Crypto Chaos: CRO Soars, PENDLE Falls – What’s Next? 🚀💸

The crypto market had a week that felt like a rollercoaster operated by a toddler with a penchant for loops. 🎢

The crypto market had a week that felt like a rollercoaster operated by a toddler with a penchant for loops. 🎢

While HBAR’s been falling faster than a teapot from a tall shelf, these big investors are adding more tokens to their treasure chests-clearly ignoring the screaming chart. But hold onto your hats, all is not sunshine and unicorns. Technical mumbo jumbo suggests we’re in for a bumpy ride.

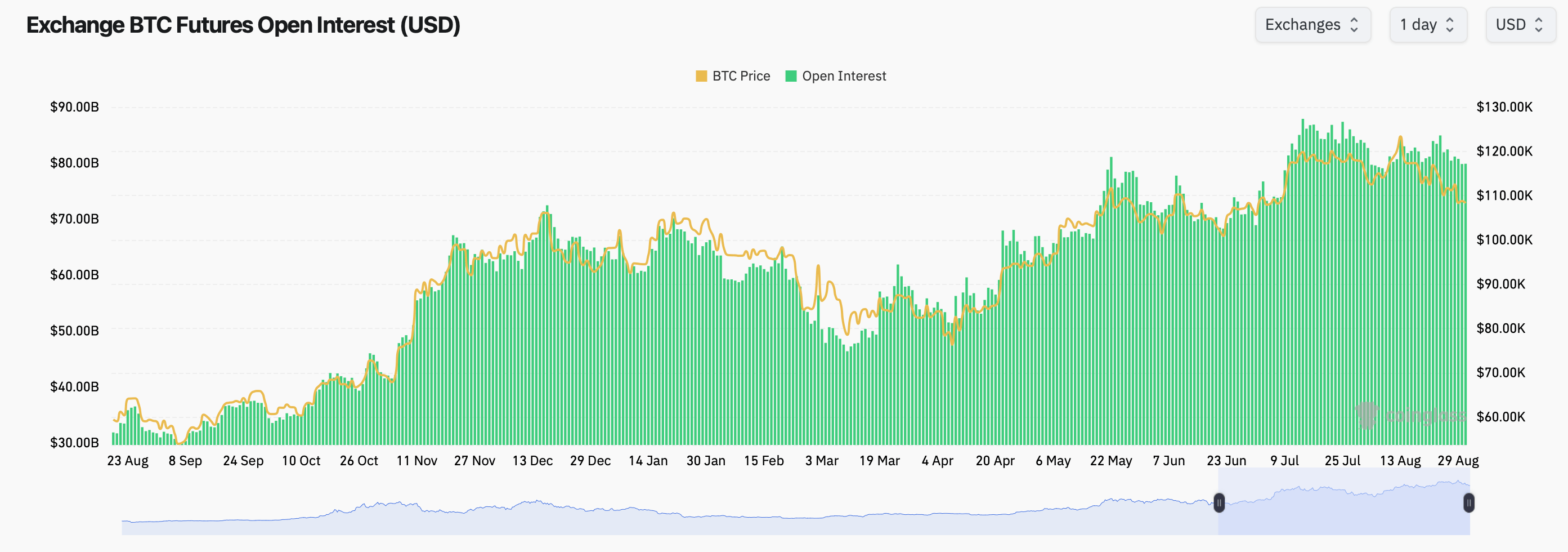

Now, those futures! My word, they remain as thick as the fog in London! The aggregate open interest in Bitcoin futures on various platforms is hovering around the mid-$80 billion area! A bit hefty, wouldn’t you agree? The good folks at CME Group are making quite the splash, flaunting a staggering 141.78K BTC in open interest, to the tune of about $15.36 billion, bless their cotton socks.

But fear not! Whale activity over the past few days suggests that “digital gold” is merely taking a breather, like a dragon after a feast, before charging toward new all-time highs. Some say it could even hit $150K by the end of 2025-though whether that’s a realistic goal or a figment of someone’s caffeine-induced imagination remains to be seen.

According to the oh-so-wise President of NovaDiusWealth, Nate Geraci (no, I don’t think he’s a distant relative of Geraci from my book club, but we live in hope), BlackRock’s iShares ETH ETF has been raking in cash like it’s Black Friday! Utterly fabulous, right? But hold on to your sparklers, because on Friday, August 29, it seems the party took a rather *unexpected* turn. Cue the dramatic music! 🎶

Apparently, Metaplanet thinks owning more Bitcoin is the surest way to a midlife crisis cure, unveiling a plan to raise 130 billion yen (that’s about $880 million for those not counting yen in their sleep) through a global share sale. The clever part? Most of that cash is earmarked for turning their Bitcoin stash from chump change into serious chunky change.

On the great and mysterious platform X, the sage Ali Martinez-keeper of charts and numbers-declared on August the 30th a truth most curious. Using the arcane scriptures of CryptoQuant, he whispered that when Bitcoin waltzed at $111,337, the trader’s realized loss margin was a paltry -0.60%. Now, it clumsily staggers at -2.2%. Alas, these numbers are but the timid footfalls upon the grand staircase of past capitulations where, at a furious -12%, the true tempest begins.

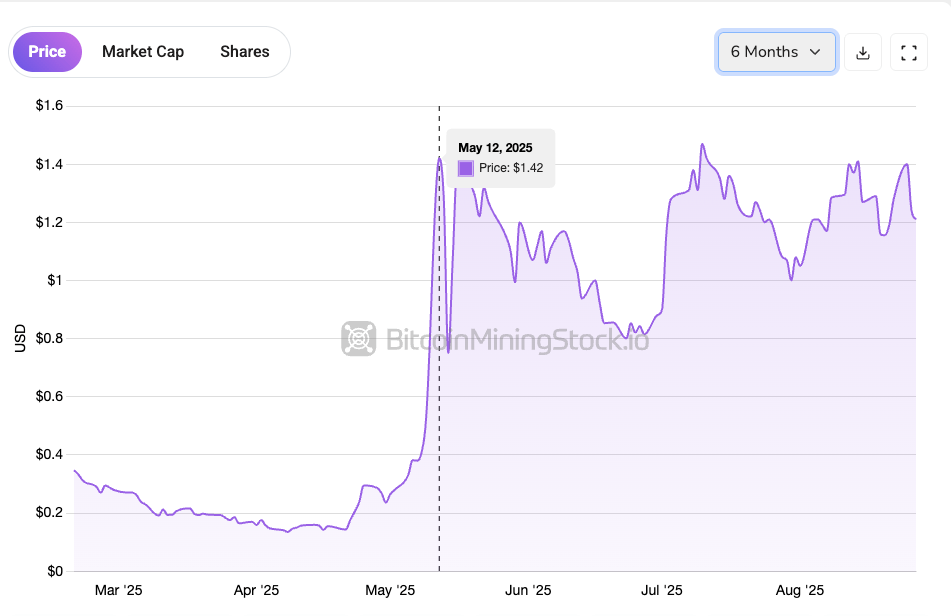

In what can only be described as a whimsical dance, Gryphon Digital Mining (GRYP), fluttering like a heraldic creature, has convened its shareholders in a special gathering. The goal? Deciding upon a merger with the newly minted American Bitcoin Corp (ABTC), orchestrated by the fraternal troupe of Eric Trump, Donald Trump Jr., and the enterprising Hut 8. Since the courtship was first trumpeted on May 12, Gryphon stock has soared over 200%, much like an over-enthusiastic maiden.

Whether you’re an altcoin aficionado or a presale thrill-seeker, we’ve got the scoop on three presale projects that are more than just your average hype-and-pump schemes. Maybe they’ll be your next big investment or, at the very least, a fabulous watercooler topic. Let’s dive in! 🤔🥤

But, ah! The future is ever a cruel mistress. September threatens to unleash upon the market a deluge of tokens – 149 million of them – like peasants flooding into the market square, their presence sure to weigh heavily on the fragile equilibrium. 🐝