BlackRock’s Crypto ETFs Rake in $260M, Leaving Rivals Eating Dust

BlackRock has stealthily built its crypto empire!👇

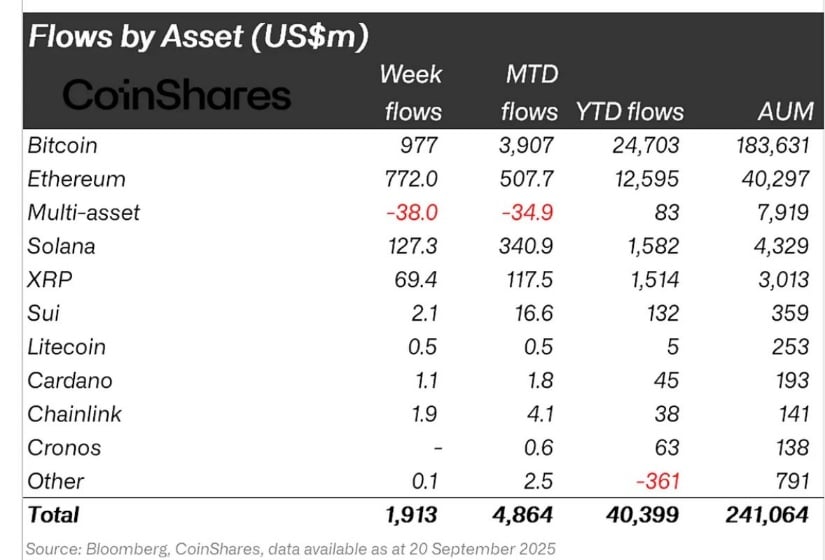

In less than 2 years, their Bitcoin and Ethereum ETFs are bringing in over $260M a year. Who knew crypto could be so lucrative, right?

🔸 $218M from Bitcoin

🔸 $42M from Ethereum

A quarter-billion-dollar operation, almost overnight. Meanwhile, other companies are still figuring out how to make their first million…