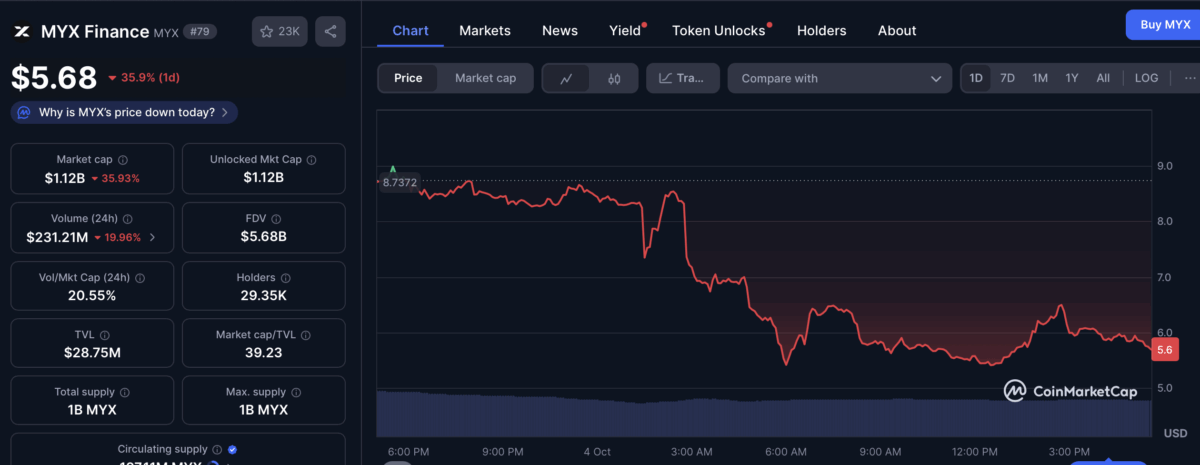

MYX Finance Plummets 33%… But TVL Hits $27.6M? What’s Going On? 🤔

MYX must defend the $2.3 support zone to prevent increased bearish control and deeper price declines. Spoiler: The bears are already drafting their victory speeches. 🐻

MYX must defend the $2.3 support zone to prevent increased bearish control and deeper price declines. Spoiler: The bears are already drafting their victory speeches. 🐻

So, what’s the deal? On October 3rd, Bloomberg, as usual, spilled the tea on this monumental effort, revealing that Tether and Antalpha-who clearly have an affinity for big numbers-are looking to raise a princely sum of at least $200 million. And all that cash? It’s going to be used to buy XAUT, Tether’s golden child of digital currency.

This sale, revealed on October 4 with all the subtlety of a cannon blast, will be executed using CowSwap’s Time-Weighted Average Price (TWAP) feature. A tool, they say, to spread large transactions over time, lest the market be startled by their sudden movements. How considerate! 🕊️✨

It wasn’t a clean break, of course. There were several failed attempts to reclaim higher ground-almost like a stubborn uncle insisting he’s “just resting his eyes” after three glasses of scotch. That’s what prompts the questions: what’s next, and why did momentum decide to take October off, despite crypto appearing to be the favorite child of the bullish month club?

Meme coin FLOKI, that impish sprite of digital absurdity, has perpetrated a veritable coup in the halls of European finance by birthing its first exchange-traded product-nay, a phantom born of folly! Listed on the Spotlight Stock Market in Sweden, it crowns FLOKI as the second such meme abomination to grace an organized European exchange. And lo, courtesy of this ludicrous launch, FLOKI’s price burgeons a ludicrous 34 percent in a mere 24 pathetic hours, to $0.000116, as the market, in its fevered delirium, embraces this so-called regulated exposure with gusto unbecoming of rational beings. 😂

According to rwa.xyz, XAUt’s market capitalization sits at $1,053,158,858, while spot gold persists above $3,800 per ounce, marking a 19.90% rise over the last thirty days. Each token bears a Net Asset Value (NAV) of $3,862, up 8.51% from the previous month, and the current price per token sits near $3,865, closely following the gold’s own glitter. A neat alignment, one might say, as if the universe itself kept time with the ticker. 🤔🧭

Stablecoins, she declares with the gravity of a Shakespearean tragedian, are no mere fad but a “growing force” in the global financial system. One can almost hear the dramatic pause as she insists that countries must “ensure financial stability and security,” lest they be swept away by the tidal wave of digital currency. 🌊💸

Mr. Cardoso, in a discourse delivered at the Lagos Business School – a circumstance I trust was not *too* taxing – has revealed that the Central Bank is deigning to collaborate with the Securities and Exchange Commission (SEC) of Nigeria to construct a sustainable arrangement for such novelties. A reversal of policy, this is, under the administration of President Tinubu, a gentleman who appears to favor a more compliant modernity.

Now, let’s turn our gaze towards our star, Zhimin Qian, 47, a Chinese national who has just taken the stage at Southwark Crown Court, where she so gallantly confessed to acquiring and possessing her ill-gotten gains in the form of cryptocurrency. Under the ever-watchful Proceeds of Crime Act, she has deftly pirouetted into the world of fraud, charming over 128,000 victims between 2014 and 2017 before converting their heartache into Bitcoin. Quite a job she’s done, I dare say! 💃

As the esteemed Maartunn of CryptoQuant’s digital den of madness cryptically proclaimed on X, the Bitcoin Open Interest has surged like a caffeinated squirrel on a trampoline. Let us clarify: Open Interest is that mystical number tracking BTC positions on derivatives exchanges. A rising number? More bets, more leverage, more chaos. A falling number? Either traders are sighing in relief or being liquidated like so many overconfident fools. 🤡