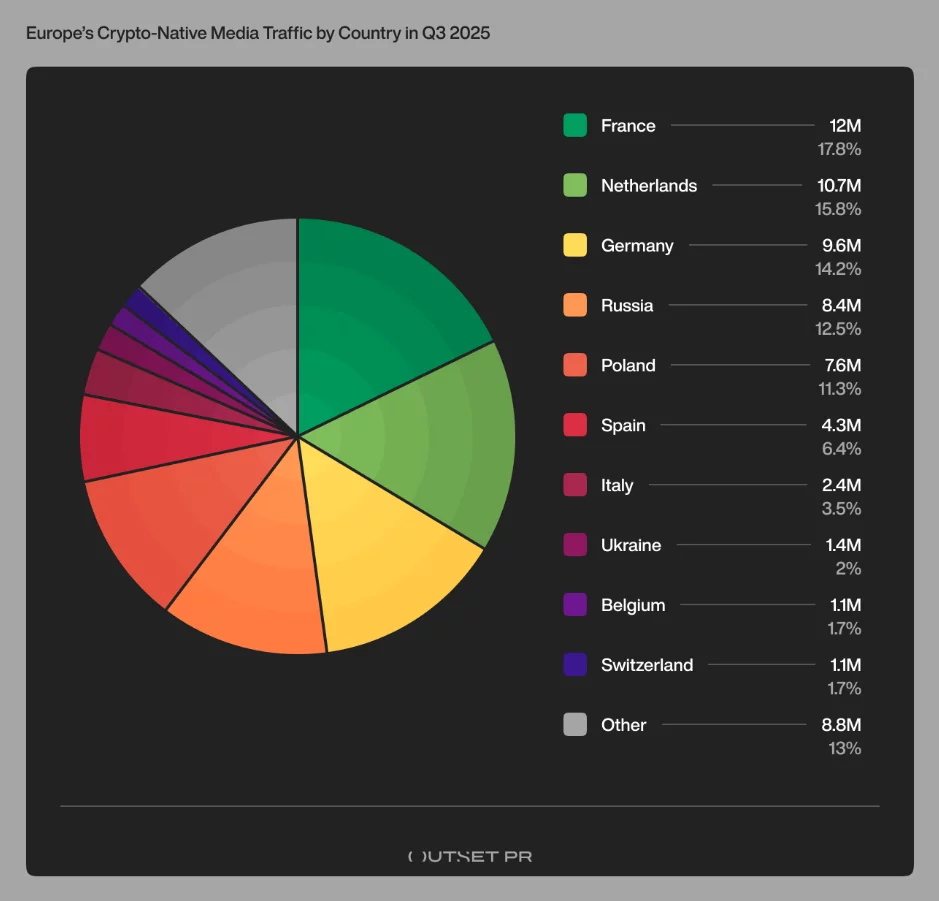

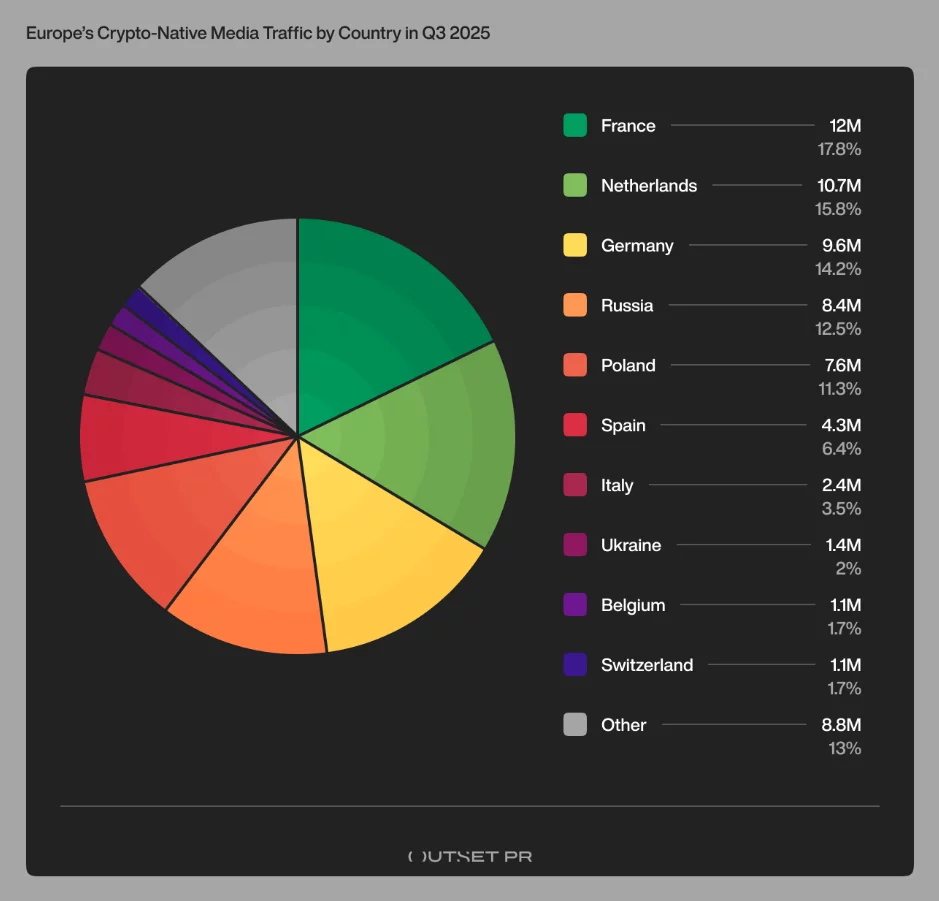

Europe’s Crypto Traffic: 5 Countries Rule All! 💸

Out of roughly 67 million total visits recorded during the quarter, nearly three-quarters came from France, the Netherlands, Germany, Russia, and Poland. 🇫🇷🇳🇱🇩🇪🇷🇺🇵🇱 Oh, the drama!

Out of roughly 67 million total visits recorded during the quarter, nearly three-quarters came from France, the Netherlands, Germany, Russia, and Poland. 🇫🇷🇳🇱🇩🇪🇷🇺🇵🇱 Oh, the drama!

CZ’s recent musings about loving “sticky” meme ideas have sent the crypto world into a tizzy, like a room full of overexcited goldfish. Though he didn’t explicitly mention Pi, the Pi faithful are now asking, “Is a coin with tens of millions of users less valuable than a dancing cat on the moon?” 🐱🌕

Our dear friends in the realm of US spot XRP exchange-traded funds (ETFs) have sadly recorded their inaugural day of net outflows since their grand debut. What a tragedy! This unfortunate event halted what had been a delightful string of steady inflows, which, like a good English breakfast, was quite satisfactory until it wasn’t. Interestingly enough, this market dip coincides with a dwindling enthusiasm for ETF products and a general cooling of the broader market. But fret not, for XRP-linked investment products still hold court among the best performers in the ETF ballpark! 🎩

This alliance promises a way for customers to dispense with the old ritual of converting digital wealth into coin or cash. Payments may be made directly with digital assets, and the procession begins this month, so you may purchase your modest trinkets without first feigning liquidity. A neat surprise, though one suspects the novelty wears thin for those who have grown to enjoy the suspense of exchange. 💳😂

Hyperliquid’s (HYPE) price action is a poem of unfulfilled promises, a ballad of bearish dominance. Since its fall from the $53 precipice, it has scribbled lower highs and lower lows across the chart, a testament to its inability to rise. Each rally, a fleeting hope, is snuffed out by the cold hand of resistance, leaving only the echo of sellers’ laughter.

In a press release as dramatic as a Victorian novel, Attorney General Catherine Hanaway proclaimed her office’s crusade against the purveyors of Bitcoin ATMs. Her ire, it seems, is directed at the “deceptive fee structures” and the “bad actors” who lurk in the shadows, preying on the cryptographically curious. “Devastating scams,” she intoned, with the gravitas of a Shakespearean tragedian, are afoot, ensnaring Missourians in their silken webs of deceit. 🕸️💔

The entire development team behind Zcash has parted ways with the Electric Coin Company (ECC), driven by disagreements that could rival the debates of Dostoevsky’s characters. Who knew that governance could be such a divisive topic? 🤔

Morgan Stanley just unleashed a Bitcoin ETF like it’s the eighth wonder of the financial world… and honestly, it’s only the 43rd. 🤷♂️

Cryptocurrency firms operating in the European Union began collecting tax data on January 1, 2026, under the bloc’s new DAC8 rules, sparking the usual chorus of privacy concerns 🗣️ and existential dread. 🌌

This tumultuous departure comes at quite an inopportune moment for the privacy-centric cryptocurrency ZEC, which has been navigating choppy waters this year. Thus far in 2026, the altcoin has plummeted by over 18%. Perhaps it’s time to invest in a life raft? 🚤