Will $4.5B in Stablecoins Breed a Crypto Tsunami?

As USDT’s dominance slips into history’s dust, the jest of capital may soon take interest in the ornate ballrooms of BTC and altcoins. 🎩💰

As USDT’s dominance slips into history’s dust, the jest of capital may soon take interest in the ornate ballrooms of BTC and altcoins. 🎩💰

Ripple’s not just dipping its toes into institutional-grade DeFi-it’s cannonballing into the deep end with Immunefi! On Oct. 13, they announced a $200,000 “Attackathon” to fortify the XRPL Lending Protocol. Because nothing says “we’re serious” like a six-figure bug hunt. 🐞💸

In the shadowed galleries of digital fates, where tokens dance like leaves in an autumn breeze, XRP whispers of resurrections past, its charts echoing the symphonies of 2017- a time when parabolic dreams soared like rockets piercing the veil of night. Yet, amidst the hum of market tempests, one senses the quiet stirrings of destiny, as Q4 unfurls its enigmatic cloak, teasing yet another crescendo of bullish fervour.

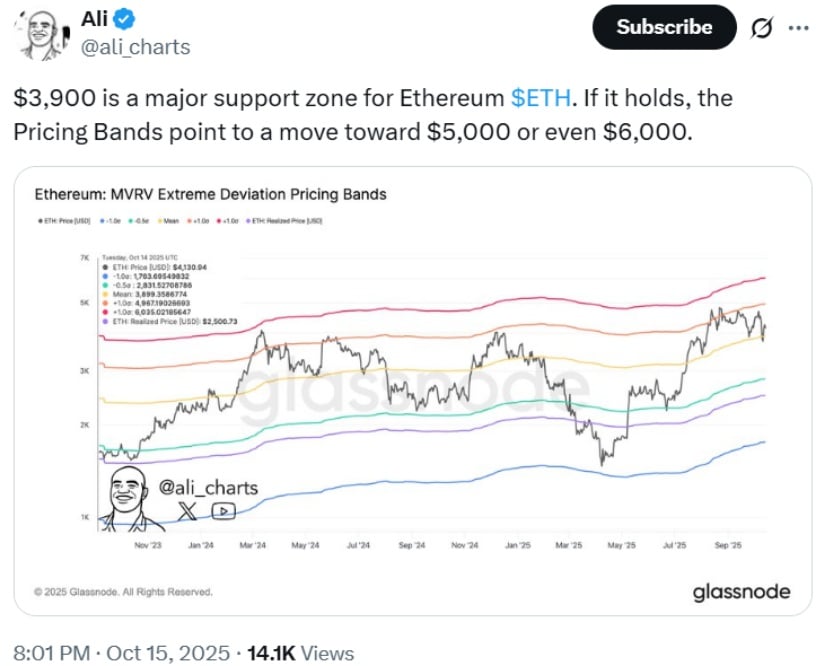

According to the sage cryptanalyst Ali (@ali_charts), the noble $3,900 remains a steadfast support-more reliable than Mr. Bingley’s good opinion-on which Ethereum’s fortunes may quite possibly hinge. Should this level hold, as Ali ardently hopes, then perhaps-and only perhaps-ETH might indulge in a gallant rally toward the lofty sums of $5,000, or daringly, even $6,000! One cannot help but think, with a smirk, that the journey is as romantic as Miss Elizabeth’s refusal of Mr. Collins’s proposal.

Oh, a delightful courtroom drama unfolds with sentencing scheduled for Qian and her partner-in-crime, Ling, on 10-11 November. Naturally, the whole show will wrap up with a civil recovery and compensation order. How thrilling!

Ah, the CME, with its $28.3 billion in futures open interest, hath surpassed the mighty Binance’s $23 billion and Bybit’s paltry $12.2 billion. A triumph, or so they say! 🎉

VanEck’s Matthew Sigel, a man who clearly enjoys confusing stock markets for sport, claims this deal is a golden goose for Bitcoin miners. Why? Because apparently, hosting AI computers pays better than mining digital gold. Who knew?

EUROD is among the first stablecoins issued by a regulated European bank and is designed to combine the reliability of traditional banking with the transparency and speed of blockchain technology. According to ODDO BHF, the token offers “24/7 transferability, euro liquidity, and institutional-grade governance” to ensure compliance and security across its operations. If only my sock drawer had this level of organization.

Meanwhile, the bigwigs in their corner offices are going hog wild for Bitcoin! According to the wise folks at Bitwise, 72 companies are hoarding over 1 million BTC-that’s $117 billion worth of digital gold, baby! 💼💰 These corporate fat cats, ETFs, and investment gurus are treating Bitcoin like the prom queen of assets, even when the market’s acting like a drama queen. 🎭

You’re reading Crypto Long & Short, our weekly newsletter featuring insights, news and analysis for the professional investor. Sign up here to get it in your inbox every Wednesday.