WIF’s Whale of a Time!

Now, let’s take a gander at the numbers, shall we? 📊

Now, let’s take a gander at the numbers, shall we? 📊

But as is always the case in our curious land, excess breeds more excess. Whale transactions did not pause for reflection before the mirror; no, they soared to dizzying heights. The weekly tallies, for those hopelessly addicted to numbers, present a drama of their own: a piteous trough at 12.03 million LTC, followed by a manic peak at 93.75 million LTC. Imagine, dear reader, if Gogol’s townsfolk ran through the streets trading overgrown turnips at these rates—the markets would be reduced to laughter and tears in record time.

Dr. Rand Hindi, the CEO and co-founder of Zama, took to X (formerly known as Twitter, but who’s counting?) to issue a warning that should concern the Shiba Inu and crypto community. “This is fake. There is no Zama token yet. Don’t get rekt, guys,” Hindi wrote, referring to an alert shared by a community member about the fake Zama token. 🚨

The poor entrepreneur’s crypto ventures suffered a blow, as he runs educational platforms and has a YouTube channel with a whopping 40,000 subscribers. 📺

On the 1-hour chart, bitcoin displayed a mild bullish recovery from the $107,300 level after enduring a sequence of red candles. However, volume tapered off, hinting at a pause in momentum and suggesting potential consolidation rather than continuation. The technical structure presents a clear resistance band at $108,500 to $109,000, with support anchored around $107,300. Intraday traders are advised to monitor a breakout above $109,000 accompanied by volume, as this may catalyze a short-term push toward $109,500 to $110,000. Conversely, a failure to sustain above $108,000 could see a reversion to lower support levels. 📈📉

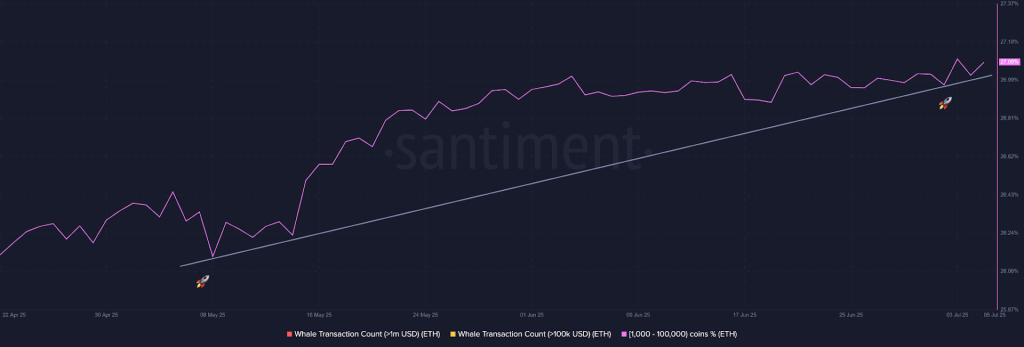

The current bullish sentiment has boosted market-wide sentiment, and analysts, with their noses buried in charts and data, are eyeing a breakout towards $3,500 in the short term. How delightful!

Cybersecurity firm Koi Security has uncovered a large-scale malicious campaign that’s like a digital version of a con artist at a casino, but instead of a deck of cards, they’re using fake Firefox extensions to do their dirty work.

Behold: in Europe’s crypto bazaar, the dollar bills still whistle the loudest. Most stablecoins here are cousins of Washington’s greenback, stoking the envious tempers of central bankers and shivering the lapels of regulators. The EU, that most Baroque of forums, rolls out scrolls of regulation, while debates about whose digital effigy graces the future’s wallet grow as heady—and convoluted—as a Dostoyevsky subplot.

The case, which has left the crypto community scratching their heads and the legal community rubbing their hands with glee, involved a ransom demand made in digital assets. Yes, you heard that right – digital assets! 😲