Hyperliquid’s HYPE: A Desperate Gamble on $41.76? 🎲

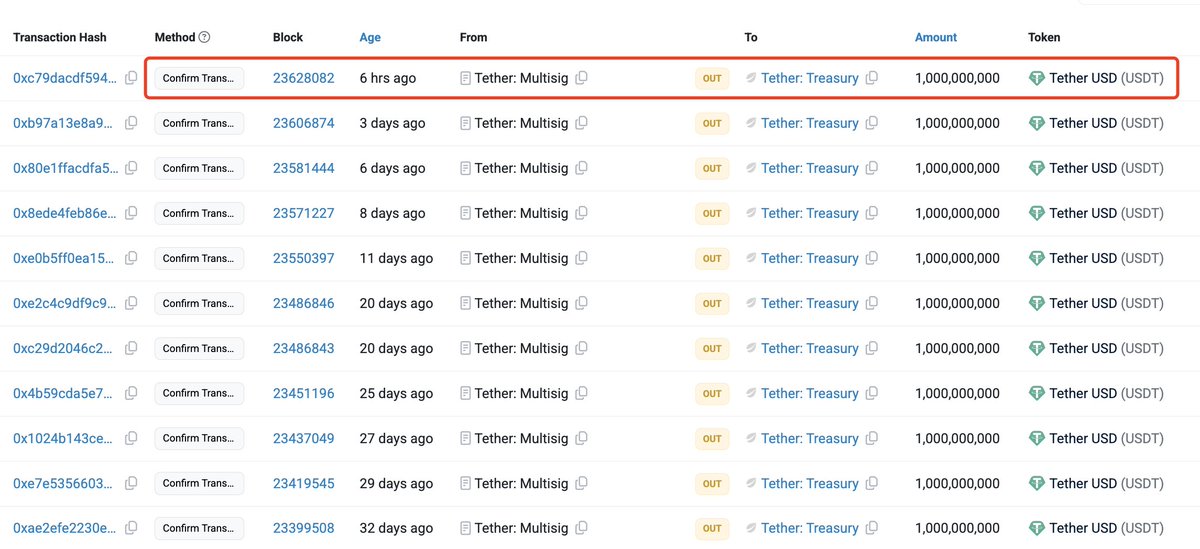

The root of this chaos? A S-1 filing with the SEC-oh, the bureaucratic farce!-by Hyperliquid Strategies Inc., which dares to siphon $1 billion through 160 million shares. And what do they intend with this ill-gotten wealth? To purchase their own tokens, of course! A self-licking ice cream cone, if ever there was one. The crowd, ever the willing fool, has swallowed it whole.