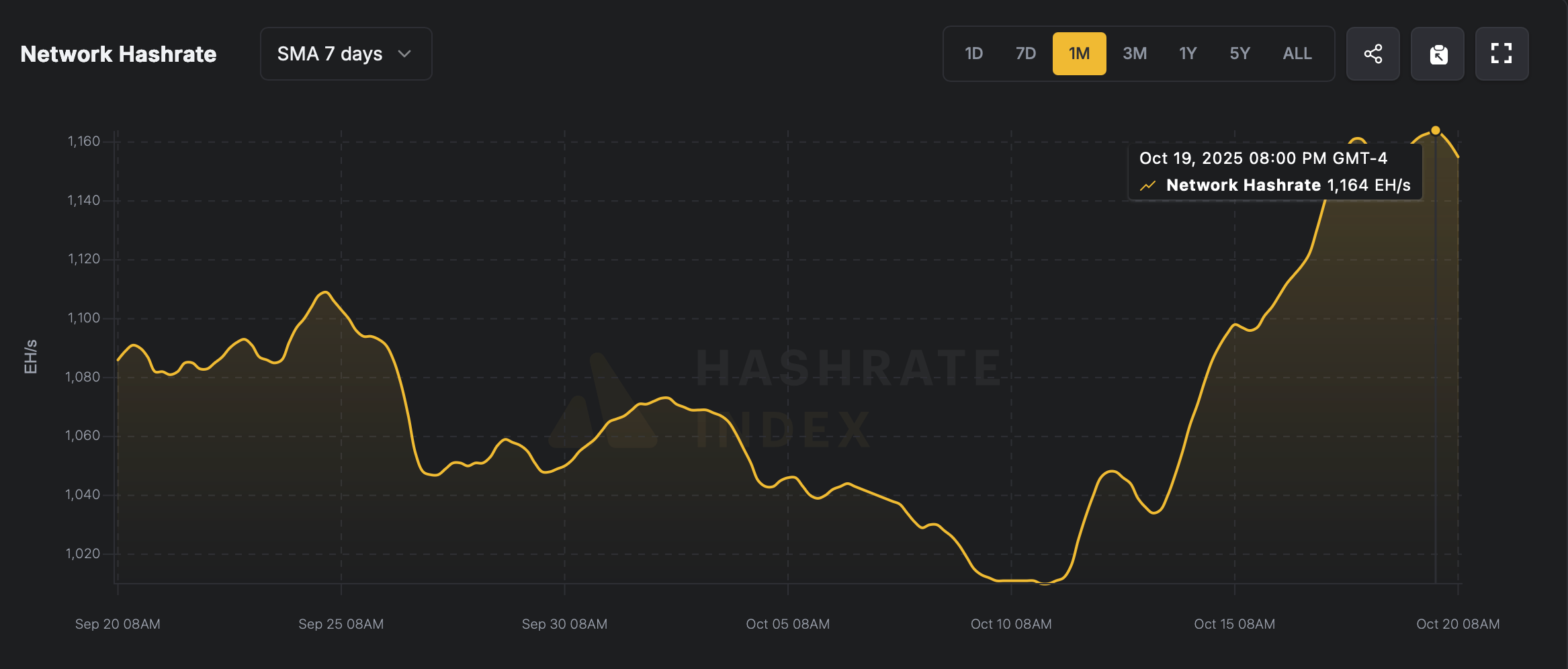

Bitcoin’s Hashrate Goes Bananas! 🚀 1.164 Zettahash of Pure Madness!

Just two days after hitting a 1,157 EH/s high, Bitcoin’s hashrate said, “Hold my beer!” and casually added another 7 EH/s to hit 1,164 EH/s. That’s like adding a million more supercomputers to the party! 🎉🤖