Base’s $147K Daily Fees: Ethereum’s L2 King? 🐍💰

The data whispered of a singular, feverish dance of digital gold, while the rest of Ethereum’s scaling symphony stumbled through a $5,000 fee fog, their notes lost in the void. 🌌

The data whispered of a singular, feverish dance of digital gold, while the rest of Ethereum’s scaling symphony stumbled through a $5,000 fee fog, their notes lost in the void. 🌌

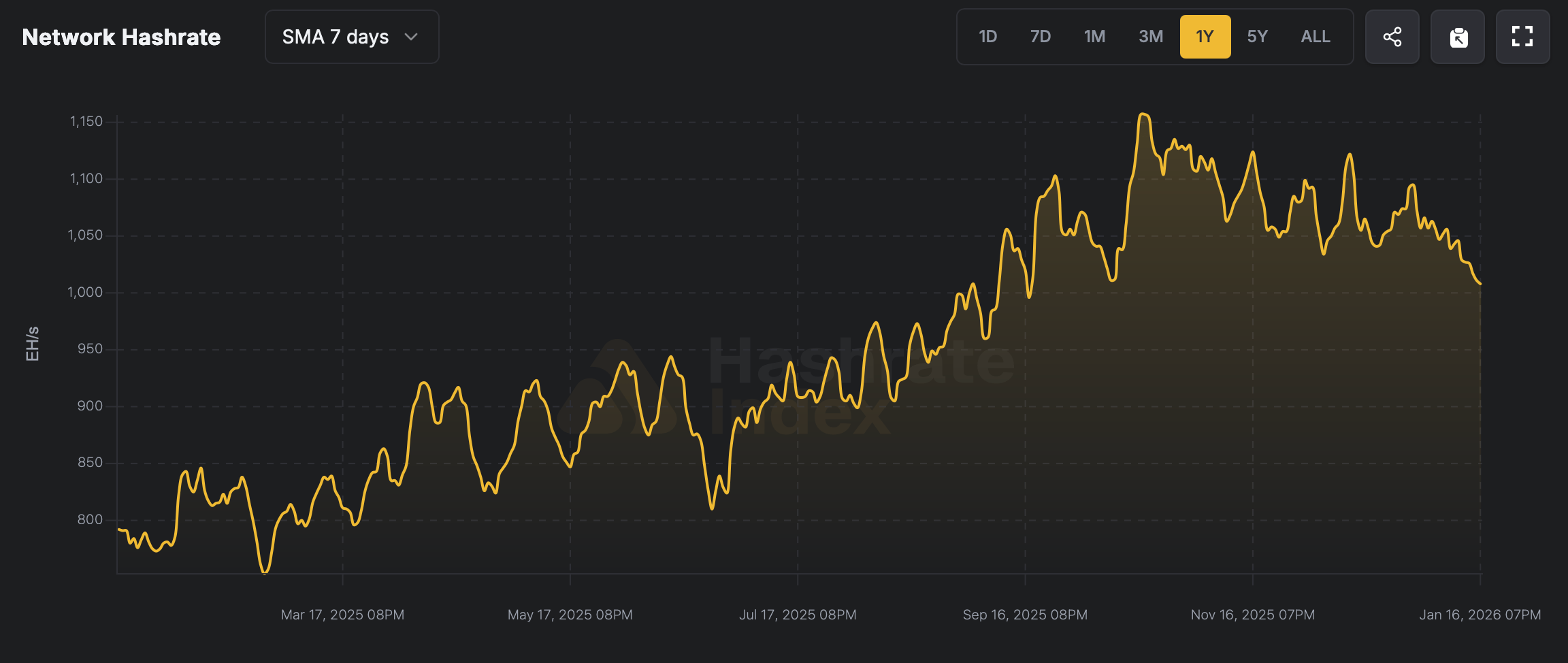

Bitcoin’s overall hashrate slipped beneath the 1 ZH/s zone on Saturday, Jan. 17, snapping a streak that had held firm above that mark since mid-September 2025. During that stretch, on Oct. 19, 2025, Bitcoin’s hashpower climbed to 1,162 EH/s-equal to 1.162 ZH/s-based on the seven-day simple moving average, according to hashrateindex.com data.

So the U.S. Department of Justice, in their infinite wisdom, confirmed that the Bitcoin snatched in the Samourai Wallet debacle is still hanging out with Uncle Sam. It’s not sold; it’s just… chilling. 🍹

In the grand tradition of humanity’s greatest achievements (and blunders), Nelnet-a company that apparently treats “data security” as a suggestion-suffered a cyberattack in August 2022. Bonus points: they also run a web portal and payment system for others. Because nothing says “trustworthy” like outsourcing your incompetence. 💸

On the fateful day of January 16, the astute on-chain investigator, ZachXBT, unveiled the monumental theft, which tragically siphoned off the victim’s digital fortune, consisting of 2.05 million Litecoin (LTC) and 1,459 Bitcoin (BTC). One can hardly fail to appreciate the irony of it all-trusting one’s fortune to a mere piece of hardware! 🎭

Mark thy calendars, dear traders, for at 08:30 UTC, the gates of new positions shall slam shut faster than a miser’s wallet. Close thy open positions, lest thou be subjected to the cruel embrace of forced settlement! 🛑

Bitcoin’s futures market has seen a shift in momentum, as derivatives data now points to a return of buy-side activity. 🤑

Ah, the modern tragedy! A crypto investor, presumably clutching their hardware wallet like a Dickensian orphan with a crust of bread, lost a staggering $282 million to a social engineering scam. The incident, reported by the ever-vigilant ZachXBT, unfolded at the stroke of 23:00 UTC on January 10-a time when most sensible people are sipping tea or plotting their own financial ruin.

Most altcoins are slouching like they’re waiting for a bus that’ll never come. ETH? Still stuck in the 3k zone. XRP? Defending $2.05 like it’s the last slice of pizza. And XMR? Oh, XMR’s having a meltdown. 🤯

The alarm was sounded by Manhattan’s District Attorney, Mr. Alvin L. Bragg, Jr., a man clearly overburdened with the cares of the state, and State Senator Zellnor Myrie. They seem to believe cryptocurrency is, and I quote, “urgent” to regulate. One wonders what grave societal ill is being averted; are rogue Bitcoin traders threatening the foundations of the republic?