…

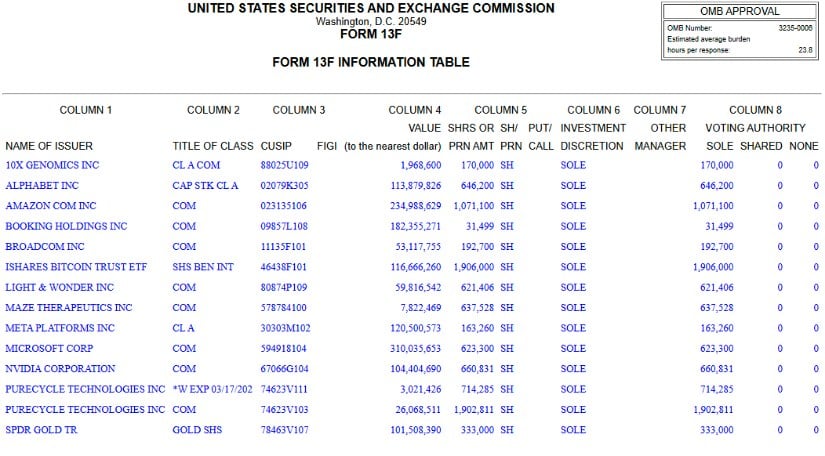

In this modern age of mercantile speculation, one observes that Ripple’s [XRP] has been graced by the rare technical event of a golden cross-a phenomenon which, in bygone days, has presaged rallies of 630% and 54%. This metric, which carefully weighs the relationship between market value and realized value, serves as a most reliable indicator of whether the token is undervalued or, heaven forbid, overvalued.