Dogecoin’s Dramatic Descend: Is This the End or a Mere Whimsy?

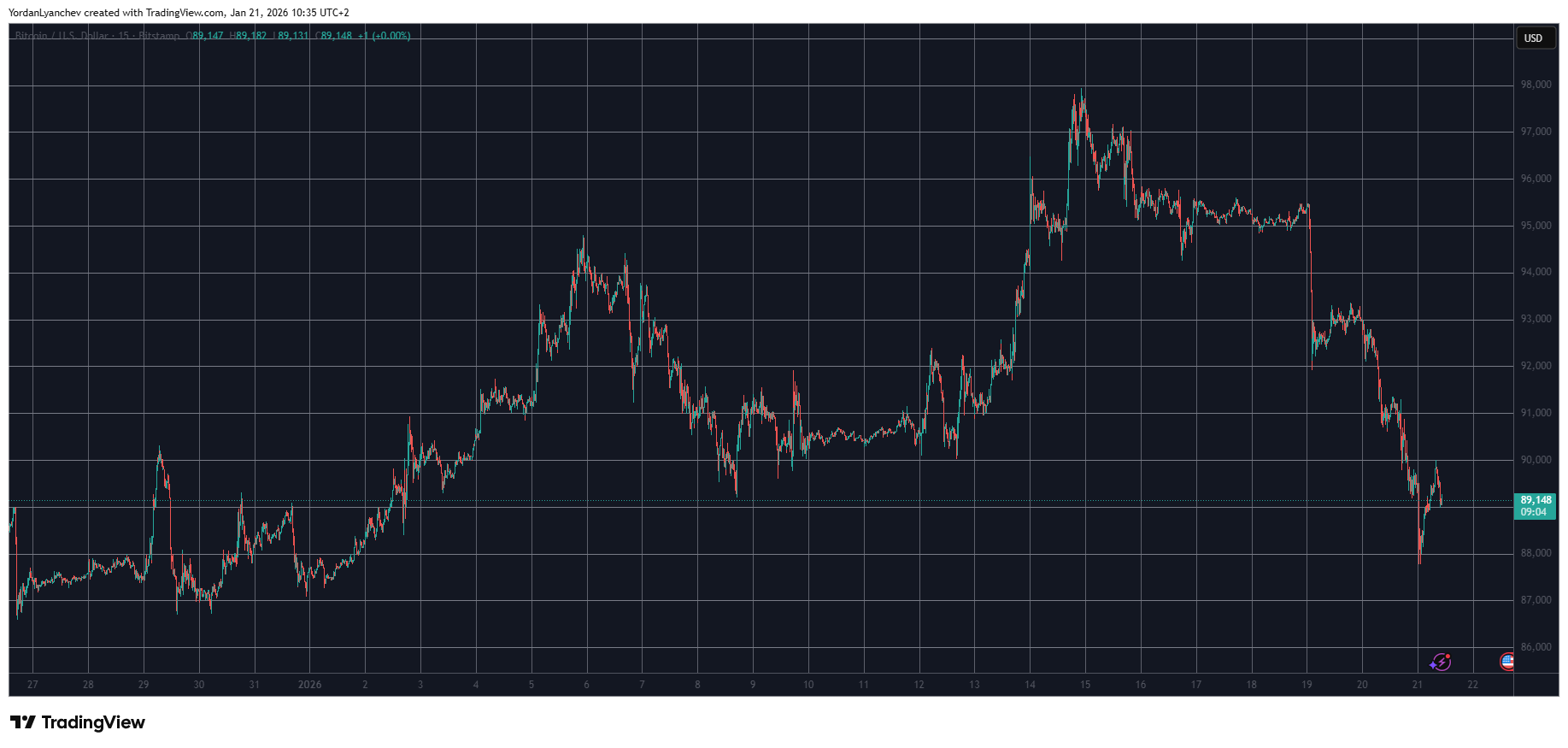

Arkham and SosoValue-those digital fortune-tellers-hint at underlying currents, whispering of secrets behind DOGE’s fall. But what truly transpired in this grand spectacle of financial melodrama?