Oh, Dear! Aster Crypto’s Folly Paints a Turbulent Picture

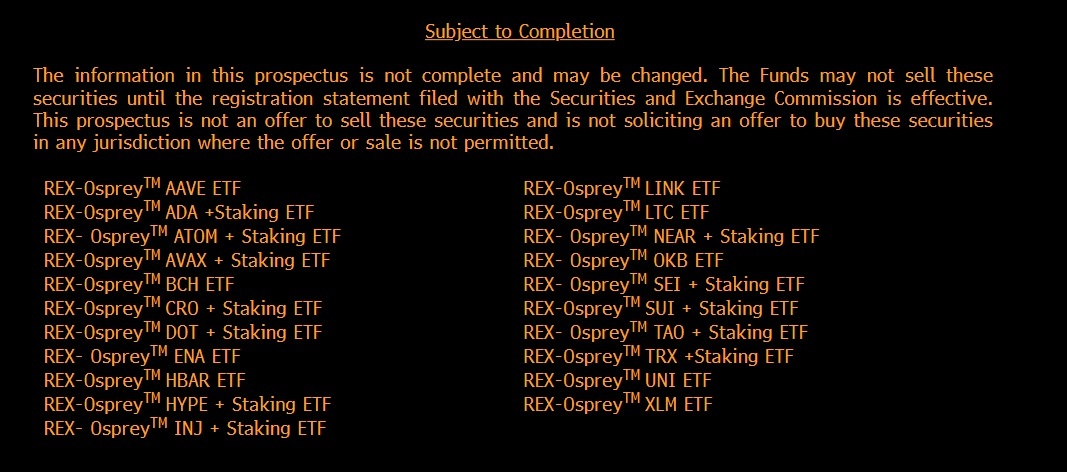

Next, the Genesis Stage 2 airdrop event, where a bonanza of sixty-six million tokens has been released for immediate trade. This unexpected freedom has indeed invited a certain anxiety amongst investors, all anxiously contemplating the arrival of increased liquidations, thereby casting an opaque cloud of uncertainty. How shall the prudent investor weigh these tattered risks against the temptations dangled before them? 🧐