Ethereum’s Privacy Makeover: How to Sneak Past Uncle Sam and Still Look Fabulous

Ethereum’s cooking up a privacy roadmap with three shiny new tricks to make sure your digital moves stay… uncaught.

Ethereum’s cooking up a privacy roadmap with three shiny new tricks to make sure your digital moves stay… uncaught.

Yet, Casey’s conviction holds firm as the ironwood tree against the biting winter winds. He envisions Bitcoin, the foremost among cryptic tokens, taking the place of gold-yes, the very yellow metal that has glimmered through the ages-as the paramount sanctuary of value. One might muse whether this is wit or folly, or perhaps both, dancing hand in hand like devils at a midsummer’s revelry.

Bitcoin bulls, those eternal dreamers, believe this easing will send Treasury yields tumbling, encouraging risk-taking across the economy. Yet, the world is a complex stage, and outcomes rarely align with expectations. Life, after all, is not a neatly written play. 🎭

Let’s break it down: Cherokee’s bid is hardly subtle. They’ve set up two neat little price ranges. For claims over $100,000, they’re offering between 70% and 75% of the original value, and for claims under $100,000, they’ll drop it to a modest 65% to 70%. How thoughtful! The sellers, in return, get the joy of an immediate cash payout while Cherokee takes on the inconvenience of waiting for distributions. Isn’t that just a delightful arrangement?

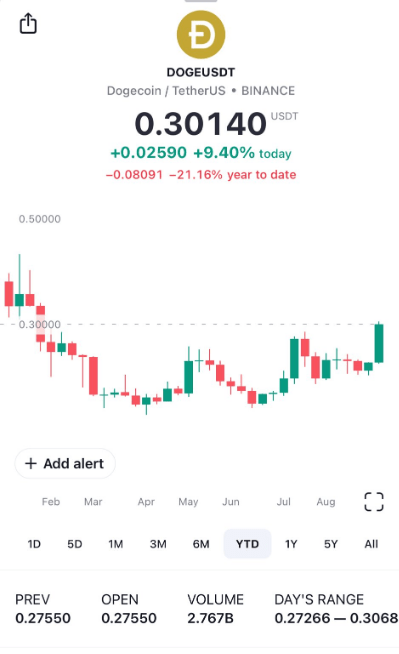

TradingView, that oracle of charts and candlesticks, reveals an 11% surge in a single session, propelling the coin to heights not seen since the halcyon days of yore. This lunge has piqued the interest of the masses, all eyes now fixed on the impending DOGE ETF, a financial instrument as inevitable as a Waugh novel’s tragicomic ending. Volume, that fickle mistress, has swollen to a staggering $5 billion, leaving one to wonder: how long shall the charade persist? 🎢💸

The The Information reports-with all the drama of a Dahlian twist-that Polymarket (the golden goose? 🐓) is considering an offer that could plump its valuation to a whopping $9 billion. Meanwhile, poor Kalshi is said to be nibbling at a $5 billion financing. Nibbling, mind you-not gobbling! 🦆 The report, whispered by those mysterious “people familiar with the discussions” (oh, how Dahl would love that!), insists these companies are merely toying with options, not sealing deals. Timelines? Ticket sizes? Hush, hush! 🤫

But wait, there’s more! In their latest update, Yala promised that all funds are “safe.” Oh, thank goodness! They even clarified that the Bitcoin deposited with them is still self-custodial (whatever that means) or locked away in vaults-no funds were lost in the chaos. Apparently, they’ve paused some product features to deal with this mess. They even threw in a bit of suspense, asking users to “wait for our green light” before re-engaging. Gee, thanks for keeping us on the edge of our seats.

Currently, DOGE is dancing around $0.292, up a modest 6% from yesterday – enough to make your grandma say, “What’s a Bitcoin?” But the real headline? Dogecoin finally busted past its all-summer “stop-you-in-your-tracks” wall at $0.27, like a rebellious teenager sneaking out past curfew. No more summer telling DOGE where it can’t go!

This chart, a humble tracker of all cryptos save Bitcoin, has now achieved what it last did in November 2021-a feat as rare as a polite debate in a Dostoevsky novel. Experts and enthusiasts alike, their eyes gleaming with greed, declare this the perfect moment to stuff portfolios with low-cap altcoins, those unruly stallions of the crypto steppe. 🐎

Here’s the definitive (and slightly absurd) overview of this week’s crypto funding shenanigans, as per the Crypto Fundraising data: