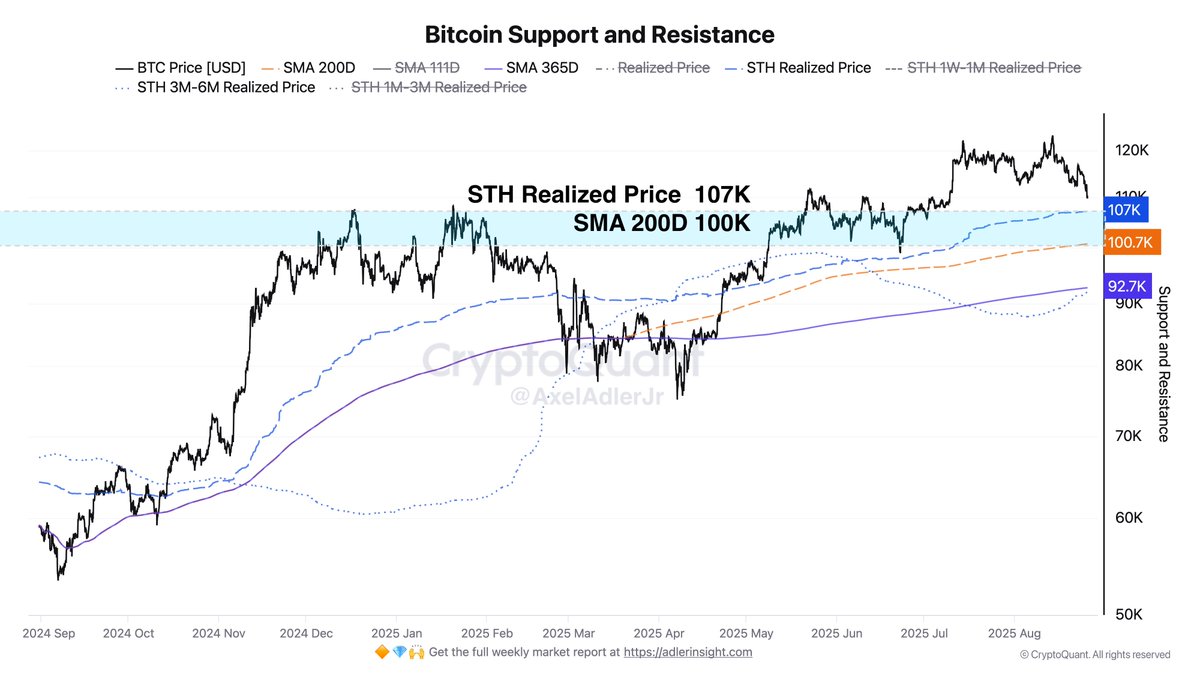

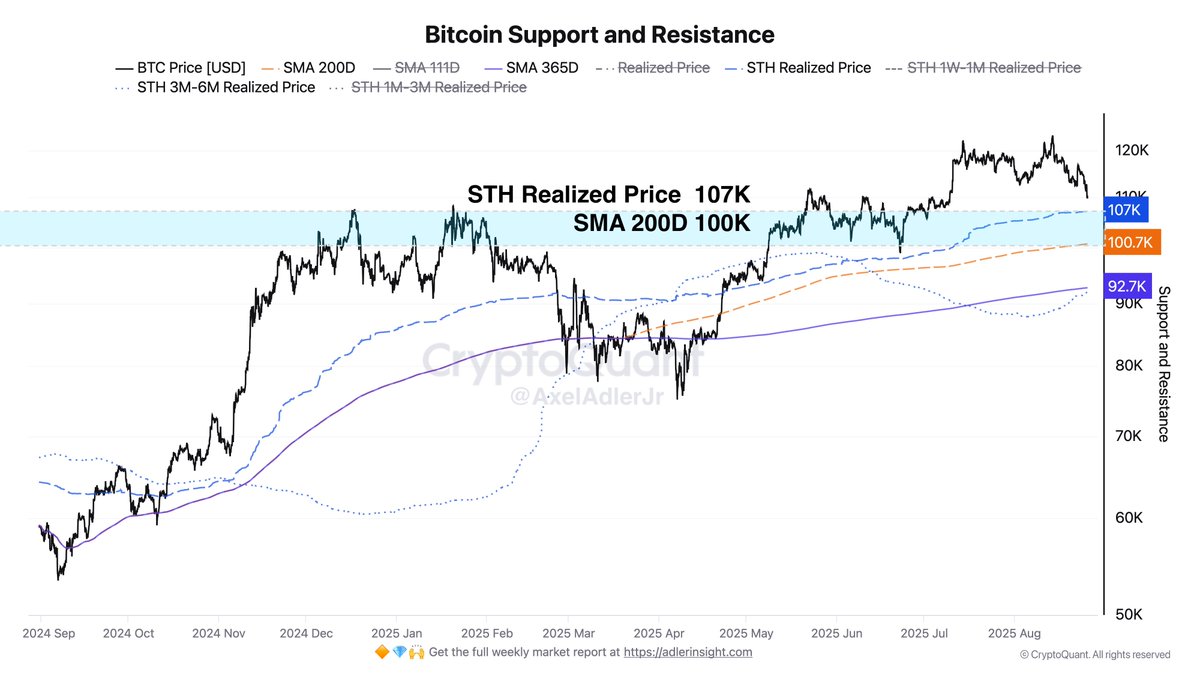

Naturally, we must consult the high priests of finance, the analysts, who speak in a language of cryptic acronyms and grim portents. One such sage, Axel Adler (a name that sounds like he should be fronting a prog-rock band, not predicting financial apocalypses), has pointed out that the digital darling’s next likely stop, should it fall, is a comfort zone between $100K and $107K. This isn’t just any old number; it’s where two of the market’s most beloved indicators, the STH Realized Price and the 200-day Simple Moving Average, decided to have a casual hook-up. Historically, this is where Bitcoin has gone to have a strong cup of coffee and reconsider its life choices before embarking on another heroic rally.