🤑 Crypto King’s Epic Fail: From $43M to “Oops, My Bad” 🤑

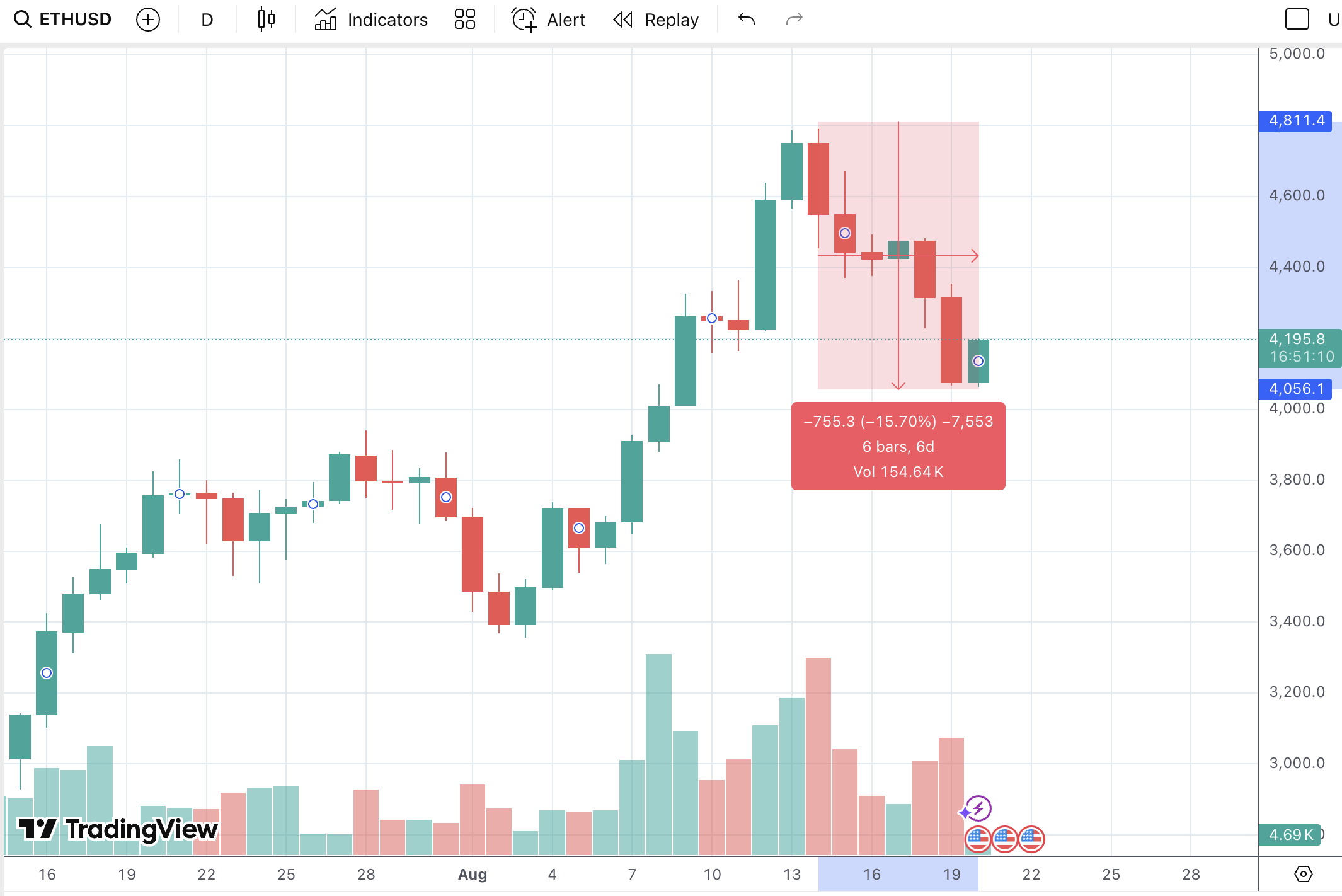

So, this hotshot turned $125k into $29.6M in four months by going *irresponsibly* long on Ethereum. Yes, you read that right. Irresponsibly. Because nothing says “financial genius” like putting all your eggs in one volatile basket. 🥚💥