Strategy Buys 196 BTC, Short-Term Buyers Panic – Is Bitcoin About to Explode? 🚀

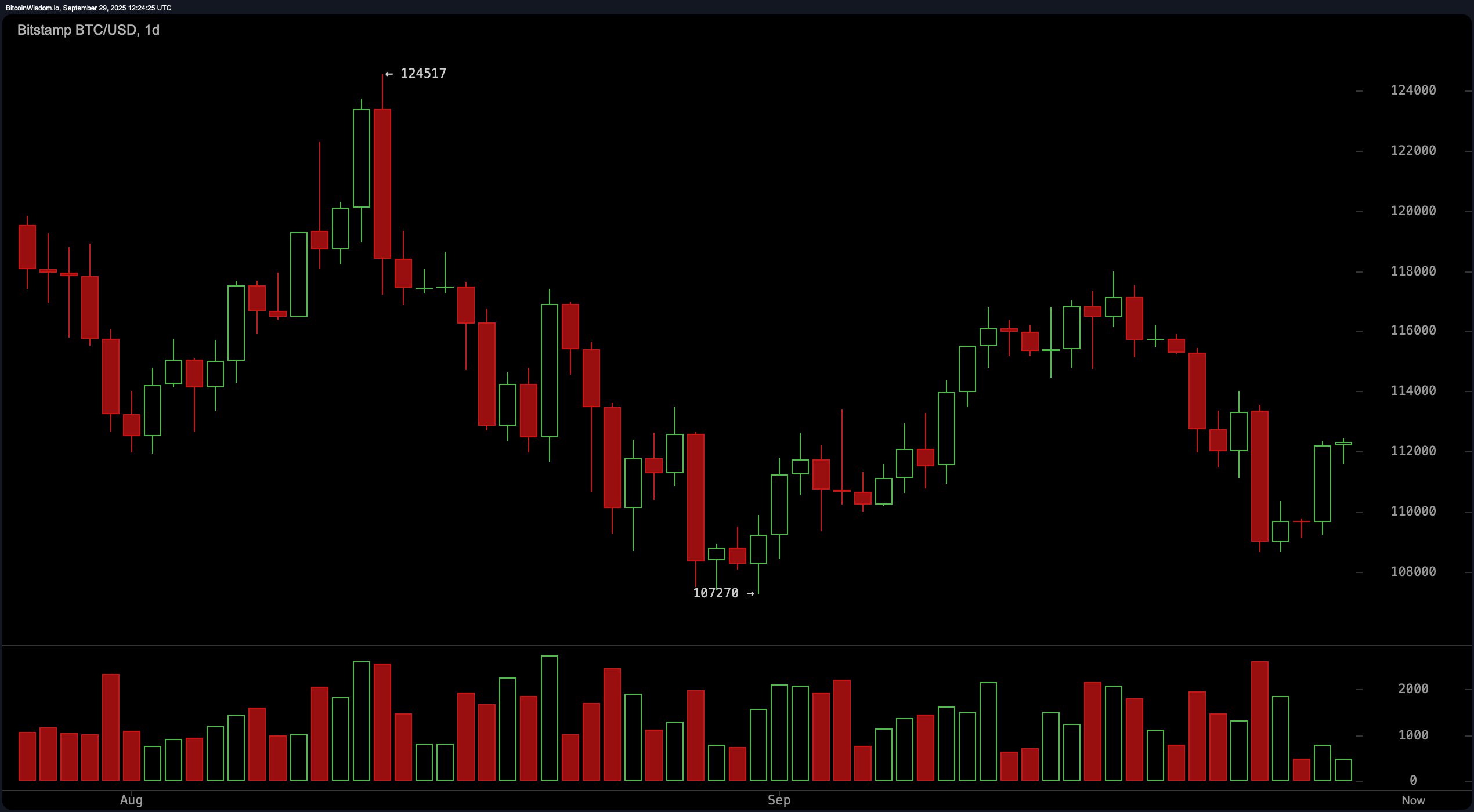

The company proudly announced its latest acquisition of 196 BTC for a staggering $22.1 million, or approximately $113,048 per coin. Now, let’s all take a moment to appreciate their growing stash of 640,031 BTC, a hoard worth around $47.35 billion-at an average bargain price of $73,983 per BTC. Let the numbers sink in… because they’re larger than your last paycheck. 💸