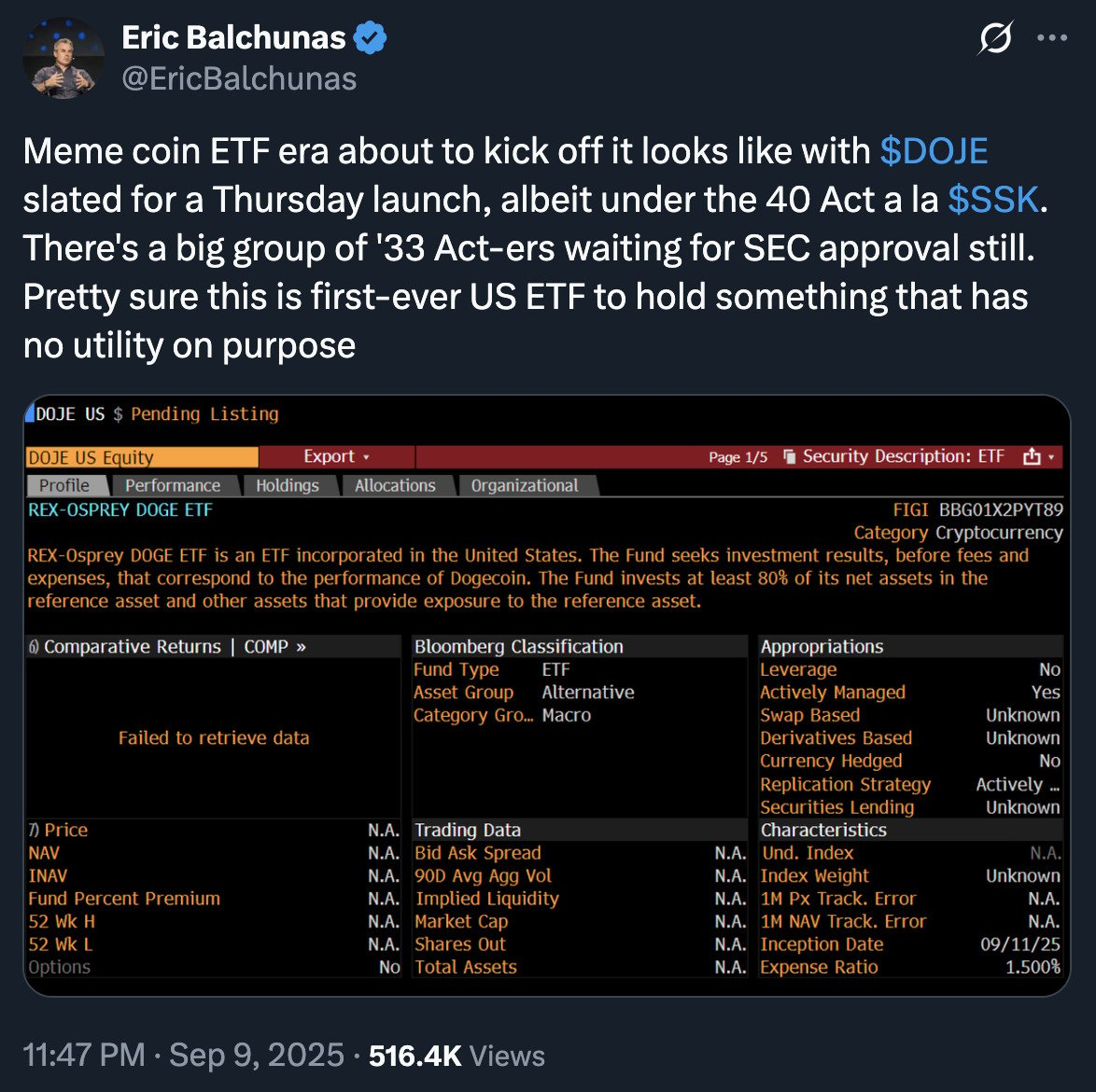

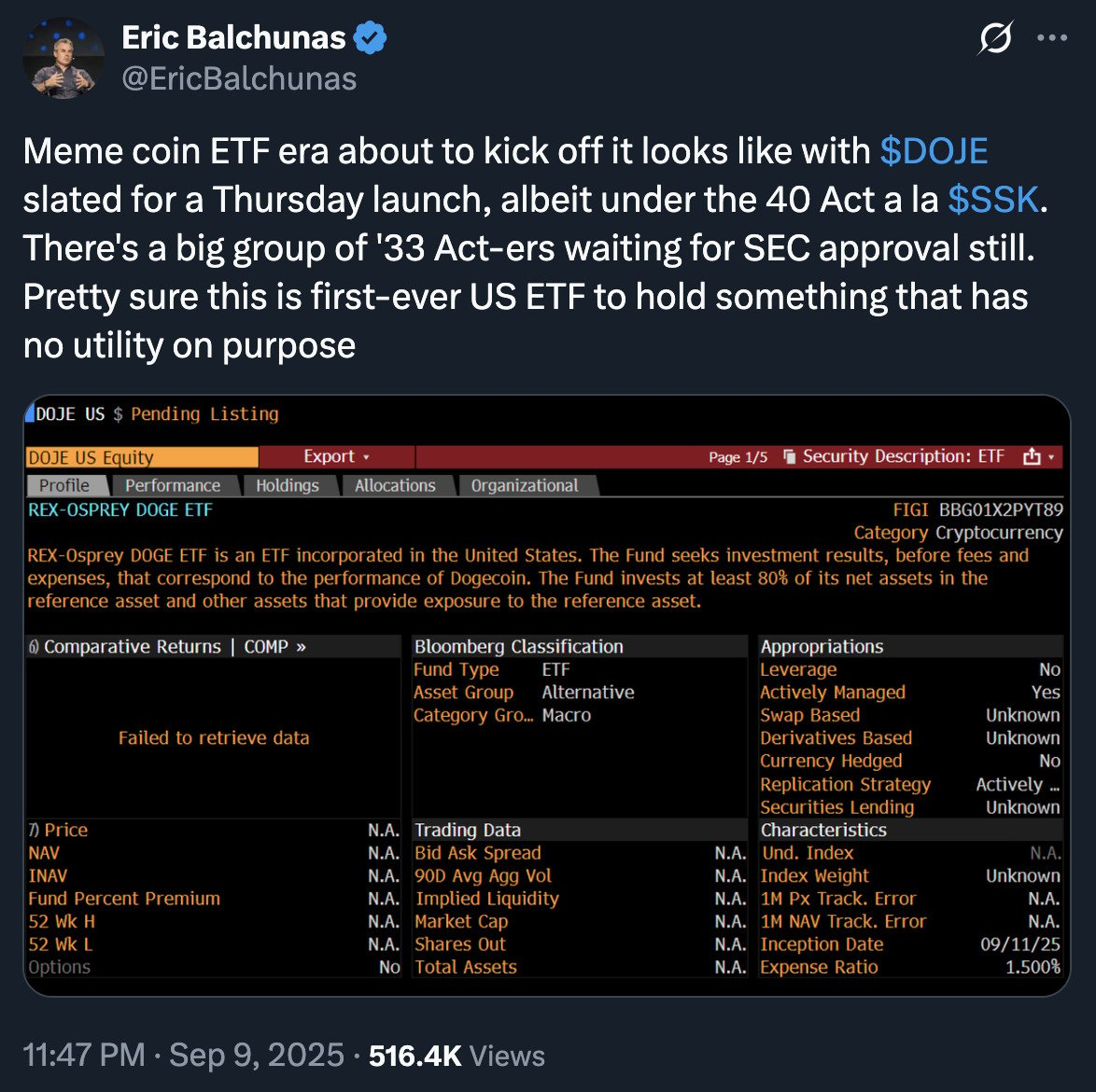

Dogecoin ETF: Wall Street’s Wildest Meme Ride Yet 🚀🐶💸

Meme coin ETF begins, source: X

Meme coin ETF begins, source: X

Well now, you’ve gone and opened Crypto for Advisors-CoinDesk’s weekly little scoop that peels back the cloak on digital coin mystery for financial folks who like numbers but hate getting their hands dirty. Sign up and get it every Thursday, come rain or shine.

Although we’ve only seen a shy 1.95% price bump, the excitement around Pepe [PEPE] has exploded like a fizzy soda shaken a little too much! 🎉 Whoever said big things come in small packages clearly wasn’t talking about PEPE!

Avalanche (AVAX) has decided it no longer enjoys being underestimated. After smashing through a stubborn resistance level near $27, it now sits comfortably around $29, with daily trading volume hitting $1.79 billion. Over the past week, AVAX surged 16%, and frankly, it looks like it’s just warming up.

But as they say, all good things must come to an end-preferably with a *fabulous* twist. Traders, those ever-astute beings, decided it was time to pocket some of those gains. After all, a resistance level above the 200-day simple moving average at $0.000013-especially that tantalizing $0.00001320-proved to be a bit too much of a temptation for the market’s sanity.

It does the heavy reading for you-summarizing fundamentals, comparing assets-yet it’s still thirsty for data sets like your Aunt at an open bar.

Now, if you’re thinking this sounds like a standard deal, think again. This three-year, eight-figure agreement isn’t just any old handshake. It’s a bold step into the wild, wild west of pro sports, where crypto exchanges are the new cowboys, looking to rope in audiences far and wide. 🤠

Oh boy, the world’s largest asset manager, BlackRock, now controls over $100 billion worth of crypto. Talk about a digital gold rush! 🏴☠️

Bitcoin, which oftentimes behaves like a lovesick suitor when confronted with CPI data-given its implications for interest rates and the dollar-briefly descended to £113,823 (converted for the more fashionable among us) post-report. One might say it was a mere waltz of despair.

SEI’s price, once a firework, now hums like a sleepy lark at $0.3276, its market cap a modest $1.966 billion. Yet, analysts murmur of a brewing tempest. Here lies a paradox: a coin that has traded its hype for a steady march through DeFi and stablecoins, processing $5.5 billion daily. July alone saw $1.53 billion in DEX volume-a new high, as if the coin had just mastered the art of the perfect metaphor.