Austen’s Take on Cryptocurrency: Flock Flutters to New Heights with Coinbase and Upbit Listings

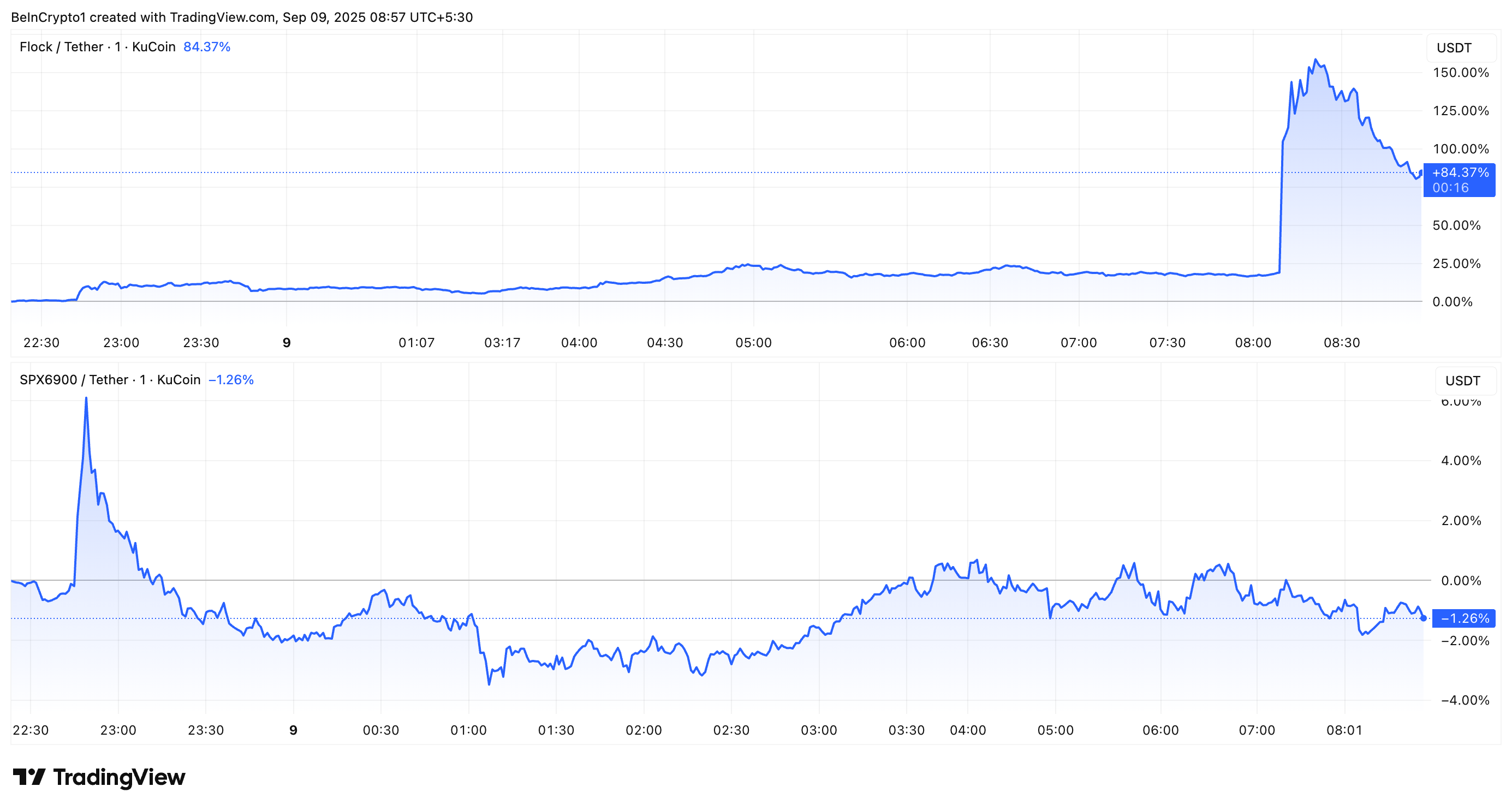

Among these novelties, Flock (FLOCK) has found itself a cozy nest on both exchanges, while Coinbase extends a welcoming hand to SPX6900 (SPX). Such benevolence has not gone unnoticed, as FLOCK has soared to unprecedented heights, much to the delight of its ardent supporters and the envy of its peers.