towards the $1.50 to $2.00 range. It’s like the final act of a play, where everything comes together for a grand finale. 🎉

The path forward depends on balancing short-term caution with the broader bullish backdrop. Long-term developments like Hydra scaling, the Midnight privacy layer, and possible ETF speculation add real weight to ADA’s case. It’s like ADA is saying, “Watch this space, because something big is about to happen.” 🌟

Read More

- BTC PREDICTION. BTC cryptocurrency

- SEC v Cryptos: ‘Innovation Exemption’ Will Arrive in 30 Days… Maybe? 🧨💸

- 🚀 NEAR Protocol Soars 8.2% While Others Stumble – CoinDesk 20 Chaos! 💸

- Bitcoin’s Cosmic Cringe: Why the Crypto World Is Now a Black Hole 🌌💸

- Ethereum Whale’s Bold $280M Short: Is the Market on a Cliff or Just a Cliffhanger? 🤔

- Bitcoin’s Wild Ride: Whales Strike Back, Shorts Cry 😭💰

- PEPE Frenzy—Will Frogs Outlast Bears? 🐸📈

- 🐳 XRP Whales Splash Cash: Is the Tide Turning? 🌊

- Litecoin’s Wild Ride: $131 or Bust? 🚀💰

- You Won’t Believe What Secretly Predicts Bitcoin’s Next Crash! 😱

2025-09-06 12:37