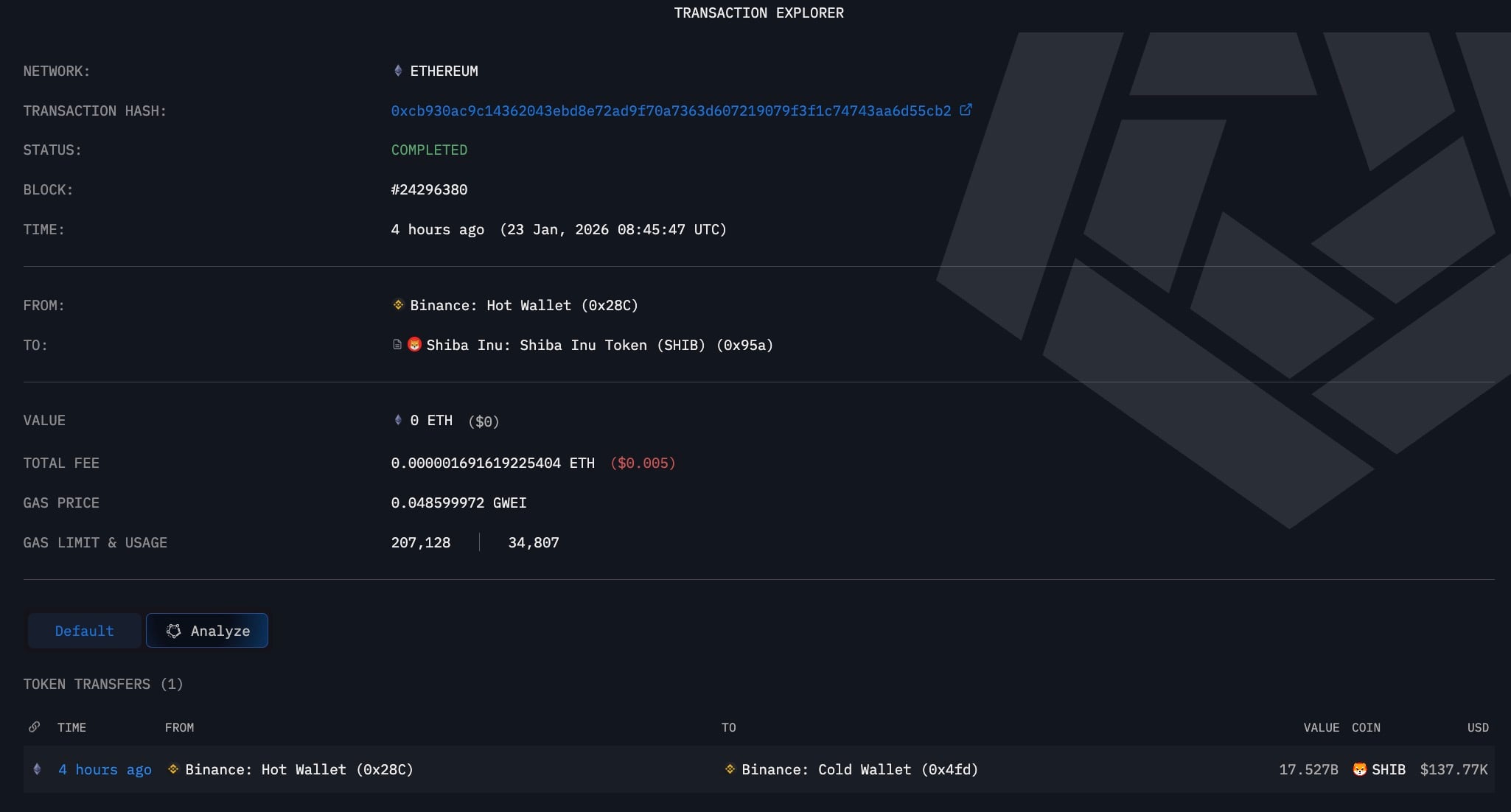

Binance’s Chilly Embrace: 17.5 Billion SHIB Frozen in Cryptic Silence

On-chain records, those dour accountants of the digital realm, confirm no ETH accompanied this exodus. But it is the timing, my dear reader, that sets the cogs of speculation whirring. What mischief is afoot? One can only imagine the SHIB holders, poor souls, scratching their heads like so many bewildered terriers.