SHIB’s July 8 Price Prediction: A Rollercoaster of Indecision 🎢

The price of SHIB has had a little pep in its step, up by 1.33% over the past day. 📈 But let’s not get too excited, shall we?

The price of SHIB has had a little pep in its step, up by 1.33% over the past day. 📈 But let’s not get too excited, shall we?

That’s right, folks! The man who brought us “The Apprentice” and “Make America Great Again” is now dipping his toes into the world of digital assets. On Tuesday, July 8, Trump Media and Technology filed an initial registration statement on Form S-1 for a multi-asset crypto ETF. 📝

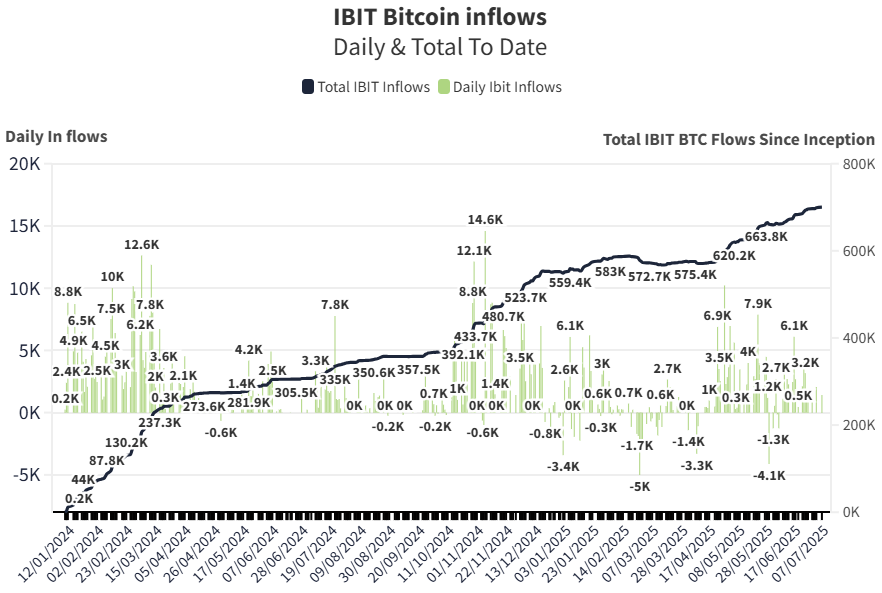

BlackRock now commands so much digital currency it makes old-fashioned bankers weep into their ledgers. With IBIT clutching a titanic 55% share of U.S. spot ETFs, rumor has it even Satoshi Nakamoto’s ghost is standing in line for autographs. Since its January debut, this fund has soared more than 80%. Yes, you heard correctly—more than eighty percent—leaving the S&P 500 ETF in the dust, waving a tiny handkerchief and muttering about “the good old days.”

Volatility in BNB clocked in at just 0.87%, reflecting a wider sense of caution across risk markets. The token’s price is essentially flat over the past 24 hours.

According to the Financial Times, Metaplanet’s CEO, Simon Gerovich, has declared that the company is on a mission to accumulate as much Bitcoin as humanly possible 💸. One can almost hear the faint sound of a “Bitcoin gold rush” in the distance, as Metaplanet aims to build a BTC position so formidable that it becomes the stuff of legends.

These transfers, like the rustling of leaves in a gentle breeze, have reignited concerns around potential sell pressure from old whales and institutions, as if the market were a grand chess game, with each move meticulously calculated.

Semler, which spent over 15 years focused on chronic disease detection, a noble but perhaps less glamorous pursuit, adopted bitcoin as its primary treasury reserve asset in May last year. This decision, as bold as it was unexpected, has set the stage for a tale of transformation and ambition. 🌟

A recent filing revealed that the U.S. Securities and Exchange Commission has accepted the application for a Bitcoin (BTC) and Ethereum (ETH) exchange-traded fund. Truth Social first filed its S-1 form with the SEC for this crypto ETF, which holds both Bitcoin and Ethereum, on June 16. Because why not, right? 🤷♀️

After plunging to $0.000021124, BONK staged a dramatic recovery and closed at $0.000022868. As of the latest reading, the token trades at $0.0000228, slightly off highs but firmly within bullish territory.

The investment gives Tether direct access to Crystal’s suite of tools for real-time risk monitoring, fraud detection, and regulatory intelligence, bolstering the company’s ability to help global law enforcement track suspicious activity, the firms said in a Tuesday press release. Crystal has worked alongside Tether to build Scam Alert, a public database that flags wallet addresses tied to scams, as if they were posting wanted posters in the town square. 📢