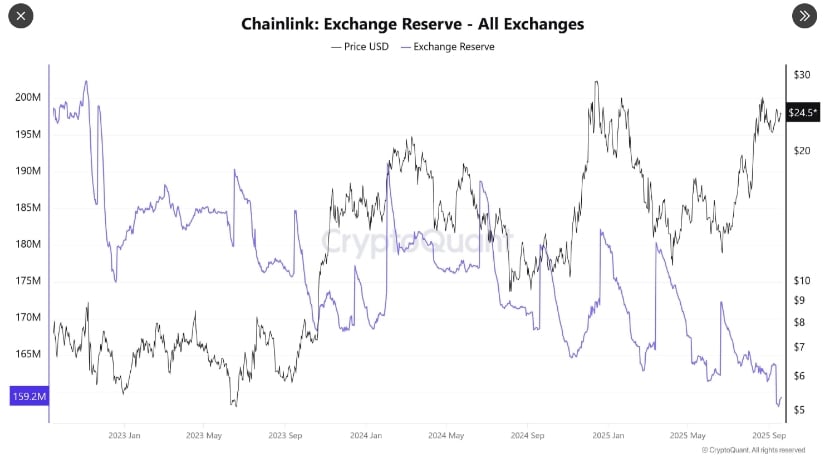

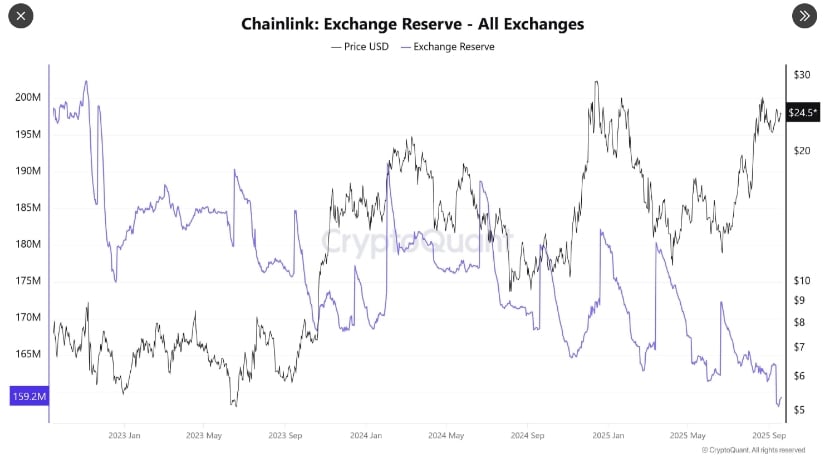

Analyst Ali, armed with a chart and a questionable grasp of reality, insists Chainlink is about to break through a “crucial resistance” at $25. If it succeeds, they claim, the token will ascend to $26.17, $27.84, and finally $30.13-a price path so precise it makes you wonder if the universe itself is trying to tell us something. Or maybe just trying to confuse us. Either way, a short-term dip to $23.3-$24 remains “possible,” because nothing says “confidence” like a backup plan involving existential despair. Current price action hovers near $23.6, with daily volume hitting $1 billion. Because nothing says “market attention” like a token that looks like it’s trying to escape Earth’s gravity-but with less fuel.