Bitcoin Cash’s Whale Drought: A Tale of $650 Dreams and $200M Realities 😂

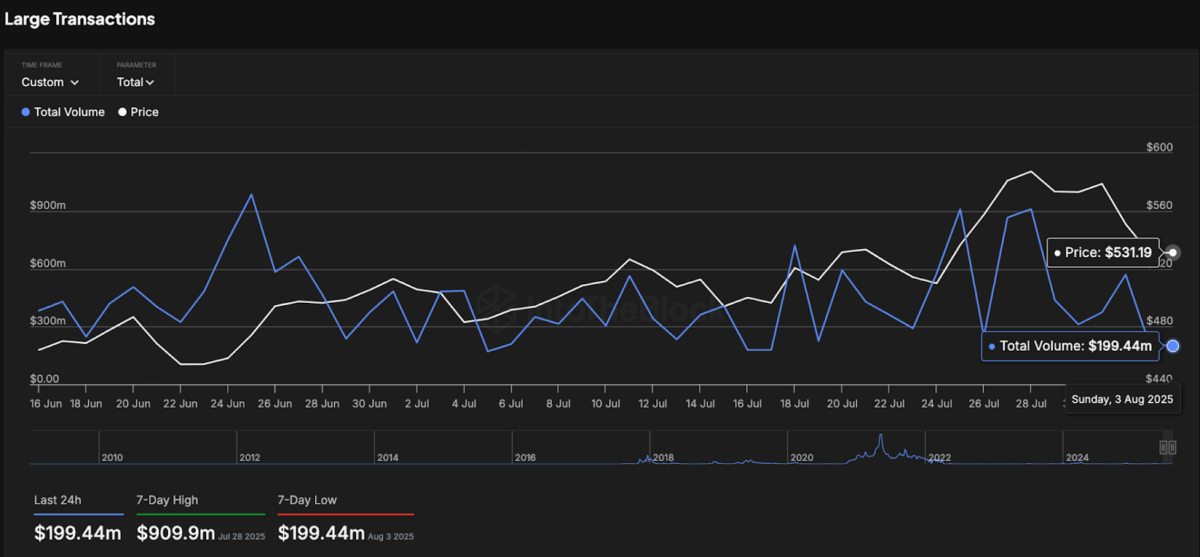

Amidst this festive atmosphere, BCH on-chain metrics whisper a cautionary tale: the whales, those majestic creatures of the crypto sea, seem to be on vacation. According to IntoTheBlock, BCH large transactions (over $100K), which peaked above $900 million in July, have now plunged below $200 million for the first time in 20 days on Sunday, Aug. 3. 🐳🌊