In the labyrinthine corridors of the crypto gulag, where hope often flickers like a candle in the wind, Arbitrum (ARB) emerges as a stoic prisoner, its chains clinking with the rhythm of resilience. The price, once shackled by a downtrend channel, has broken free, reclaiming its 200 EMA on the 4-hour chart-a technical triumph that whispers of a revolution. 🌪️✨

Arbitrum’s TVL: A Defiant Dance Amidst the Chaos

While the crypto masses tremble under the boot of FUD, Arbitrum pirouettes with grace. Its Total Value Locked (TVL) stands at the precipice of $3 billion, a stone’s throw from its all-time high. Rumi’s on-chain chart, a testament to this defiance, reveals not just stability but a burgeoning confidence within the ecosystem. Who needs applause when you’re marching to your own drum? 🥁💪

This surge is no solitary act. Key metrics-24-hour chain revenue, application fees-stand firm, like loyal comrades in arms. Over $25K in daily chain fees and nearly $900K in app revenue suggest Arbitrum is not merely reacting but strategizing, its gaze fixed on the horizon. 🧭🔮

The Breakout: A Whisper of Rebellion

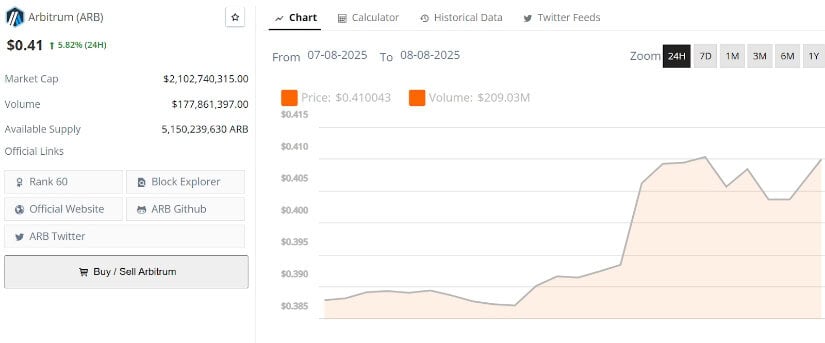

On the lower timeframe, Rumi’s 1-hour chart reveals a breakout from a short-term down channel, followed by a consolidation above support. The RSI, once in the gulag of oversold territory, has staged its own escape, hinting at a relief rally toward $0.4025 to $0.4185. Resistance, they say, is futile. 🏰🔓

Yet, the true victory lies in the break of the downtrend, supported by volume, and the structure holding above $0.3820. A small step for ARB, a giant leap for its holders. 🚀🌕

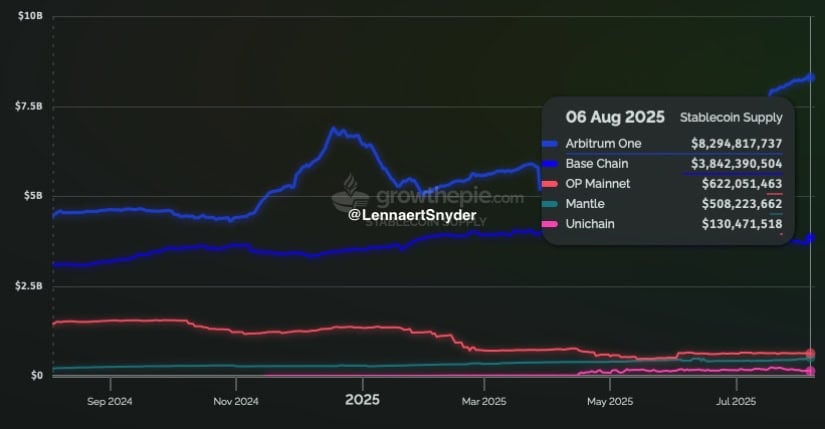

Stablecoin Dominance: The Currency of Trust

As Arbitrum flirts with TVL highs, its stablecoin supply tells a tale of unyielding trust. Lennart Snyder’s chart crowns Arbitrum as the leader in stablecoin inflows among Ethereum L2s, with over $8.29 billion locked. Base and OP Mainnet? Left in the dust. Liquidity, like a loyal spy, follows utility. And Arbitrum’s utility? Unquestionable. 💼💸

This stablecoin surge, aligned with the technical breakout, provides a foundation as solid as a Siberian winter. If liquidity grows, so too shall the price. 🏗️⬆️

The 200 EMA Reclaim: A Technical Triumph

AltWolf, ever the keen observer, highlights ARB’s reclaim of the 200 EMA on the 4-hour chart-a feat as rare as a smile in a Solzhenitsyn novel. Coupled with a break of the descending trendline, this move adds credibility to the bounce. The upper liquidity pocket near $0.50 now looms, a tantalizing prize. 🎯💎

With price building structure above moving averages and former resistance, ARB’s ascent seems not just possible, but inevitable. 🏔️🚀

The $2 Target: A Dream or Destiny?

Chris’s chart offers a panoramic view of ARB’s journey, as compelling as a Solzhenitsyn epic. Breaking above a long-standing descending trendline, ARB now ventures into the Ichimoku cloud-a zone of dynamic resistance. Weeks of structural rebuilding have opened a path to $1.50 to $2.00, marked by Fibonacci extensions. 🌩️📏

With confluence across timeframes, the $2 target is not just a dream but a destination within reach. 🗺️💫

Final Musings: Arbitrum’s Quiet Uprising

Arbitrum, in a market rife with hesitation, stands as a beacon of resilience. TVL nearing records, stablecoin inflows soaring, and technicals across timeframes pointing upward-ARB’s case for a sustainable rally is as strong as a Siberian bear. 🦍⚖️

Key levels at $0.42 and $0.50 must fall with conviction, and the market’s mood will play its part. But if Arbitrum maintains its structure and momentum, the $1.50 to $2.00 zone may soon be its new home. 🏡🚀

Read More

- BTC PREDICTION. BTC cryptocurrency

- 🚀 NEAR Protocol Soars 8.2% While Others Stumble – CoinDesk 20 Chaos! 💸

- Bitcoin’s Wild Ride: Whales Strike Back, Shorts Cry 😭💰

- Chinese Company Sheds Cars, Digs Digital Gold-You Won’t Believe Cango’s Bitcoin Binge! 🚗💰

- PEPE Frenzy—Will Frogs Outlast Bears? 🐸📈

- SEC’s Peirce Champions Crypto Privacy as Tornado Cash Trial Heats Up 🚒💼

- Ethena’s $106M Token Unlock: Will Aave’s Liquidity Bust or Just a Bad Hair Day? 🤔

- Ethereum Whale’s Bold $280M Short: Is the Market on a Cliff or Just a Cliffhanger? 🤔

- Binance Now Fully Approved in Abu Dhabi-What This Means for Crypto!

- Meet Vector: The Blockchain That Tosses Finality Speeds Out the Window! 🚀

2025-08-08 00:38