Old Bitcoins Wake Up!

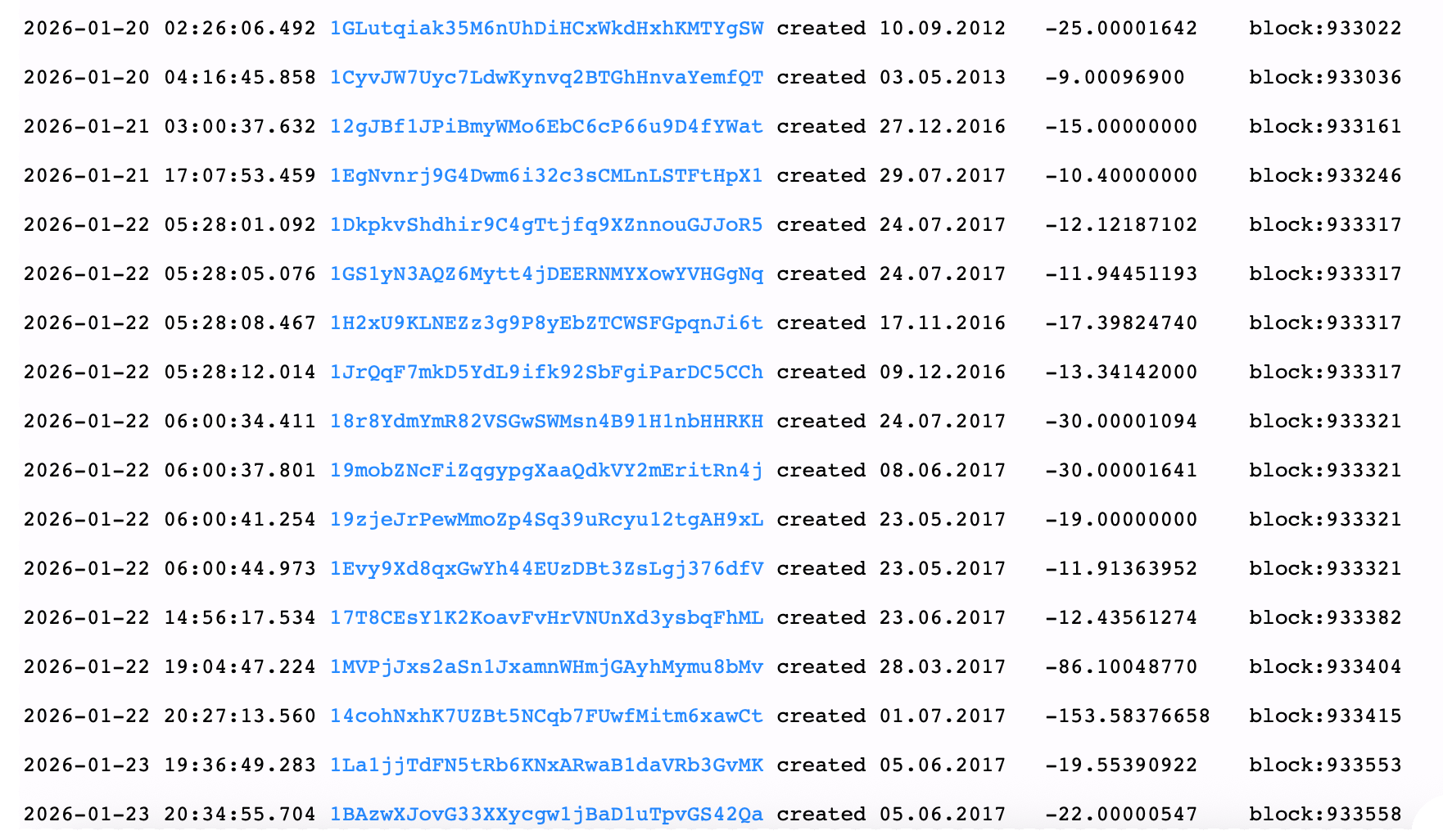

One might have presumed that Bitcoin, remaining stubbornly below a price that would elicit true delight, would remain undisturbed. However, certain legacy wallets, yearning for a bit of activity, have begun the most curious of re-positionings. Mr. Sani, a gentleman well-versed in the study of the Blockchain, noted on Thursday the emergence of addresses of a most venerable age, all engaged in the rather organized effort of consolidation.