ETHZilla Dives Into $250M Buyback: Cash, Crypto & Cunning Corporate Chaos!

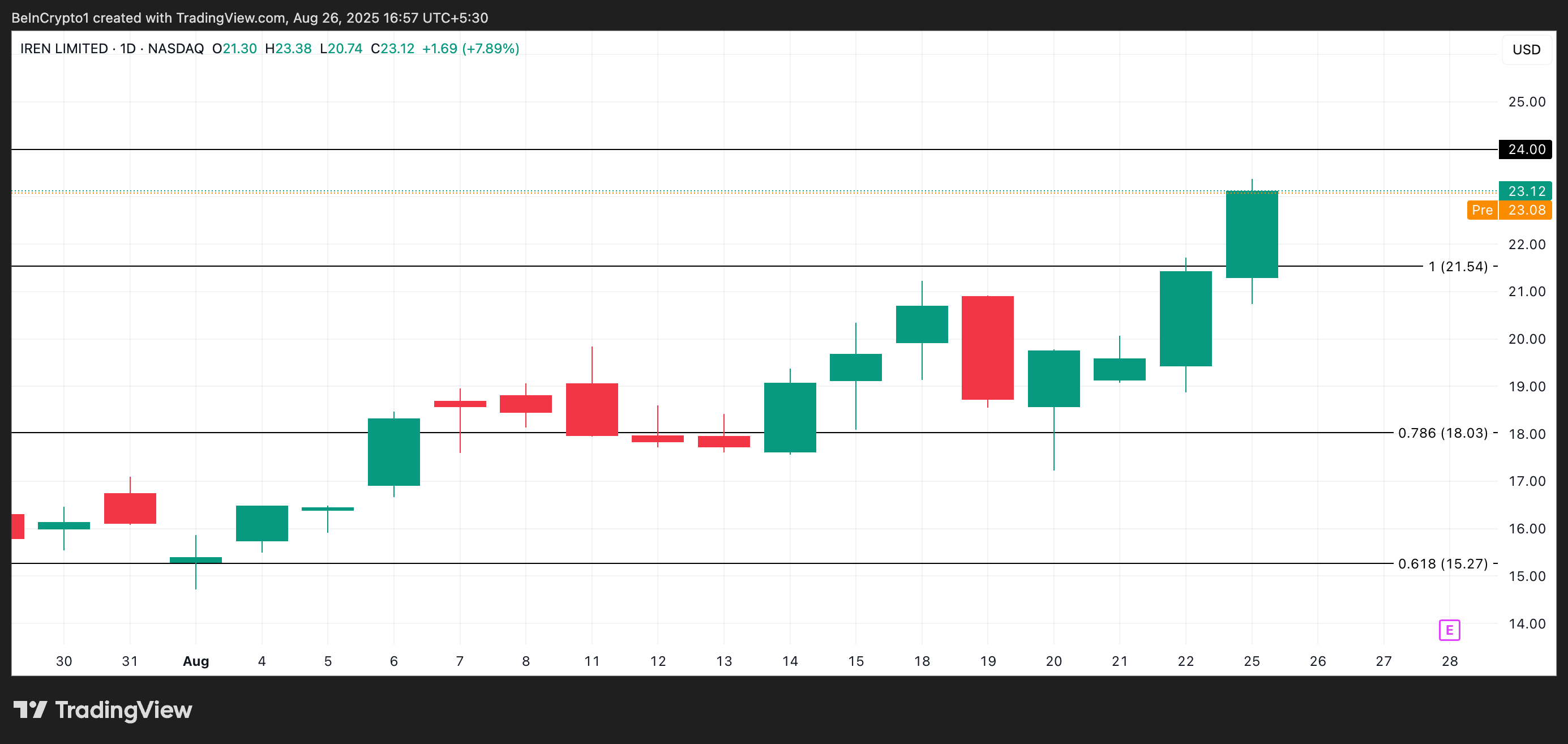

A stampede of companies is rushing to shovel crypto into their treasuries, apparently convinced this is not a feverish hallucination. On the fateful Monday of August 25th, ETHZilla confirmed its $250 million buyback plan, aimed at “strengthening” its own stock price. Whether the price can be cured is another story.