Bitcoin’s Wild Ride: Bulls Wrestle Bears and Keep $112K Dream Alive!

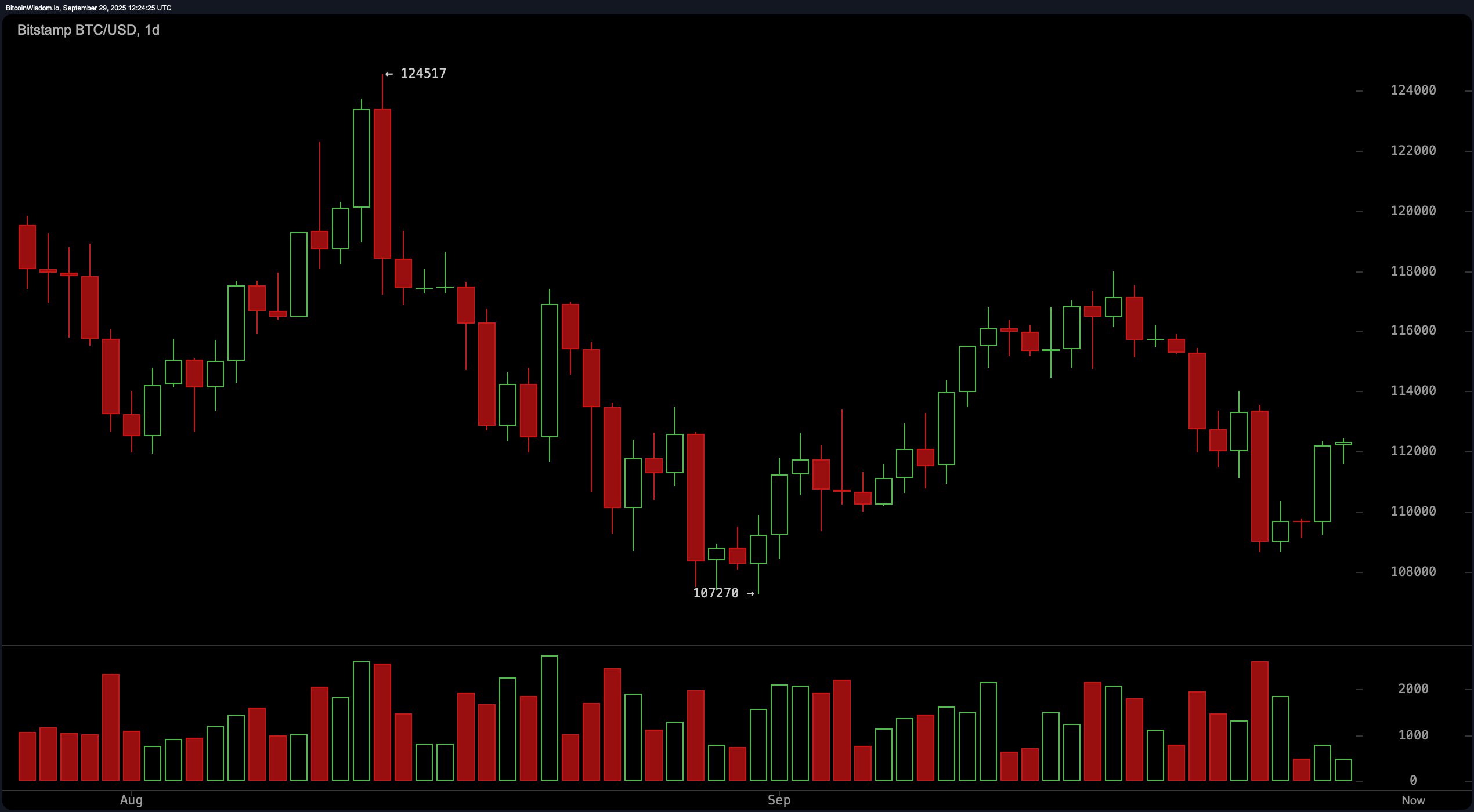

Peer now at the daily chart-our dear protagonist, bitcoin, played the Shakespearean fool in early September, tumbling into the $107,000 abyss with all the grace of a drunken ballet dancer. But lo! A double-bottom formation emerged, as cunning as a fox in a hat shop, signaling a surge worthy of a Hollywood comeback. Green candlesticks, chiseled with brawn and heft, parade bullish swagger, whispering sweet reassurances to the panting crowd of traders.