Litecoin (LTC) Price Prediction: History Repeats – Is A Parabolic Rally Coming?

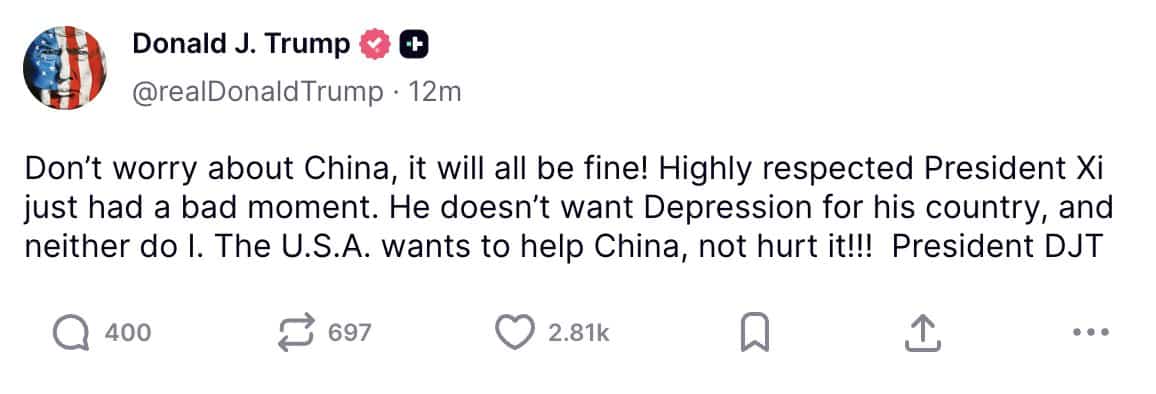

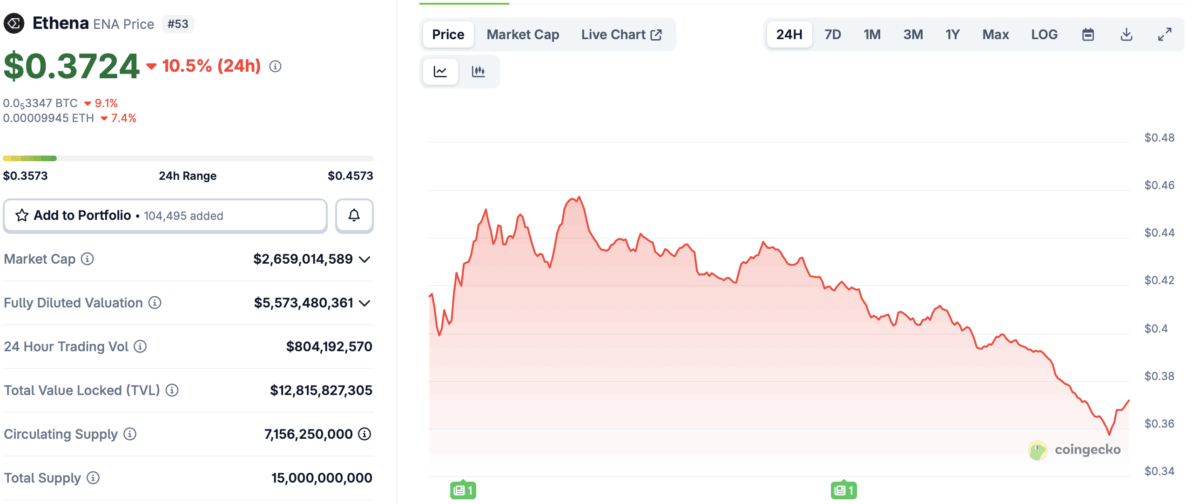

On October 10, 2025, Litecoin (LTC) went on a 23% joyride from $134 to $85. Oops! But hey, that’s what happens when a crypto market-wide liquidation shakes up almost $19 billion in open positions, right? The sell-off was triggered by US-China tariff drama – because that’s exactly what every crypto investor needs right now – another international conflict to spice things up. The nerves were real, but here’s where it gets interesting: some analysts think this crash might be setting the stage for a parabolic rally, just like the good ol’ days of 2017, when a similar drop was followed by a sprint to over $375.